Region:Global

Author(s):Shubham

Product Code:KRAA1879

Pages:96

Published On:August 2025

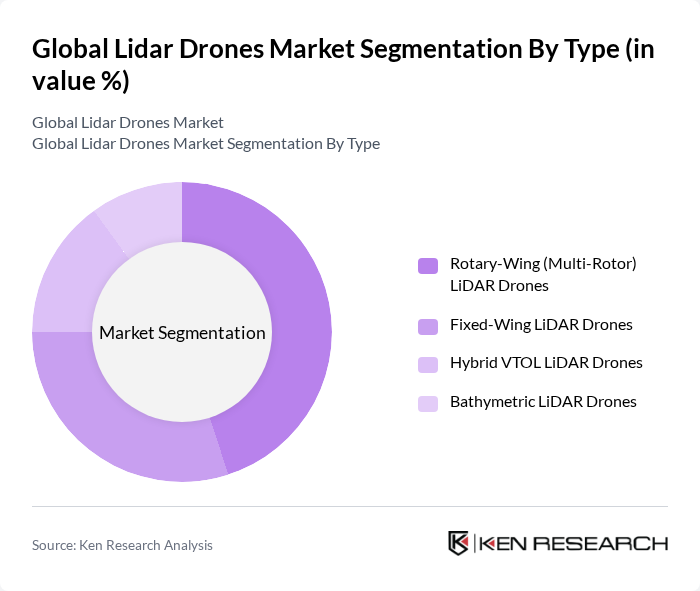

By Type:The market is segmented into four main types of Lidar drones: Rotary-Wing (Multi-Rotor) LiDAR Drones, Fixed-Wing LiDAR Drones, Hybrid VTOL LiDAR Drones, and Bathymetric LiDAR Drones. Among these, Rotary-Wing (Multi-Rotor) LiDAR Drones are leading the market due to their versatility, ease of use, and ability to operate in confined spaces. They are particularly favored in urban environments for surveying and mapping applications, consistent with industry analyses that show rotary-wing systems holding the highest share due to mission flexibility and integration with popular payloads . Fixed-Wing LiDAR Drones are also gaining traction for larger area coverage and corridor mapping, while Hybrid VTOL Drones combine the benefits of both types, supporting long-range missions with vertical takeoff and landing. Bathymetric LiDAR Drones are specialized for shallow-water/coastal mapping and environmental monitoring, serving niche markets .

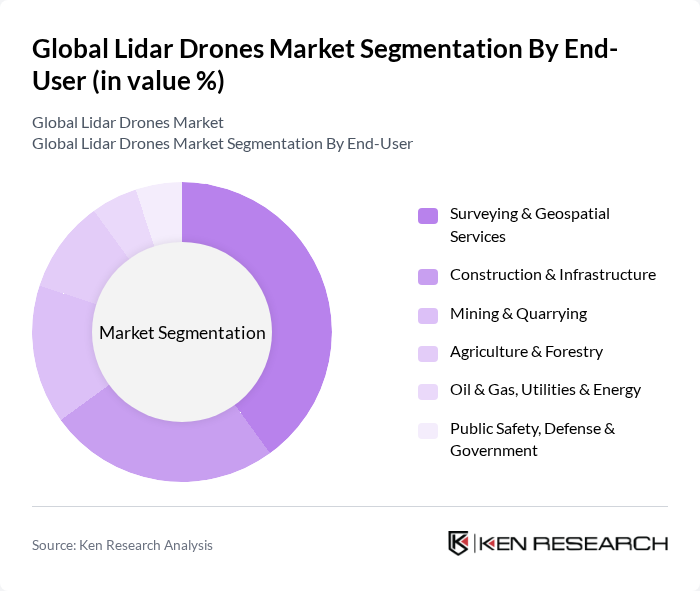

By End-User:The end-user segmentation includes Surveying & Geospatial Services, Construction & Infrastructure, Mining & Quarrying, Agriculture & Forestry, Oil & Gas, Utilities & Energy, and Public Safety, Defense & Government. The Surveying & Geospatial Services segment is currently the dominant end-user, driven by the increasing need for accurate topographical data, corridor mapping, and rapid point-cloud generation for digital twins and BIM workflows . Construction & Infrastructure is also a significant segment, as Lidar drones are increasingly used for site surveys, progress monitoring, and as-built verification. The Agriculture & Forestry segment is growing through terrain modeling and biomass/forest inventory, while the Oil & Gas sector utilizes Lidar for pipeline/right-of-way inspections and environmental assessments .

The Global Lidar Drones Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Teledyne Geospatial (Teledyne Technologies Inc.), RIEGL Laser Measurement Systems GmbH, Leica Geosystems AG (Hexagon AB), YellowScan SAS, GeoCue Group Inc. (TrueView, Microdrone-integrated), Microdrones GmbH, Phoenix LiDAR Systems, Parrot Drones SAS, Quantum-Systems GmbH, Trimble Inc., Livox Technology Co., Ltd., GreenValley International (GVI), Emesent Pty Ltd. (Hovermap), Wingtra AG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Lidar drones market appears promising, driven by technological advancements and increasing demand across various sectors. As autonomous drone technology continues to evolve, operational efficiency will improve, leading to broader adoption. Additionally, the integration of AI and machine learning will enhance data processing capabilities, allowing for more sophisticated applications. The focus on sustainability will also drive innovation, as industries seek eco-friendly solutions for surveying and monitoring, positioning Lidar drones as essential tools in the future landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary-Wing (Multi-Rotor) LiDAR Drones Fixed-Wing LiDAR Drones Hybrid VTOL LiDAR Drones Bathymetric LiDAR Drones |

| By End-User | Surveying & Geospatial Services Construction & Infrastructure Mining & Quarrying Agriculture & Forestry Oil & Gas, Utilities & Energy Public Safety, Defense & Government |

| By Application | Corridor Mapping (roads, rails, powerlines, pipelines) Topographic Surveying & Mapping Infrastructure Inspection (bridges, transmission, dams) Environmental & Coastal Monitoring Archaeology & Cultural Heritage Disaster Response & Risk Modeling |

| By Payload Capacity | Sub-2 kg LiDAR Payloads –5 kg LiDAR Payloads Above 5 kg LiDAR Payloads |

| By Range | Short Range (?200 m) Medium Range (200–500 m) Long Range (>500 m) |

| By Distribution Channel | Direct (OEM and System Integrators) Value-Added Resellers (VARs) & Distributors Online & Marketplace Channels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Band | Entry (?USD 25,000 system) Mid-Range (USD 25,001–75,000 system) Premium (?USD 75,001 system) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Lidar Applications | 100 | Agronomists, Farm Managers |

| Construction and Surveying | 80 | Surveyors, Project Managers |

| Environmental Monitoring | 70 | Environmental Scientists, Policy Makers |

| Infrastructure Inspection | 60 | Maintenance Engineers, Safety Inspectors |

| Mapping and GIS Applications | 90 | GIS Analysts, Urban Planners |

The Global Lidar Drones Market is valued at approximately USD 210 million, based on a five-year historical analysis. This valuation reflects the growing demand for high-resolution mapping and efficient surveying methods across various industries.