Region:Global

Author(s):Dev

Product Code:KRAC0502

Pages:88

Published On:August 2025

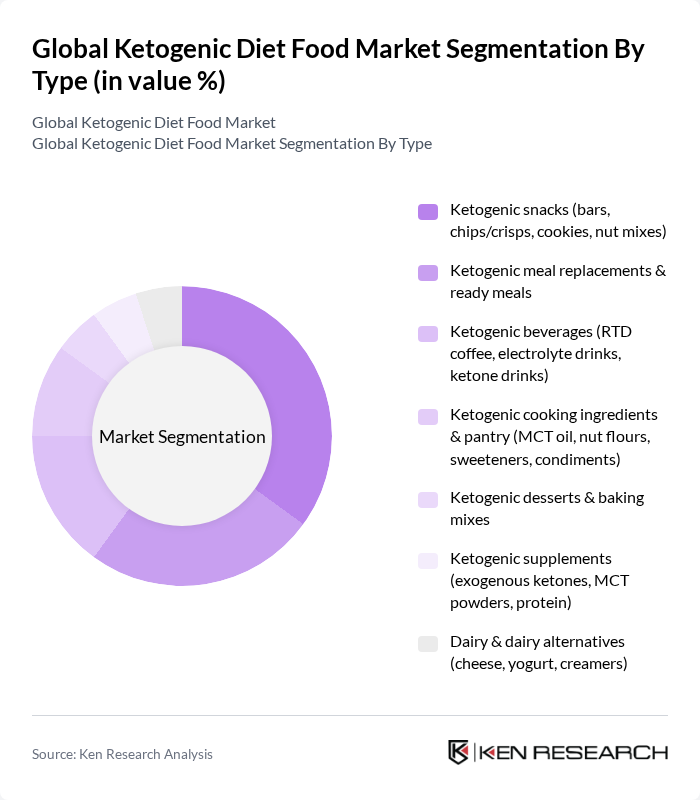

By Type:The market is segmented into various types, including ketogenic snacks, meal replacements, beverages, cooking ingredients, desserts, supplements, and dairy alternatives. Among these, ketogenic snacks, such as bars and chips, are leading the market due to their convenience and increasing popularity among health-conscious consumers. The demand for meal replacements is also significant, driven by busy lifestyles and the need for quick, nutritious options.

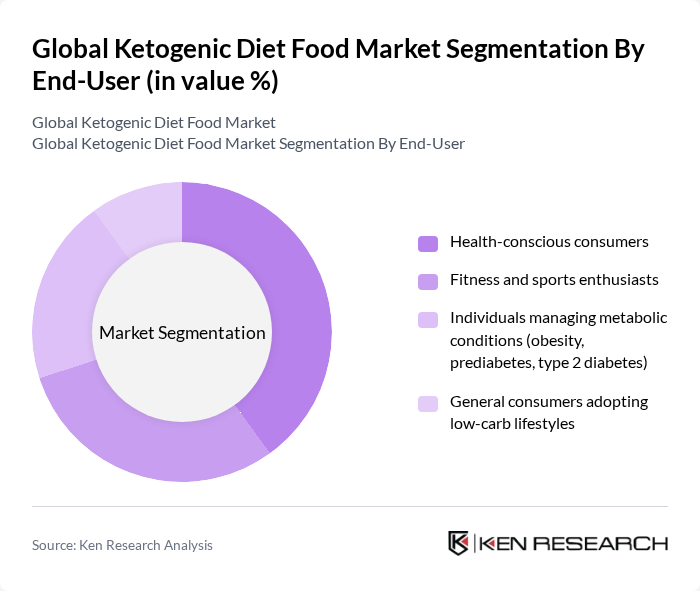

By End-User:The end-user segmentation includes health-conscious consumers, fitness enthusiasts, individuals managing metabolic conditions, and general consumers adopting low-carb lifestyles. Health-conscious consumers are the largest segment, driven by a growing awareness of the health benefits associated with ketogenic diets. Fitness enthusiasts also contribute significantly, as they seek products that support their active lifestyles and nutritional needs.

The Global Ketogenic Diet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (including Atkins/Simply Good Foods partnership channels where relevant), The Simply Good Foods Company (Atkins, Quest Nutrition), Bulletproof 360, Inc., Perfect Keto (KetoSports/Equip Foods), Primal Kitchen (a Kraft Heinz Company brand), HighKey Snacks, ChocZero, Inc., Kiss My Keto, Keto and Co (Including Wholesome Yum Foods collaboration lines where applicable), Julian Bakery, Inc., KNOW Foods (Know Better), Dang Foods LLC, Perfect Snacks, LLC (Perfect Bar – low-sugar, keto-friendly SKUs), Zenwise (Zenwise Health), Ample Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ketogenic diet food market appears promising, driven by increasing consumer interest in health and wellness. As more individuals seek effective weight management solutions, the demand for ketogenic products is expected to rise. Additionally, advancements in food technology will likely lead to innovative product offerings, enhancing consumer appeal. The market is also anticipated to benefit from the growing trend of personalized nutrition, allowing for tailored dietary solutions that align with individual health goals and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Ketogenic snacks (bars, chips/crisps, cookies, nut mixes) Ketogenic meal replacements & ready meals Ketogenic beverages (RTD coffee, electrolyte drinks, ketone drinks) Ketogenic cooking ingredients & pantry (MCT oil, nut flours, sweeteners, condiments) Ketogenic desserts & baking mixes Ketogenic supplements (exogenous ketones, MCT powders, protein) Dairy & dairy alternatives (cheese, yogurt, creamers) |

| By End-User | Health-conscious consumers Fitness and sports enthusiasts Individuals managing metabolic conditions (obesity, prediabetes, type 2 diabetes) General consumers adopting low-carb lifestyles |

| By Distribution Channel | Online retail (brand D2C, e-marketplaces) Supermarkets and hypermarkets Health food and specialty nutrition stores Convenience stores Direct sales & subscriptions |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Premium Mid-range Budget |

| By Packaging Type | Rigid packaging Flexible packaging Bulk packaging |

| By Product Form | Solid Liquid Powder |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Ketogenic Foods | 150 | Health-conscious consumers, Diet enthusiasts |

| Retail Insights on Ketogenic Product Offerings | 100 | Store Managers, Category Buyers |

| Nutritionist Perspectives on Ketogenic Diets | 80 | Registered Dietitians, Nutrition Experts |

| Market Trends in Health Food Retail | 70 | Market Analysts, Retail Strategists |

| Consumer Feedback on Ketogenic Meal Plans | 90 | Consumers following ketogenic meal plans, Health Coaches |

The Global Ketogenic Diet Food Market is valued at approximately USD 9.8 billion, reflecting a significant growth trend driven by increasing consumer demand for low-carb diets and healthier food alternatives.