Region:Global

Author(s):Dev

Product Code:KRAA3075

Pages:94

Published On:August 2025

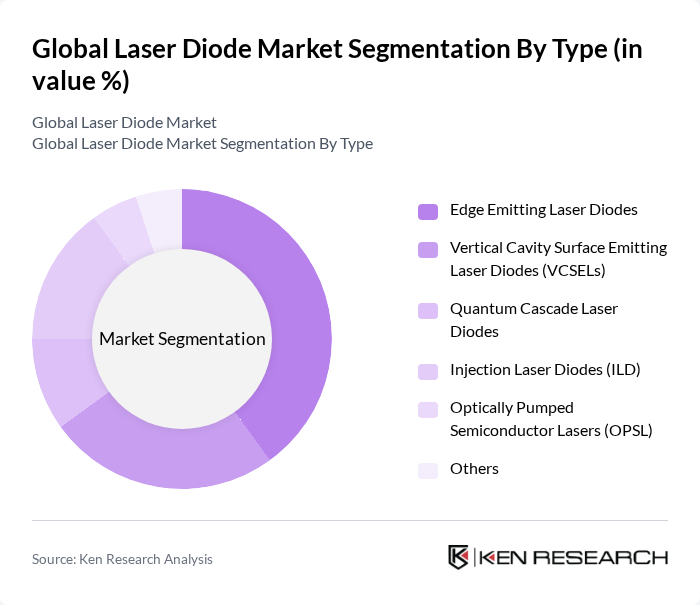

By Type:The laser diode market is segmented into various types, including Edge Emitting Laser Diodes, Vertical Cavity Surface Emitting Laser Diodes (VCSELs), Quantum Cascade Laser Diodes, Injection Laser Diodes (ILD), Optically Pumped Semiconductor Lasers (OPSL), and Others. Among these, Edge Emitting Laser Diodes remain the leading segment due to their widespread use in telecommunications, optical storage, and data centers, where high efficiency and performance are critical. VCSELs are rapidly gaining traction, particularly in consumer electronics, 3D sensing, and automotive LiDAR, owing to their compact size, scalability, and cost-effectiveness .

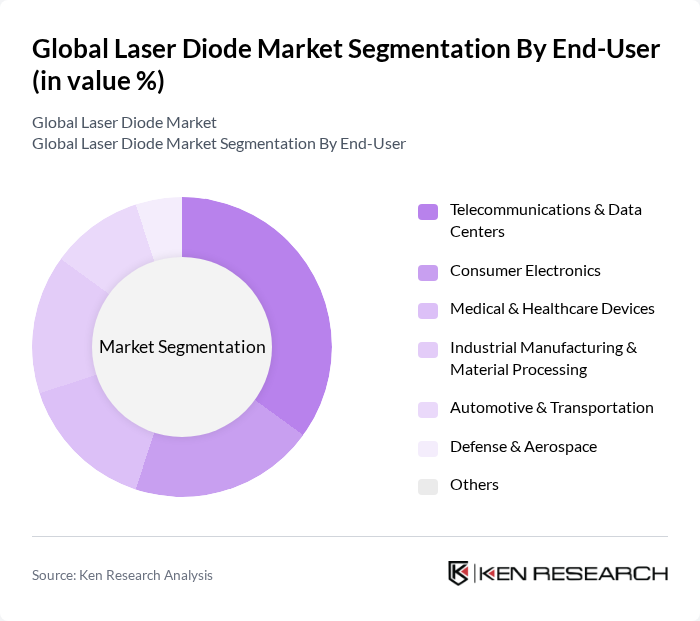

By End-User:The market is also segmented by end-user applications, including Telecommunications & Data Centers, Consumer Electronics, Medical & Healthcare Devices, Industrial Manufacturing & Material Processing, Automotive & Transportation, Defense & Aerospace, and Others. Telecommunications & Data Centers hold the largest share due to the increasing demand for high-speed internet, optical fiber networks, and data transmission. The medical sector is expanding rapidly, driven by the adoption of laser technologies in surgical, diagnostic, and aesthetic procedures. Industrial manufacturing is also a significant segment, leveraging laser diodes for cutting, welding, and material processing .

