Global Kaolin Market Overview

- The Global Kaolin Market is valued at USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for kaolin in industries such as ceramics, paper, and paints, as well as the rising need for high-quality fillers and coatings. The market is further supported by advancements in mining technologies and the expansion of applications in plastics and rubber sectors. Recent trends highlight robust investments in construction and infrastructure, particularly in Asia Pacific, which is accelerating demand for kaolin-based products .

- Key players in this market include the United States, Brazil, and China, which dominate due to their rich kaolin reserves and established mining infrastructure. The U.S. is recognized for its high-quality kaolin production, while Brazil and China benefit from lower production costs and strong export markets, making them significant contributors to the global supply chain. Asia Pacific, led by China and India, is currently the largest regional market, driven by rapid urbanization and construction activity .

- In 2023, the U.S. government continued to strengthen regulations aimed at promoting sustainable mining practices in the kaolin industry. These measures include stricter environmental assessments and guidelines for waste management, ensuring that mining operations minimize their ecological footprint while maintaining productivity and profitability. The industry is also seeing increased adoption of green construction standards, which further supports sustainable growth .

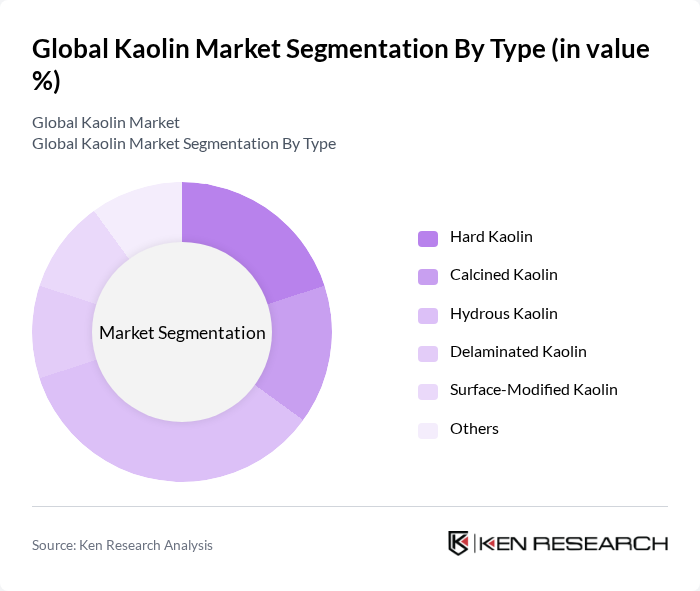

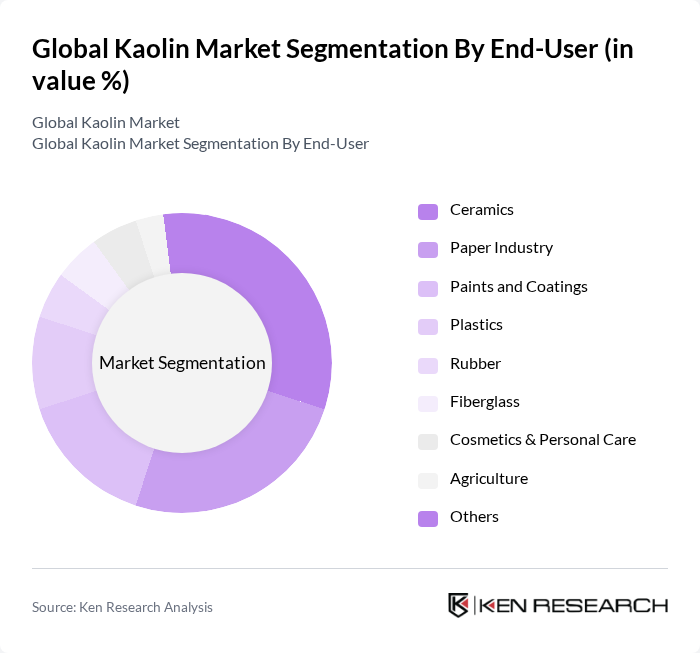

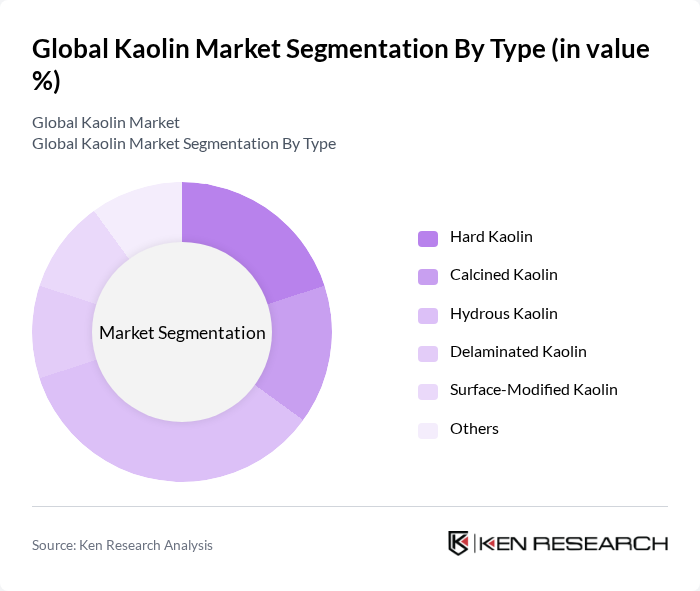

Global Kaolin Market Segmentation

By Type:The kaolin market is segmented into Hard Kaolin, Calcined Kaolin, Hydrous Kaolin, Delaminated Kaolin, Surface-Modified Kaolin, and Others. Among these,Hydrous Kaolinremains the leading sub-segment due to its extensive use in the paper and ceramics industries, where it is valued for its brightness, fine particle size, and ability to enhance product aesthetics and performance. The demand for Hydrous Kaolin is driven by its application in high-quality paper production and as a filler in ceramics, contributing to improved durability and finish .

By End-User:The end-user segmentation includes Ceramics, Paper Industry, Paints and Coatings, Plastics, Rubber, Fiberglass, Cosmetics & Personal Care, Agriculture, and Others. TheCeramicssegment is the dominant player, driven by the increasing demand for ceramic products in construction and home decor. Growth in the ceramics industry is fueled by consumer preferences for aesthetically pleasing and durable materials, leading to a surge in kaolin usage as a key ingredient in ceramic formulations. The paper industry also remains a major consumer, particularly for high-brightness and coated papers .

Global Kaolin Market Competitive Landscape

The Global Kaolin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., KaMin LLC, BASF SE, Thiele Kaolin Company, Sibelco N.V., Ashapura Minechem Ltd., EICL Limited, I-Minerals Inc., Kaolin AD, Quarzwerke GmbH, LB Minerals, s.r.o., J.M. Huber Corporation, Lasselsberger Group, W. R. Grace & Co., S.A.M. Minerals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Kaolin Market Industry Analysis

Growth Drivers

- Increasing Demand from the Paper Industry:The kaolin market is significantly driven by the paper industry, which consumed approximately 4.6 million tons of kaolin in future. The global paper production is projected to reach 425 million tons in future, with kaolin being a critical component for enhancing paper quality. This demand is fueled by the rising need for high-quality printing and writing papers, particularly in emerging economies where literacy rates are improving, leading to increased paper consumption.

