Region:Global

Author(s):Dev

Product Code:KRAC0464

Pages:96

Published On:August 2025

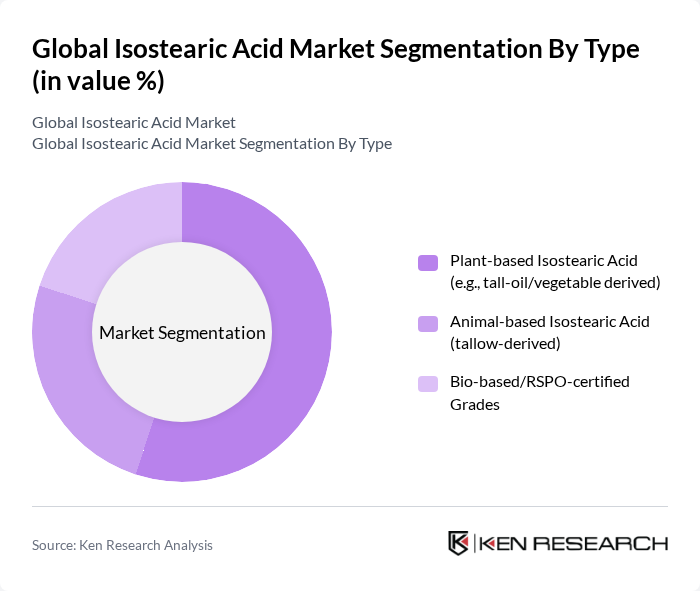

By Type:The market is segmented into three main types: Plant-based Isostearic Acid (e.g., tall-oil/vegetable derived), Animal-based Isostearic Acid (tallow-derived), and Bio-based/RSPO-certified Grades. Among these, Plant-based Isostearic Acid is currently leading the market due to the rising consumer preference for sustainable and eco-friendly products. The demand for plant-based ingredients in personal care and cosmetics is driving this segment's growth, as consumers increasingly seek natural alternatives. The Animal-based segment, while significant, is facing challenges due to ethical concerns and regulatory pressures. Bio-based grades are gaining traction as manufacturers aim to meet sustainability goals.

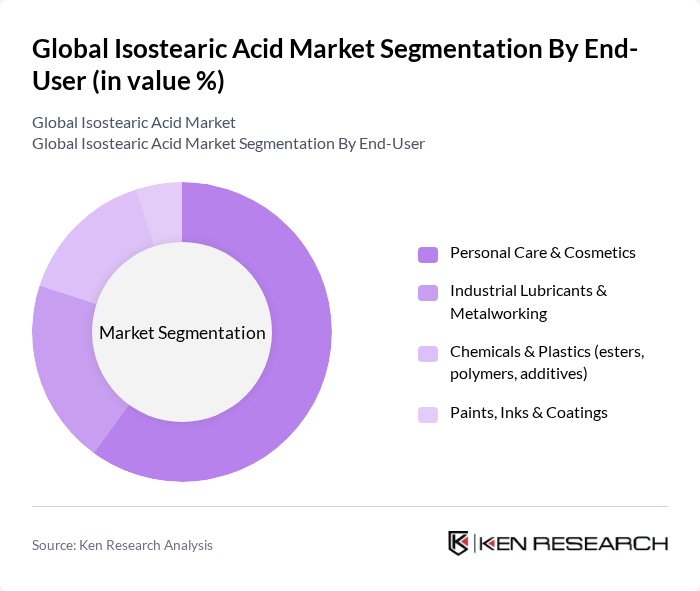

By End-User:The end-user segments include Personal Care & Cosmetics, Industrial Lubricants & Metalworking, Chemicals & Plastics (esters, polymers, additives), and Paints, Inks & Coatings. The Personal Care & Cosmetics segment is the dominant force in the market, driven by the increasing use of isostearic acid in skincare and haircare products due to its emollient properties. The Industrial Lubricants segment is also significant, as isostearic acid is utilized in various lubrication applications. The Chemicals & Plastics segment is growing, but it is the Personal Care segment that is leading the charge, reflecting changing consumer preferences towards natural and sustainable ingredients.

The Global Isostearic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Croda International Plc, BASF SE, Evonik Industries AG, Oleon NV, Kraton Corporation, AAK AB, Emery Oleochemicals Group, Univar Solutions Inc., Wilmar International Limited, Cargill, Incorporated, P&G Chemicals, KLK OLEO (Kuala Lumpur Kepong Berhad), Musim Mas Holdings Pte. Ltd., IOI Oleochemical Industries Berhad, Godrej Industries (Chemicals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the isostearic acid market appears promising, driven by increasing consumer demand for sustainable and natural products. As industries continue to prioritize eco-friendly formulations, the adoption of isostearic acid is expected to rise significantly. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making isostearic acid more accessible. The market is poised for growth, particularly in emerging economies where awareness of bio-based products is increasing, creating new avenues for expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-based Isostearic Acid (e.g., tall-oil/vegetable derived) Animal-based Isostearic Acid (tallow-derived) Bio-based/RSPO-certified Grades |

| By End-User | Personal Care & Cosmetics Industrial Lubricants & Metalworking Chemicals & Plastics (esters, polymers, additives) Paints, Inks & Coatings |

| By Application | Chemical Esters (isostearates) Lubricants & Greases Surfactants & Emulsifiers Corrosion Inhibitors & Metalworking Fluids |

| By Distribution Channel | Direct Sales (producers to OEMs/formulators) Chemical Distributors Online/Marketplace Procurement |

| By Packaging Type | Bulk (ISO tanks, IBCs) Drums Small Containers (lab packs) |

| By Region | North America Europe Asia-Pacific Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Product Manufacturers | 100 | Product Development Managers, Marketing Directors |

| Industrial Lubricants Producers | 80 | Operations Managers, Technical Sales Representatives |

| Food Industry Applications | 70 | Quality Assurance Managers, Food Technologists |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

| Regulatory Bodies and Associations | 40 | Policy Analysts, Compliance Officers |

The Global Isostearic Acid Market is valued at approximately USD 290 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for bio-based products in personal care and industrial applications.