Region:Global

Author(s):Geetanshi

Product Code:KRAA1210

Pages:88

Published On:August 2025

By Type:The IT device market is segmented into laptops, desktops, tablets, smartphones, wearable devices, peripheral devices, accessories, servers, networking equipment, storage devices, and others. Among these, laptops and smartphones remain the most dominant segments, driven by their versatility, portability, and widespread adoption for both personal and professional use. The increasing prevalence of remote work, online education, and mobile-first business operations has accelerated demand for these devices, making them essential for daily productivity and connectivity.

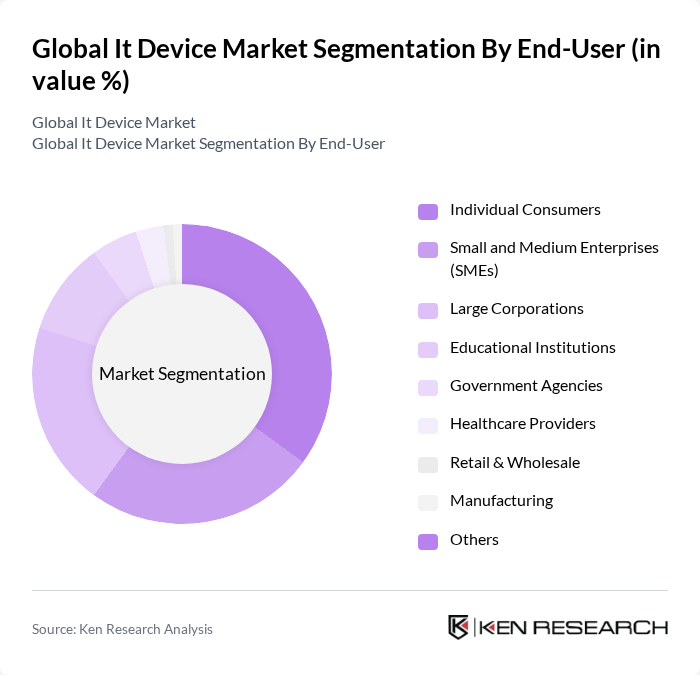

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, educational institutions, government agencies, healthcare providers, retail & wholesale, manufacturing, and others. Individual consumers and SMEs are the leading segments, driven by the increasing need for personal computing, mobile connectivity, and digital collaboration. The rise of e-learning, telehealth, and digital government services has also contributed to the growing demand from educational institutions, healthcare providers, and public sector organizations.

The Global IT Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Dell Technologies Inc., HP Inc., Lenovo Group Limited, Microsoft Corporation, AsusTek Computer Inc., Acer Inc., Sony Group Corporation, Huawei Technologies Co., Ltd., Xiaomi Corporation, LG Electronics Inc., Razer Inc., Toshiba Corporation, Panasonic Holdings Corporation, Google LLC, IBM Corporation, Fujitsu Limited, Cisco Systems, Inc., Intel Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IT device market is poised for transformative growth, driven by technological advancements and evolving consumer needs. The integration of 5G technology is expected to enhance connectivity, enabling faster data transfer and improved user experiences. Additionally, the shift towards remote work solutions will continue to drive demand for versatile and efficient devices. As sustainability becomes a priority, manufacturers will increasingly focus on developing eco-friendly products, aligning with global environmental goals and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Laptops Desktops Tablets Smartphones Wearable Devices Peripheral Devices Accessories Servers Networking Equipment Storage Devices Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Educational Institutions Government Agencies Healthcare Providers Retail & Wholesale Manufacturing Others |

| By Application | Business Operations Education and Training Entertainment and Media Healthcare Services Research and Development Gaming Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Value-Added Resellers Others |

| By Price Range | Budget Devices Mid-Range Devices Premium Devices Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Usage Frequency | Daily Use Weekly Use Occasional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 120 | General Consumers, Tech Enthusiasts |

| Enterprise IT Device Procurement | 90 | IT Managers, Procurement Officers |

| Education Sector Device Usage | 60 | School Administrators, IT Coordinators |

| Healthcare IT Device Adoption | 50 | Healthcare IT Directors, Medical Equipment Managers |

| Small Business IT Needs | 70 | Small Business Owners, IT Consultants |

The Global IT Device Market is valued at approximately USD 1,950 billion, reflecting significant growth driven by digital transformation, remote work models, and technological advancements. This market is expected to continue expanding as demand for connectivity and smart devices increases.