Region:Global

Author(s):Shubham

Product Code:KRAA0818

Pages:89

Published On:August 2025

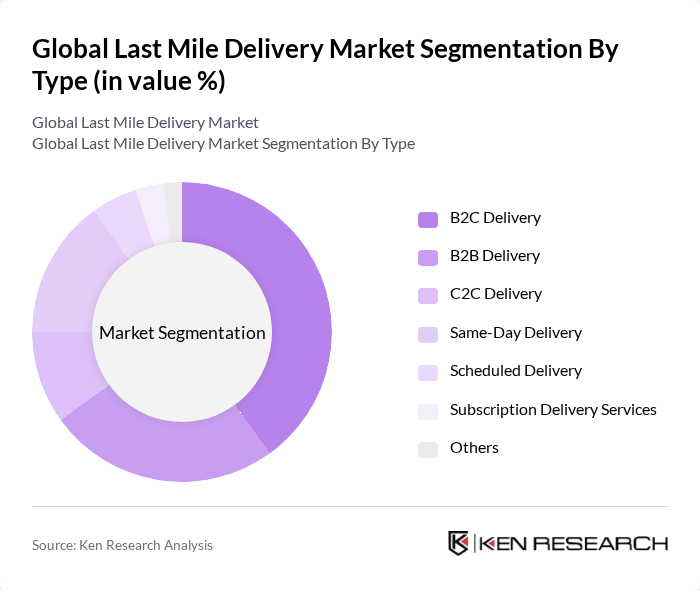

By Type:The last mile delivery market can be segmented into B2C Delivery, B2B Delivery, C2C Delivery, Same-Day Delivery, Scheduled Delivery, Subscription Delivery Services, and Others. Among these, B2C Delivery is the most dominant segment, driven by the rapid growth of e-commerce and consumer expectations for quick and reliable delivery services. The increasing trend of online shopping and the rise of direct-to-consumer brands have led to a significant rise in demand for B2C delivery solutions, making it a key focus for logistics providers. Same-day and on-demand delivery options are also gaining traction, particularly in urban centers, as retailers and logistics companies compete to meet consumer expectations for speed and convenience , .

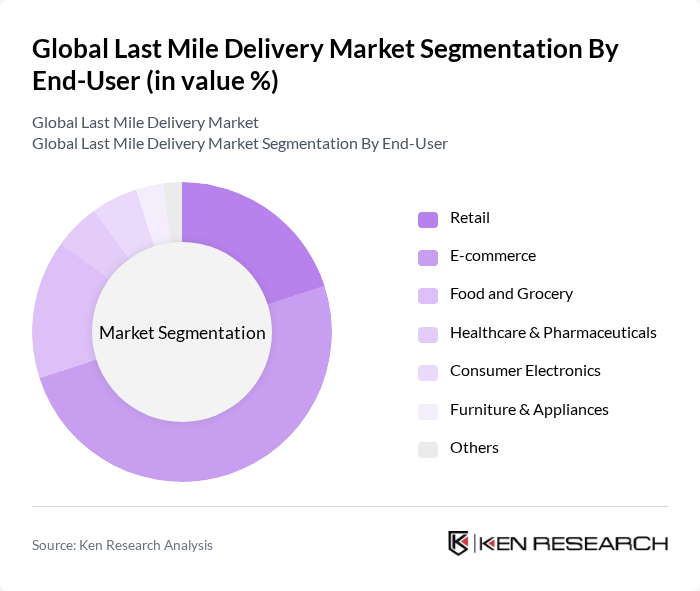

By End-User:The end-user segmentation of the last mile delivery market includes Retail, E-commerce, Food and Grocery, Healthcare & Pharmaceuticals, Consumer Electronics, Furniture & Appliances, and Others. The E-commerce segment is the leading end-user, fueled by the exponential growth of online shopping platforms and consumer preferences for home delivery. This segment's dominance is attributed to the increasing number of online retailers, the expansion of omnichannel retail strategies, and the demand for efficient, flexible delivery solutions. Food and grocery delivery is also a rapidly growing segment, driven by the proliferation of quick commerce and meal delivery platforms , .

The Global Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL, FedEx, UPS, Amazon Logistics, XPO Logistics, DPDgroup (GeoPost), Postmates (Uber Technologies Inc.), DoorDash, Instacart, Glovo, Zomato, ShipBob, Sendle, Lalamove, Gojek, JD Logistics, Cainiao (Alibaba Group), SF Express, YTO Express, and Delhivery contribute to innovation, geographic expansion, and service delivery in this space .

The future of last mile delivery is poised for transformation, driven by technological innovations and evolving consumer preferences. As urbanization continues, companies will increasingly adopt sustainable practices, such as electric vehicles and eco-friendly packaging, to meet regulatory demands and consumer expectations. Additionally, the integration of AI and automation will streamline operations, enhancing efficiency and reducing costs. These trends indicate a shift towards more agile, responsive delivery models that prioritize customer satisfaction and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Delivery B2B Delivery C2C Delivery Same-Day Delivery Scheduled Delivery Subscription Delivery Services Others |

| By End-User | Retail E-commerce Food and Grocery Healthcare & Pharmaceuticals Consumer Electronics Furniture & Appliances Others |

| By Distribution Mode | Road Transport (Vans, Trucks, Two-Wheelers) Air Transport (Cargo Drones, Aircraft) Rail Transport Maritime Transport Autonomous Delivery (Drones, Robots) Others |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Locker Delivery Contactless Delivery Others |

| By Package Size | Small Packages Medium Packages Large Packages Oversized Packages Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing Subscription Pricing Dynamic Pricing Others |

| By Service Type | Same-Day Delivery Services Scheduled Delivery Services On-Demand Delivery Services White Glove Delivery Services Others |

| By Region | North America Latin America Western Europe Eastern Europe Asia Pacific Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery | 100 | Logistics Coordinators, Urban Planners |

| Rural Delivery Solutions | 60 | Supply Chain Managers, Rural Retailers |

| Food Delivery Services | 50 | Operations Managers, Restaurant Owners |

| Parcel Delivery Innovations | 40 | Product Managers, Technology Developers |

| Last Mile Delivery Technology | 50 | IT Managers, Logistics Technology Experts |

The Global Last Mile Delivery Market is valued at approximately USD 185 billion, driven by the growth of e-commerce, consumer demand for faster delivery, and advancements in logistics technology.