- Growth in Construction Activities:The construction sector is a major consumer of kaolin, utilizing around 3.1 million tons in future. With global construction spending expected to exceed $10.5 trillion in future, driven by urbanization and infrastructure development, the demand for kaolin in ceramics, tiles, and cement is anticipated to rise. This growth is particularly pronounced in Asia-Pacific, where urbanization rates are among the highest globally, further propelling kaolin consumption in construction materials.

- Rising Use in Paints and Coatings:The paints and coatings industry accounted for approximately 2.6 million tons of kaolin usage in future. As the global paints and coatings market is projected to reach $205 billion in future, the demand for kaolin as a filler and pigment is expected to grow. This trend is driven by the increasing focus on aesthetic appeal and durability in residential and commercial buildings, alongside a shift towards eco-friendly formulations that utilize kaolin for its non-toxic properties.

Market Challenges

- Environmental Regulations:The kaolin industry faces stringent environmental regulations, particularly in regions like Europe and North America, where compliance costs can reach up to $1.1 million per facility annually. These regulations aim to minimize the ecological impact of mining activities, leading to increased operational costs and potential project delays. Companies must invest in sustainable practices, which can strain financial resources and affect profitability in the short term.

- Fluctuating Raw Material Prices:The kaolin market is challenged by the volatility of raw material prices, which can fluctuate by as much as 22% annually. Factors such as geopolitical tensions, supply chain disruptions, and changes in demand from key industries contribute to this instability. For instance, the price of kaolin rose by 16% in future due to increased demand from the construction sector, impacting profit margins for manufacturers who rely on stable pricing for budgeting and forecasting.

Global Kaolin Market Future Outlook

The future of the kaolin market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in kaolin processing are expected to enhance product quality and reduce environmental impact, aligning with global trends towards eco-friendly materials. Additionally, the expansion into emerging markets, particularly in Asia and Africa, will provide new growth avenues as infrastructure development accelerates. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

Market Opportunities

- Innovations in Kaolin Processing:Advancements in processing technologies, such as high-efficiency classifiers and eco-friendly extraction methods, present significant opportunities. These innovations can improve kaolin purity and reduce waste, potentially increasing market share for companies that adopt these practices, especially in regions with strict environmental regulations.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, are witnessing rapid industrialization and urbanization. This trend is expected to drive demand for kaolin in various applications, including construction and ceramics. Companies that strategically enter these markets can capitalize on the growing need for quality materials, enhancing their global footprint and revenue potential.