Region:Global

Author(s):Dev

Product Code:KRAC0432

Pages:95

Published On:August 2025

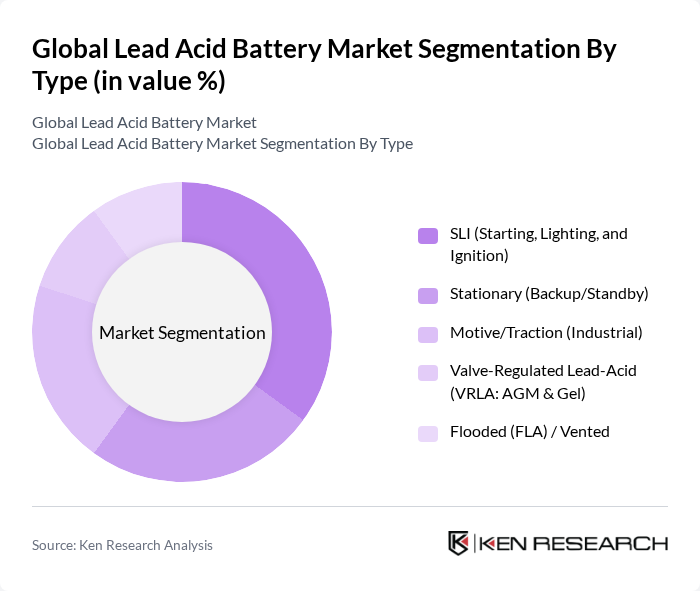

By Type:The lead acid battery market can be segmented into various types, including SLI (Starting, Lighting, and Ignition), Stationary (Backup/Standby), Motive/Traction (Industrial), Valve-Regulated Lead-Acid (VRLA: AGM & Gel), and Flooded (FLA) / Vented. Each type serves distinct applications and industries, contributing to the overall market dynamics.

The SLI (Starting, Lighting, and Ignition) segment dominates the market due to its extensive use in the automotive industry for starting vehicles and powering electrical systems. The increasing number of vehicles on the road, coupled with the growing trend of electric vehicles, has further fueled the demand for SLI batteries. Additionally, advancements in battery technology have improved the performance and lifespan of SLI batteries, making them a preferred choice among consumers.

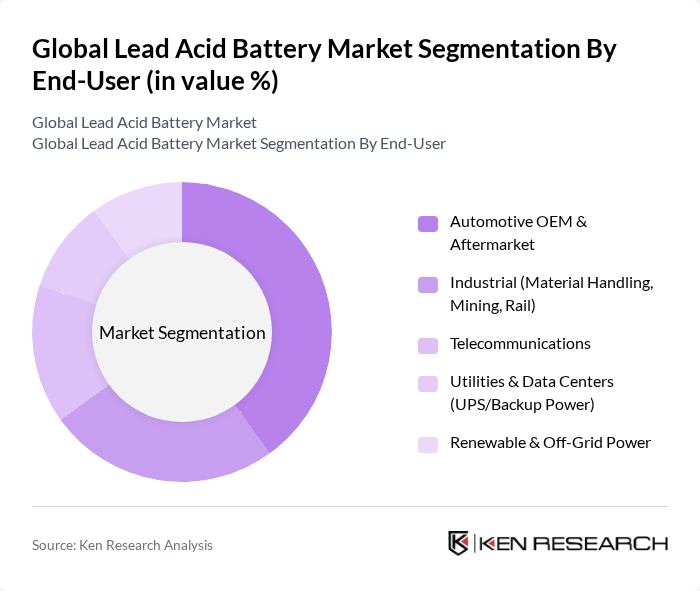

By End-User:The lead acid battery market can also be segmented by end-user applications, including Automotive OEM & Aftermarket, Industrial (Material Handling, Mining, Rail), Telecommunications, Utilities & Data Centers (UPS/Backup Power), and Renewable & Off-Grid Power. Each end-user segment has unique requirements and contributes to the overall market growth.

The Automotive OEM & Aftermarket segment is the largest end-user of lead acid batteries, driven by the high demand for vehicles and the need for replacement batteries in the aftermarket. The automotive sector's growth, particularly in emerging markets, has significantly boosted the demand for lead acid batteries. Furthermore, the trend towards electric vehicles is also influencing the development of advanced lead acid battery technologies, ensuring their continued relevance in the automotive industry.

The Global Lead Acid Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Clarios (formerly Johnson Controls Power Solutions), EnerSys, East Penn Manufacturing Co. (Deka), GS Yuasa Corporation, Exide Industries Ltd., Amara Raja Energy & Mobility Ltd. (Amaron), Leoch International Technology Ltd., Stryten Energy, C&D Technologies, Inc., Crown Battery Manufacturing Company, FIAMM Energy Technology S.p.A., HOPPECKE Batteries (Accumulators), Exide Technologies (Europe), Amperex Technology Limited (ATL) – Lead-Acid Subsidiaries/Legacy Units, Trojan Battery Company (A Motive/Deep-Cycle Brand under C&D/EnerSys partnerships) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lead acid battery market appears promising, driven by increasing investments in energy storage and the ongoing transition towards renewable energy sources. As governments worldwide implement stricter emission regulations, the demand for lead acid batteries in hybrid and electric vehicles is expected to rise. Additionally, advancements in recycling technologies will enhance sustainability, allowing manufacturers to mitigate environmental concerns while capitalizing on the growing need for reliable energy storage solutions in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | SLI (Starting, Lighting, and Ignition) Stationary (Backup/Standby) Motive/Traction (Industrial) Valve-Regulated Lead-Acid (VRLA: AGM & Gel) Flooded (FLA) / Vented |

| By End-User | Automotive OEM & Aftermarket Industrial (Material Handling, Mining, Rail) Telecommunications Utilities & Data Centers (UPS/Backup Power) Renewable & Off-Grid Power |

| By Application | Automotive SLI UPS and Data Center Backup Motive Power (Forklifts, AGVs) Telecom Base Stations Energy Storage Systems (ESS), Inverters & Solar |

| By Distribution Channel | OEM Direct Industrial Distributors/Dealers Retail & Aftermarket (Brick-and-Mortar) E-commerce |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry (Economy) Mid (Value) Premium (High Performance/Long Life) |

| By Technology | Flooded Lead-Acid (FLA) VRLA-AGM VRLA-Gel Enhanced Flooded Battery (EFB) & Stop-Start |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lead Acid Battery Users | 150 | Fleet Managers, Automotive Engineers |

| Industrial Battery Applications | 100 | Plant Managers, Operations Directors |

| Renewable Energy Storage Solutions | 80 | Energy Consultants, Project Managers |

| Battery Recycling and Disposal Services | 70 | Environmental Compliance Officers, Waste Management Experts |

| Research and Development in Battery Technology | 60 | R&D Managers, Product Development Engineers |

The Global Lead Acid Battery Market is valued at approximately USD 54 billion, driven by increasing demand for energy storage solutions in automotive and industrial sectors, particularly due to the rise in electric vehicle adoption and backup power systems.