Global Licensed Sports Merchandise Market Overview

- The Global Licensed Sports Merchandise Market was valued at USD 35 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of sports, the rise of e-commerce platforms, and the growing trend of sports fandom among consumers. The market has seen a surge in demand for licensed products, particularly apparel and accessories, as fans seek to express their loyalty to teams and athletes. The expansion of major sports leagues, the influence of celebrity athletes, and the proliferation of social media have further accelerated market growth. Additionally, youth participation in sports and the impact of global sporting events continue to fuel demand for branded merchandise .

- Key players in this market include the United States, China, and Germany, which dominate due to their strong sports culture, extensive fan bases, and significant investments in sports marketing. The U.S. market is estimated at approximately USD 6 billion, reflecting its well-established sports merchandise industry and high consumer spending on sports-related products. China is rapidly growing, driven by its expanding middle class and increasing interest in sports, with a market size projected to reach USD 5 billion. Germany remains a leading European market, supported by a robust sports ecosystem and steady growth in licensed merchandise sales .

- In 2023, the U.S. government implemented regulations to enhance consumer protection in the licensed merchandise sector. This includes stricter guidelines on the authenticity of licensed products, requiring manufacturers to provide proof of licensing agreements. The initiative aims to combat counterfeit merchandise and ensure that consumers receive genuine products, thereby fostering trust in the licensed sports merchandise market .

