Region:Global

Author(s):Geetanshi

Product Code:KRAD0111

Pages:91

Published On:August 2025

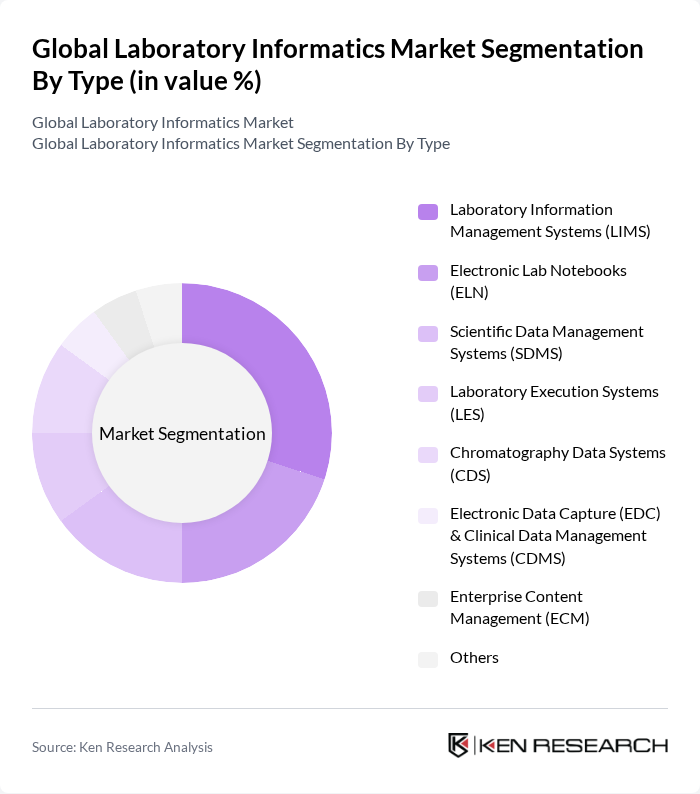

By Type:The laboratory informatics market is segmented into Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Chromatography Data Systems (CDS), Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS), Enterprise Content Management (ECM), and Others. These solutions play a crucial role in enhancing laboratory efficiency, streamlining workflows, ensuring regulatory compliance, and improving data management and accessibility.

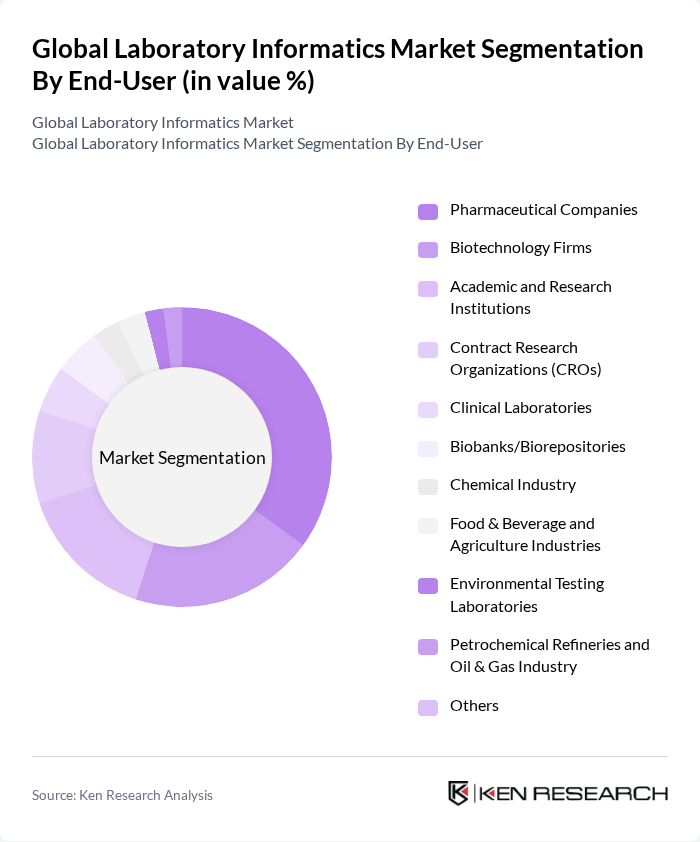

By End-User:The end-user segmentation of the laboratory informatics market includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Contract Research Organizations (CROs), Clinical Laboratories, Biobanks/Biorepositories, Chemical Industry, Food & Beverage and Agriculture Industries, Environmental Testing Laboratories, Petrochemical Refineries and Oil & Gas Industry, and Others. These sectors utilize laboratory informatics solutions to streamline operations, optimize research workflows, ensure data integrity, and comply with regulatory standards.

The Global Laboratory Informatics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., LabWare, Inc., STARLIMS Corporation, PerkinElmer, Inc., Veeva Systems Inc., Agilent Technologies, Inc., Waters Corporation, Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Bio-Rad Laboratories, Inc., LabVantage Solutions, Inc., Dassault Systèmes, QIAGEN N.V., Medidata Solutions, Inc., Autoscribe Informatics, Core Informatics (Thermo Fisher Scientific), Informatics Unlimited, LLC, Accelerated Technology Laboratories, Inc., LabLynx, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of laboratory informatics is poised for transformative growth, driven by technological advancements and evolving industry needs. As laboratories increasingly adopt integrated solutions, the role of artificial intelligence and machine learning will become more prominent, enhancing data analysis capabilities. Additionally, regulatory compliance will continue to shape the market, pushing laboratories to invest in systems that ensure adherence to stringent standards. The focus on personalized medicine will further drive innovation, creating a dynamic landscape for laboratory informatics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Laboratory Information Management Systems (LIMS) Electronic Lab Notebooks (ELN) Scientific Data Management Systems (SDMS) Laboratory Execution Systems (LES) Chromatography Data Systems (CDS) Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) Enterprise Content Management (ECM) Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Clinical Laboratories Biobanks/Biorepositories Chemical Industry Food & Beverage and Agriculture Industries Environmental Testing Laboratories Petrochemical Refineries and Oil & Gas Industry Others |

| By Component | Software Services Hardware |

| By Deployment Mode | On-Premise Cloud-Based |

| By Application | Drug Discovery Quality Control Clinical Trials Research and Development Environmental Monitoring Forensics Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Laboratories | 100 | Laboratory Managers, IT Directors |

| Biotechnology Firms | 60 | R&D Leaders, Data Analysts |

| Clinical Laboratories | 50 | Laboratory Technicians, Quality Assurance Managers |

| Academic Research Institutions | 40 | Principal Investigators, Research Coordinators |

| Environmental Testing Labs | 40 | Compliance Officers, Laboratory Supervisors |

The Global Laboratory Informatics Market is valued at approximately USD 3.85 billion, driven by the increasing demand for automation, efficient data management, and regulatory compliance in sectors such as healthcare, pharmaceuticals, and biotechnology.