Region:Global

Author(s):Dev

Product Code:KRAB0481

Pages:98

Published On:August 2025

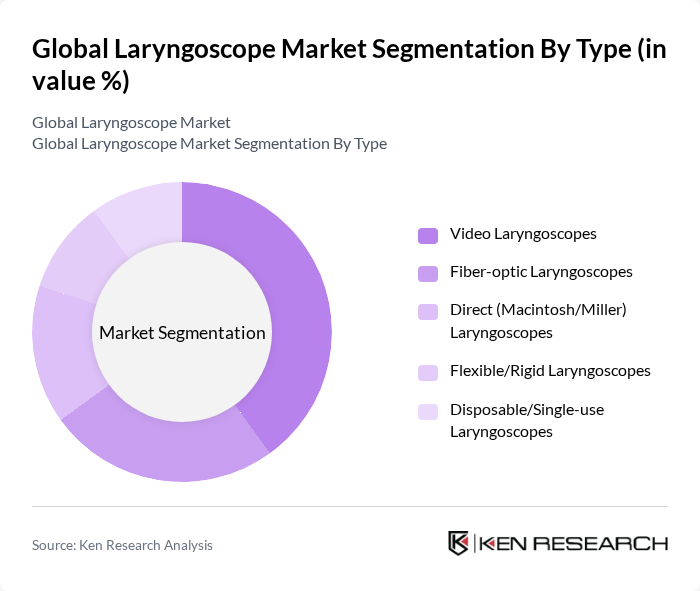

By Type:The laryngoscope market is segmented into various types, including video laryngoscopes, fiber-optic laryngoscopes, direct (Macintosh/Miller) laryngoscopes, flexible/rigid laryngoscopes, and disposable/single-use laryngoscopes. Among these, video laryngoscopes are gaining significant traction due to their ability to provide enhanced visualization, which is crucial for successful intubation. The demand for disposable laryngoscopes is also on the rise, driven by the need for infection control and ease of use in emergency settings.

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, specialty clinics (ENT/Anesthesiology), emergency medical services (Pre-hospital/EMS), and academic & training institutes. Hospitals are the leading end-users, primarily due to their high patient volume and the need for advanced laryngoscopy procedures. Ambulatory surgical centers are also witnessing growth as they adopt more sophisticated laryngoscope technologies to enhance patient care.

The Global Laryngoscope Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, KARL STORZ SE & Co. KG, Olympus Corporation, Ambu A/S, Welch Allyn (Hill-Rom/Baxter), Richard Wolf GmbH, CONMED Corporation, Teleflex Incorporated, Smiths Medical (ICU Medical), Vyaire Medical, Verathon Inc. (Roper Technologies), B. Braun Melsungen AG, Venner Medical (Medius Holdings), Timesco Healthcare Ltd., HEINE Optotechnik GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the laryngoscope market appears promising, driven by ongoing technological innovations and an increasing focus on patient-centered care. As healthcare systems worldwide continue to invest in advanced medical technologies, the integration of artificial intelligence and digital solutions in laryngoscopy is expected to enhance diagnostic accuracy. Furthermore, the rise of telemedicine will likely create new avenues for laryngoscope applications, ensuring that healthcare providers can deliver quality care remotely, thus expanding market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Laryngoscopes Fiber-optic Laryngoscopes Direct (Macintosh/Miller) Laryngoscopes Flexible/Rigid Laryngoscopes Disposable/Single-use Laryngoscopes |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics (ENT/Anesthesiology) Emergency Medical Services (Pre-hospital/EMS) Academic & Training Institutes |

| By Application | Anesthesia & Airway Management Emergency Medicine & Critical Care Otolaryngology (ENT) Diagnostics/Procedures Pediatric & Neonatal Intubation |

| By Distribution Channel | Direct Sales (Manufacturers) Authorized Distributors/Dealers Group Purchasing Organizations (GPOs) Online/Procurement Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Range Mid Range High Range |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Directors |

| ENT Specialists and Laryngologists | 100 | ENT Surgeons, Medical Directors |

| Medical Device Distributors | 60 | Sales Managers, Distribution Coordinators |

| Healthcare Facility Administrators | 70 | Facility Managers, Operations Directors |

| Clinical Researchers in Otolaryngology | 50 | Research Scientists, Clinical Trial Coordinators |

The Global Laryngoscope Market is valued at approximately USD 1.1 billion, driven by factors such as the increasing prevalence of respiratory diseases and advancements in medical technology, particularly the adoption of video-assisted laryngoscopy.