Region:Global

Author(s):Dev

Product Code:KRAC0382

Pages:84

Published On:August 2025

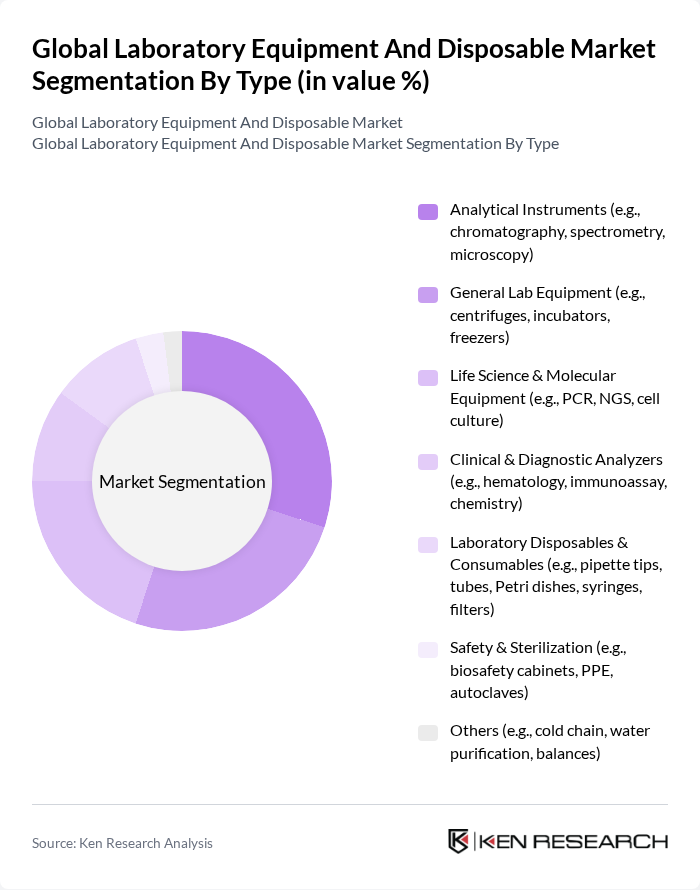

By Type:The market is segmented into various types of laboratory equipment and disposables, including analytical instruments, general lab equipment, life science and molecular equipment, clinical and diagnostic analyzers, laboratory disposables and consumables, safety and sterilization equipment, and others. Among these, analytical instruments are leading the market due to their critical role in research and diagnostics, driven by the increasing focus on precision and accuracy in laboratory results .

By End-User:The end-user segmentation includes academic and research institutes, pharmaceutical and biotechnology companies, clinical and diagnostic laboratories, contract research and manufacturing organizations (CROs/CDMOs), hospitals and reference centers, industrial testing labs, and others. The pharmaceutical and biotechnology companies segment is the largest due to the increasing demand for innovative drugs and therapies, which require advanced laboratory equipment for research and development .

The Global Laboratory Equipment And Disposable Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), Eppendorf SE, Avantor, Inc. (including VWR), Sartorius AG, Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, Inc., Beckman Coulter, Inc. (a Danaher company), Siemens Healthineers AG, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Abbott Laboratories, Becton, Dickinson and Company (BD), Hitachi High-Tech Corporation, Danaher Corporation, Waters Corporation, Shimadzu Corporation, ZEISS Group (Carl Zeiss Microscopy GmbH), Illumina, Inc., QIAGEN N.V., Tecan Group Ltd., Hamilton Company, Corning Incorporated (Corning Life Sciences), Greiner Bio-One International GmbH, Hologic, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the laboratory equipment and disposable market appears promising, driven by technological advancements and increasing healthcare demands. As laboratories continue to adopt digital technologies and automation, efficiency and accuracy will improve significantly. Furthermore, the focus on sustainability will lead to innovations in eco-friendly labware. The market is expected to see a shift towards integrated solutions that combine equipment with software, enhancing operational capabilities and data management, thus positioning laboratories for future growth and adaptability.

| Segment | Sub-Segments |

|---|---|

| By Type | Analytical Instruments (e.g., chromatography, spectrometry, microscopy) General Lab Equipment (e.g., centrifuges, incubators, freezers) Life Science & Molecular Equipment (e.g., PCR, NGS, cell culture) Clinical & Diagnostic Analyzers (e.g., hematology, immunoassay, chemistry) Laboratory Disposables & Consumables (e.g., pipette tips, tubes, Petri dishes, syringes, filters) Safety & Sterilization (e.g., biosafety cabinets, PPE, autoclaves) Others (e.g., cold chain, water purification, balances) |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Contract Research & Manufacturing Organizations (CROs/CDMOs) Hospitals & Reference Centers Industrial Testing Labs (food, environmental, materials) Others |

| By Application | Research & Development Quality Control/Assurance & Regulatory Testing Clinical Diagnostics & Point-of-Care Environmental & Industrial Testing Food & Beverage Safety Testing Bioproduction & Bioprocessing Support Others |

| By Distribution Channel | Direct Sales (OEM) Authorized Distributors & Dealers E-commerce & Marketplaces Retail/Scientific Catalogs Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Economy Mid-tier Premium |

| By Brand | Established Brands Emerging Brands Private Labels & OEM/ODM Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Laboratory Equipment | 150 | Laboratory Managers, R&D Directors |

| Biotechnology Research Facilities | 110 | Procurement Officers, Lab Technicians |

| Academic Research Institutions | 90 | Research Scientists, Equipment Operators |

| Clinical Laboratories | 70 | Quality Control Managers, Lab Supervisors |

| Environmental Testing Labs | 60 | Environmental Scientists, Lab Managers |

The Global Laboratory Equipment and Disposable Market is valued at approximately USD 4042 billion, with recent estimates indicating values of USD 41.29 billion and USD 40.5 billion, reflecting strong demand across research, pharmaceuticals, and diagnostics.