Region:Global

Author(s):Rebecca

Product Code:KRAD0207

Pages:85

Published On:August 2025

By Type:The leveraged loan market is segmented into First-Lien Loans, Second-Lien Loans, Unitranche Loans, Mezzanine Loans, and Bridge Loans. First-Lien Loans continue to dominate due to their seniority in the capital structure, offering lower risk to lenders and higher repayment priority in the event of default. This segment is favored by both traditional and non-bank lenders seeking to balance risk and return, while Second-Lien and Unitranche Loans have gained traction among borrowers seeking flexible capital structures for acquisitions and refinancing .

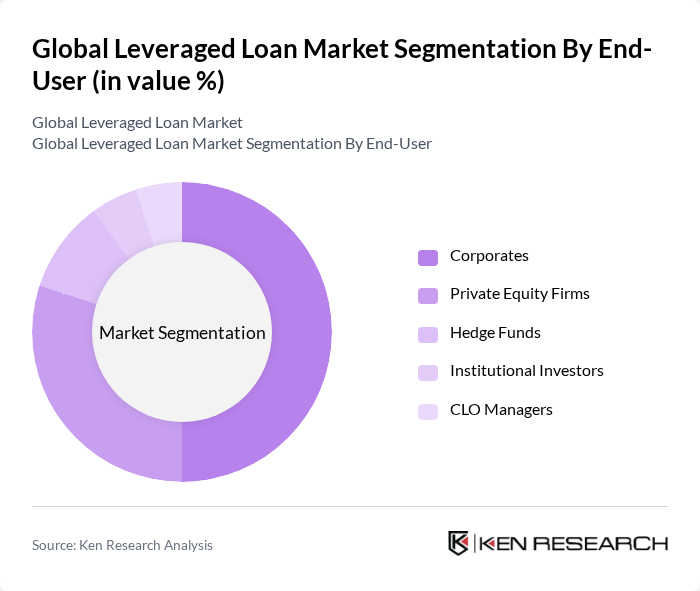

By End-User:The end-user segmentation includes Corporates, Private Equity Firms, Hedge Funds, Institutional Investors, and CLO Managers. Corporates remain the largest end-users, leveraging loans for acquisitions, refinancing, and operational expansion. Private equity firms are also significant participants, utilizing leveraged loans to finance buyouts and portfolio company growth. CLO Managers and institutional investors play a growing role as buyers and arrangers, reflecting the increasing institutionalization of the leveraged loan market .

The Global Leveraged Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as JPMorgan Chase & Co., Bank of America Merrill Lynch, Citigroup Inc., Wells Fargo & Co., Goldman Sachs Group, Inc., Barclays PLC, Deutsche Bank AG, Credit Suisse Group AG, Morgan Stanley, UBS Group AG, BNP Paribas S.A., HSBC Holdings PLC, RBC Capital Markets, Macquarie Group Limited, Apollo Global Management, Inc., Ares Management Corporation, KKR & Co. Inc., Blackstone Inc., Carlyle Group Inc., and Bain Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the leveraged loan market appears promising, driven by ongoing corporate demand for flexible financing solutions and the continued evolution of lending practices. As companies increasingly seek to optimize their capital structures, the market is likely to witness a rise in innovative loan products tailored to specific industry needs. Additionally, the integration of advanced technologies in loan management will enhance operational efficiencies, enabling lenders to better serve their clients while navigating regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Lien Loans Second-Lien Loans Unitranche Loans Mezzanine Loans Bridge Loans |

| By End-User | Corporates Private Equity Firms Hedge Funds Institutional Investors CLO Managers |

| By Loan Size | Small Loans (< USD 100 million) Medium Loans (USD 100–500 million) Large Loans (> USD 500 million) |

| By Industry | Technology Healthcare Consumer Goods Energy Industrials Telecommunications Others |

| By Geographical Focus | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Type | Secured Loans Unsecured Loans |

| By Maturity Period | Short-Term Loans (< 3 years) Medium-Term Loans (3–7 years) Long-Term Loans (> 7 years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Investment Firms Leveraging Loans | 70 | Portfolio Managers, Credit Analysts |

| Corporate Borrowers in High-Leverage Sectors | 60 | CFOs, Financial Controllers |

| Loan Syndication Professionals | 40 | Loan Officers, Syndication Managers |

| Regulatory Bodies and Financial Authorities | 40 | Regulators, Compliance Officers |

| Market Analysts and Researchers | 50 | Market Analysts, Research Directors |

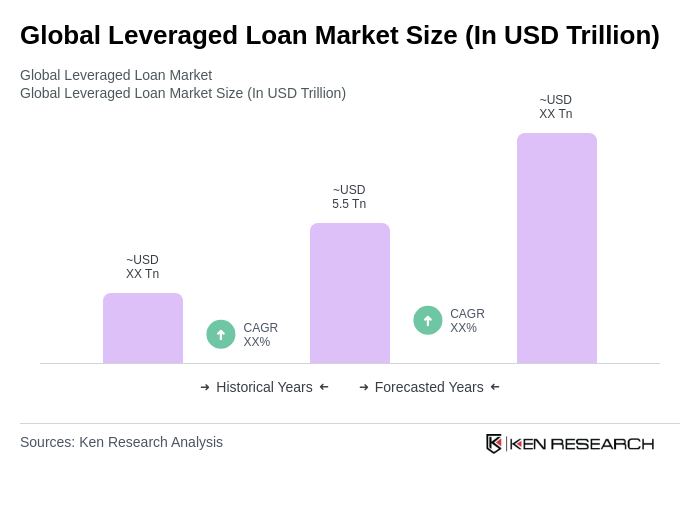

The Global Leveraged Loan Market is valued at approximately USD 5.5 trillion, driven by strong demand for refinancing, corporate financing, and investor interest in floating rate instruments. This valuation reflects a significant rebound in loan issuance activity.