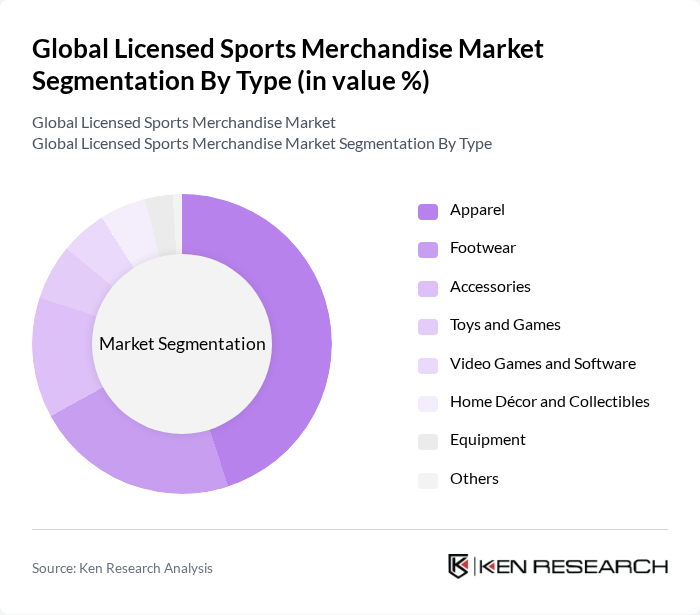

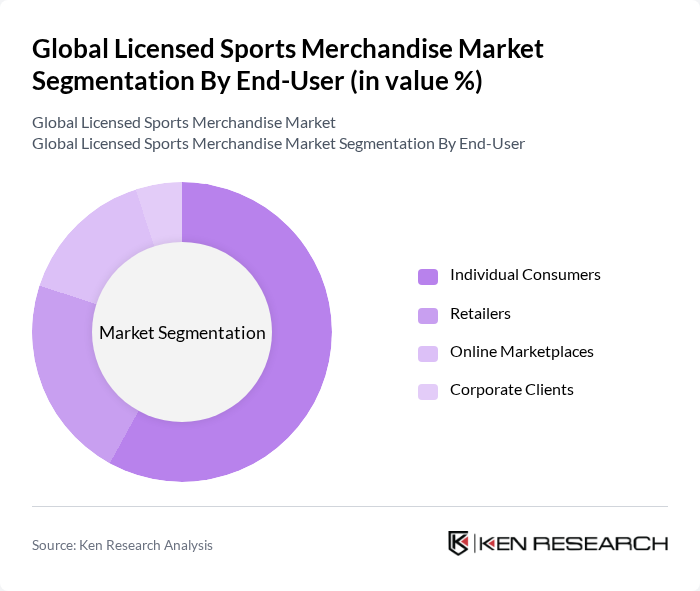

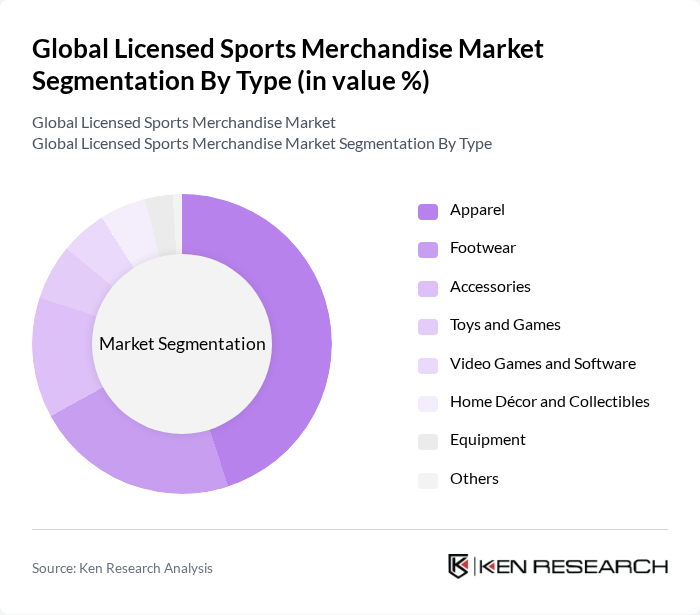

Global Licensed Sports Merchandise Market Segmentation

By Type:The licensed sports merchandise market is segmented into various types, including apparel, footwear, accessories, toys and games, video games and software, home décor and collectibles, equipment, and others. Among these, apparel is the leading sub-segment, driven by consumer preferences for team jerseys, caps, and casual wear that showcase team loyalty. The growing trend of athleisure and sports-inspired fashion has also contributed to the popularity of sports apparel, making it a dominant force in the market. Sports apparel accounts for the largest share, as fans increasingly seek branded clothing to express their support for teams and athletes .

By End-User:The market is segmented by end-user into individual consumers, retailers, online marketplaces, and corporate clients. Individual consumers represent the largest segment, as they are the primary purchasers of licensed sports merchandise for personal use. The rise of online shopping and digital retail platforms has empowered individual consumers, allowing them to access a wide range of products from various brands and teams. Retailers and online marketplaces are also significant channels, facilitating the distribution of licensed merchandise to a broader audience .

Global Licensed Sports Merchandise Market Competitive Landscape

The Global Licensed Sports Merchandise Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Fanatics, Inc., Under Armour, Inc., Puma SE, New Era Cap Co., Inc., Reebok International Ltd., Mitchell & Ness Nostalgia Co., G-III Apparel Group, Ltd., Jarden Corporation (now part of Newell Brands), Fanatics Brands, Sports Memorabilia, Inc., The North Face, Inc., Columbia Sportswear Company, Wilson Sporting Goods Co., VF Corporation, Hanesbrands Inc., MLB Advanced Media, L.P., NBA Properties, Inc., NFL Properties LLC contribute to innovation, geographic expansion, and service delivery in this space.

Global Licensed Sports Merchandise Market Industry Analysis

Growth Drivers

- Increasing Popularity of Sports Events:The global sports industry is projected to generate approximately $600 billion in revenue in future, driven by major events like the FIFA World Cup and the Olympics. This surge in viewership and attendance translates to heightened demand for licensed merchandise, as fans seek to express their allegiance. For instance, the FIFA World Cup has previously seen merchandise sales exceeding $2.5 billion, showcasing the potential for growth in this sector.

- Rise in Disposable Income:According to the World Bank, global GDP per capita is expected to rise to $13,000 in future, indicating increased disposable income for consumers. This economic growth allows fans to spend more on licensed sports merchandise, particularly in emerging markets where income levels are rapidly increasing. As consumers prioritize spending on leisure and entertainment, the demand for authentic sports merchandise is likely to see a significant boost.

- Expansion of E-commerce Platforms:E-commerce sales in the sports merchandise sector are projected to reach $120 billion in future, driven by the convenience of online shopping. Major platforms like Amazon and Alibaba are enhancing their sports merchandise offerings, making it easier for consumers to access a wide range of products. This shift towards online retail is expected to increase overall sales, as consumers prefer the ease of purchasing from home.

Market Challenges

- Counterfeit Products:The global counterfeit market is estimated to be worth over $1.8 trillion, with a significant portion attributed to sports merchandise. This prevalence of counterfeit goods undermines brand integrity and consumer trust, leading to potential revenue losses for legitimate manufacturers. The challenge of distinguishing authentic products from fakes remains a critical issue, particularly in regions with less stringent enforcement of intellectual property laws.

- Fluctuating Consumer Preferences:Consumer preferences in the sports merchandise market can shift rapidly, influenced by trends, team performance, and social media. For example, a sudden rise in popularity for a previously underperforming team can lead to a spike in merchandise demand. However, this volatility can create challenges for manufacturers and retailers in inventory management and forecasting, potentially leading to overproduction or stock shortages.

Global Licensed Sports Merchandise Market Future Outlook

The future of the licensed sports merchandise market appears promising, driven by technological advancements and evolving consumer behaviors. As fans increasingly seek personalized experiences, brands are likely to invest in customization options for merchandise. Additionally, the integration of augmented reality and virtual reality technologies can enhance fan engagement, creating immersive shopping experiences. These trends suggest a dynamic market landscape where innovation will play a crucial role in meeting consumer expectations and driving sales growth.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for licensed sports merchandise. With a combined population of over 2.5 billion, these regions are experiencing rising disposable incomes and increasing interest in sports. Targeting these markets can lead to substantial revenue growth as brands establish a foothold in untapped consumer bases.

- Collaborations with Influencers:Collaborating with social media influencers can enhance brand visibility and reach younger audiences. Influencer marketing is projected to be a $16.4 billion industry in future, providing sports brands with a powerful tool to promote merchandise. By leveraging influencers' platforms, brands can effectively engage with fans and drive merchandise sales through authentic endorsements.