The Global Laser Diode Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coherent Corp., II-VI Incorporated (now Coherent Corp.), Lumentum Holdings Inc., Nichia Corporation, OSRAM Opto Semiconductors GmbH (ams OSRAM), Sharp Corporation, Mitsubishi Electric Corporation, Broadcom Inc., Qorvo, Inc., LASER COMPONENTS GmbH, ams OSRAM AG, Samsung Electronics Co., Ltd., TRUMPF GmbH + Co. KG, Renesas Electronics Corporation, AixiZ LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the laser diode market in None appears promising, driven by ongoing technological advancements and increasing applications across various sectors. The integration of laser diodes with IoT devices is expected to enhance connectivity and efficiency, while the shift towards green technologies will promote sustainable practices. As industries continue to innovate, the demand for customized laser solutions will likely rise, creating new avenues for growth and collaboration among market players.

| Segment | Sub-Segments |

|---|---|

| By Type | Edge Emitting Laser Diodes Vertical Cavity Surface Emitting Laser Diodes (VCSELs) Quantum Cascade Laser Diodes Injection Laser Diodes (ILD) Optically Pumped Semiconductor Lasers (OPSL) Others |

| By End-User | Telecommunications & Data Centers Consumer Electronics Medical & Healthcare Devices Industrial Manufacturing & Material Processing Automotive & Transportation Defense & Aerospace Others |

| By Application | Optical Communication & Storage Laser Printing & Imaging Material Processing (Cutting, Welding, Marking) Sensing & Measurement Medical & Aesthetic Procedures Automotive LiDAR & Lighting Military & Defense Applications Others |

| By Distribution Channel | Direct Sales Online Retail Distributors/Value-Added Resellers Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Semiconductor Laser Diodes Fiber-Coupled Laser Diodes Solid-State Laser Diodes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Applications | 100 | Network Engineers, Product Managers |

| Industrial Laser Systems | 80 | Manufacturing Engineers, Operations Managers |

| Medical Device Integration | 70 | Biomedical Engineers, Regulatory Affairs Specialists |

| Consumer Electronics | 90 | Product Development Managers, Supply Chain Analysts |

| Research and Development | 60 | Research Scientists, Technical Directors |

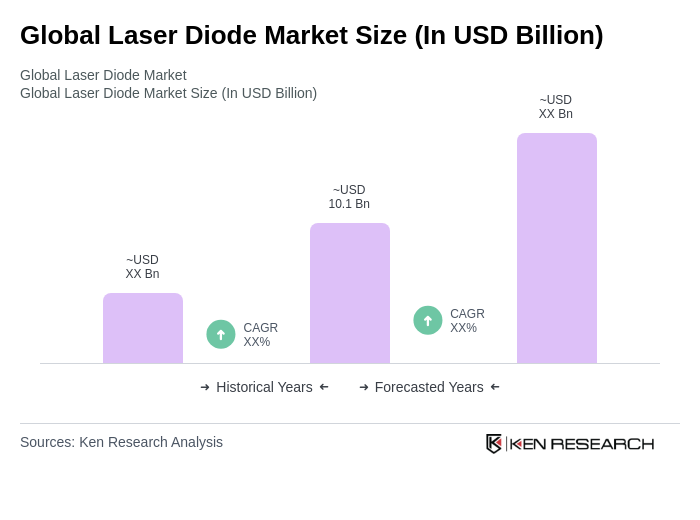

The Global Laser Diode Market is valued at approximately USD 10.1 billion, driven by increasing demand across telecommunications, consumer electronics, automotive, and medical applications. This growth reflects a significant expansion in data traffic and advancements in laser technologies.