Region:Global

Author(s):Rebecca

Product Code:KRAA1344

Pages:99

Published On:August 2025

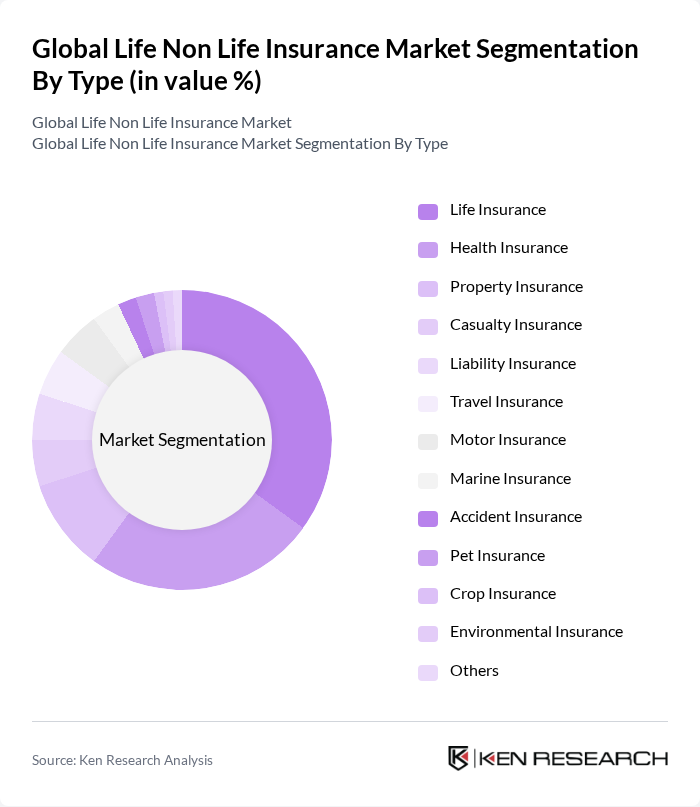

By Type:

The market is segmented into various types, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Liability Insurance, Travel Insurance, Motor Insurance, Marine Insurance, Accident Insurance, Pet Insurance, Crop Insurance, Environmental Insurance, and Others. Among these,Life Insuranceis the leading sub-segment, driven by increasing awareness of the need for financial security, the growing trend of long-term savings among consumers, and the introduction of innovative savings-type products.Health Insuranceis also gaining traction due to rising healthcare costs, the increasing prevalence of chronic diseases, and heightened consumer focus on health protection, making it a critical component of personal financial planning .

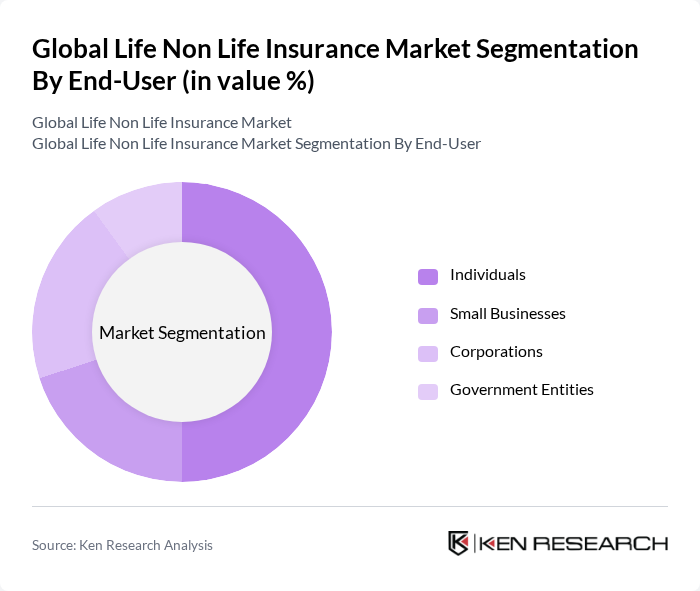

By End-User:

The end-user segmentation includes Individuals, Small Businesses, Corporations, and Government Entities.Individualsrepresent the largest segment, driven by the increasing need for personal financial security, growing awareness of insurance products, and the rise of digital distribution channels that make insurance more accessible.Small businessesare also a significant segment, as they seek to protect their assets and manage risks effectively, particularly in the face of evolving regulatory requirements and emerging risks such as cyber threats.CorporationsandGovernment Entitiesfollow, focusing on comprehensive insurance solutions to mitigate operational risks and ensure compliance with regulatory requirements .

The Global Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, AXA S.A., MetLife, Inc., Prudential Financial, Inc., American International Group, Inc. (AIG), Zurich Insurance Group AG, Chubb Limited, Munich Reinsurance Company, Berkshire Hathaway Inc., State Farm Mutual Automobile Insurance Company, Cigna Corporation, Generali Group, Aviva plc, Legal & General Group plc, Tokio Marine Holdings, Inc., Ping An Insurance (Group) Company of China, Ltd., China Life Insurance Company Limited, Sompo Holdings, Inc., Swiss Re Ltd., Manulife Financial Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the life and non-life insurance market appears promising, driven by technological innovations and changing consumer preferences. The shift towards digital solutions is expected to enhance customer engagement and streamline operations. Additionally, the growing emphasis on sustainability and ESG factors will likely influence product offerings, as insurers adapt to meet the demands of environmentally conscious consumers. As these trends evolve, the market is poised for significant transformation, fostering new growth avenues and competitive dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Casualty Insurance Liability Insurance Travel Insurance Motor Insurance Marine Insurance Accident Insurance Pet Insurance Crop Insurance Environmental Insurance Others |

| By End-User | Individuals Small Businesses Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Bancassurance Embedded Insurance |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Premium Type | Fixed Premium Variable Premium |

| By Customer Segment | High Net Worth Individuals Middle-Class Families Low-Income Households |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Coverage Parametric Insurance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Products | 100 | Insurance Agents, Financial Advisors |

| Health Insurance Market | 90 | Healthcare Administrators, Policyholders |

| Property Insurance Sector | 60 | Risk Managers, Property Owners |

| Casualty Insurance Insights | 50 | Claims Adjusters, Underwriters |

| Emerging Insurance Technologies | 40 | IT Managers, Innovation Officers |

The Global Life Non Life Insurance Market is valued at approximately USD 9.8 trillion, reflecting significant growth driven by increased consumer awareness, rising disposable incomes, and the expansion of digital platforms facilitating insurance purchases.