Region:Global

Author(s):Geetanshi

Product Code:KRAA0086

Pages:95

Published On:August 2025

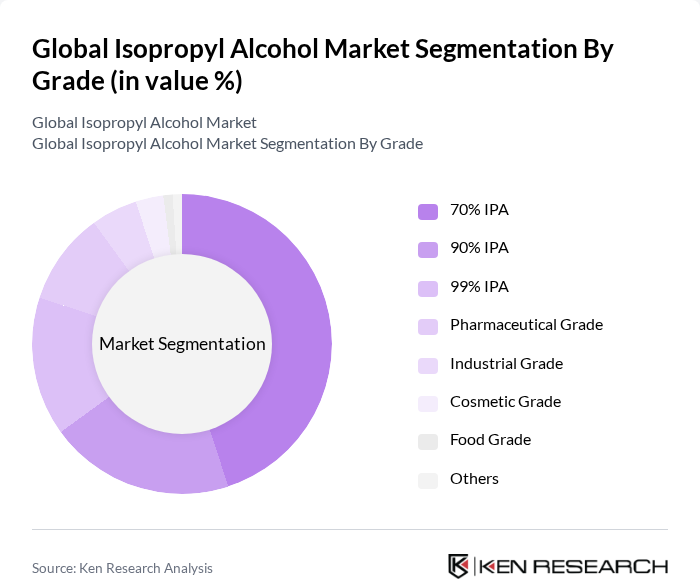

By Grade:The isopropyl alcohol market is segmented by grade into various categories, including 70% IPA, 90% IPA, 99% IPA, Pharmaceutical Grade, Industrial Grade, Cosmetic Grade, Food Grade, and Others. Among these, the 70% IPA segment is the most dominant due to its widespread use in disinfectants and antiseptics, particularly in healthcare settings. The demand for 70% IPA has surged due to its effectiveness in killing bacteria and viruses, making it a preferred choice for hospitals and households alike. The 99% IPA segment is also significant, especially in industrial and electronics cleaning applications .

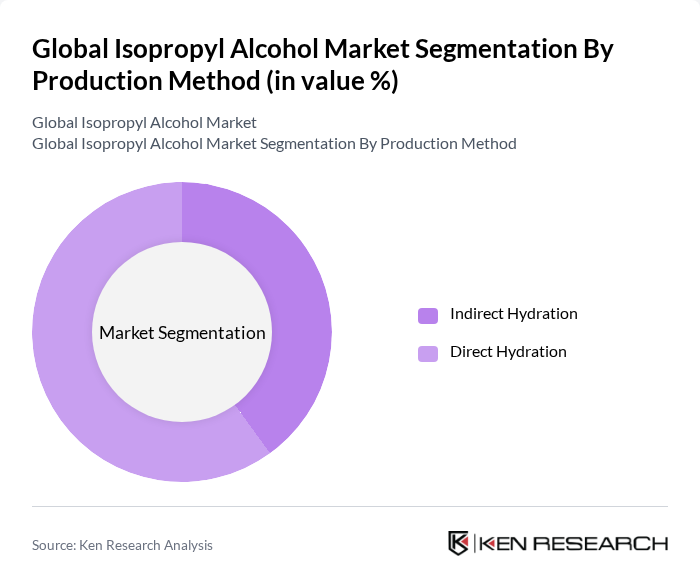

By Production Method:The production methods for isopropyl alcohol include Indirect Hydration and Direct Hydration. The Direct Hydration method is currently the leading production technique due to its efficiency and lower production costs. This method allows for a more straightforward synthesis process, which is crucial for meeting the growing demand in various industries, including pharmaceuticals and cosmetics .

The Global Isopropyl Alcohol Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical, Shell Chemicals, LyondellBasell Industries, INEOS, Dow Chemical Company, Eastman Chemical Company, SABIC, Mitsubishi Gas Chemical Company, Tokuyama Corporation, LG Chem, Huntsman Corporation, BASF SE, Formosa Plastics Corporation, Sasol Limited, Mitsui Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the isopropyl alcohol market appears promising, driven by ongoing innovations in production technologies and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the demand for bio-based isopropyl alcohol is expected to rise. Furthermore, the growing awareness of hygiene and sanitation will likely sustain the demand for isopropyl alcohol in healthcare and cleaning applications, ensuring a robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Grade | % IPA % IPA % IPA Pharmaceutical Grade Industrial Grade Cosmetic Grade Food Grade Others |

| By Production Method | Indirect Hydration Direct Hydration |

| By Application | Solvent Disinfectant Antiseptic & Astringent Cleaning Agent Chemical Intermediate Others |

| By End-User | Healthcare & Pharmaceuticals Electronics Automotive Cosmetics & Personal Care Household Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Drums Bottles Bulk Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 60 | Production Managers, Quality Control Analysts |

| Cosmetic and Personal Care Products | 50 | Product Development Managers, Marketing Directors |

| Industrial Cleaning Solutions | 40 | Operations Managers, Procurement Specialists |

| Automotive and Aerospace Applications | 45 | Engineering Managers, Supply Chain Coordinators |

| Research and Development in Chemical Labs | 55 | R&D Scientists, Lab Managers |

The Global Isopropyl Alcohol Market is valued at approximately USD 6.3 billion, driven by increasing demand across various sectors such as pharmaceuticals, cosmetics, and cleaning products, particularly in response to heightened health awareness following the pandemic.