Region:Global

Author(s):Dev

Product Code:KRAB0419

Pages:94

Published On:August 2025

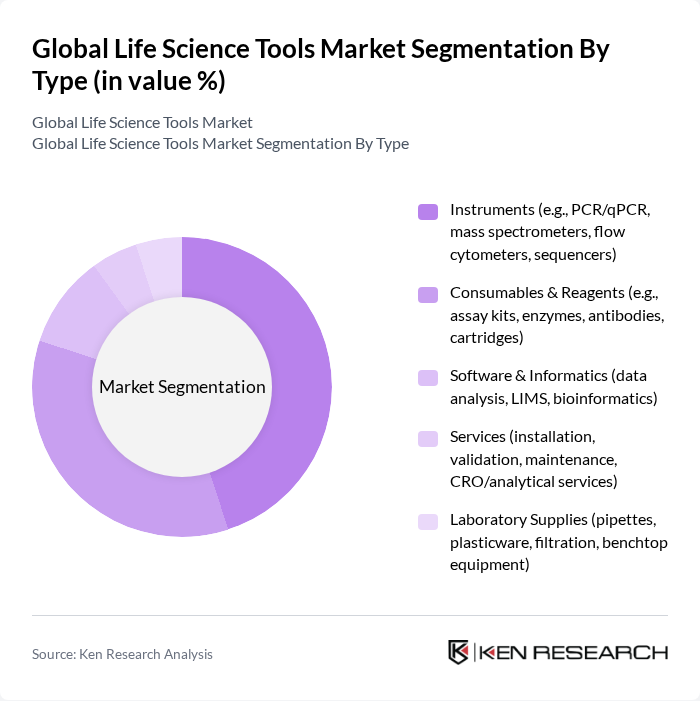

By Type:The market is segmented into various types, including Instruments, Consumables & Reagents, Software & Informatics, Services, and Laboratory Supplies. Among these, Instruments and Consumables & Reagents are the most significant contributors to market growth. Instruments such as PCR/qPCR machines and mass spectrometers are essential for research and diagnostics, while consumables like assay kits and reagents are critical for laboratory operations. The increasing demand for precision medicine and personalized healthcare is driving the growth of these segments.

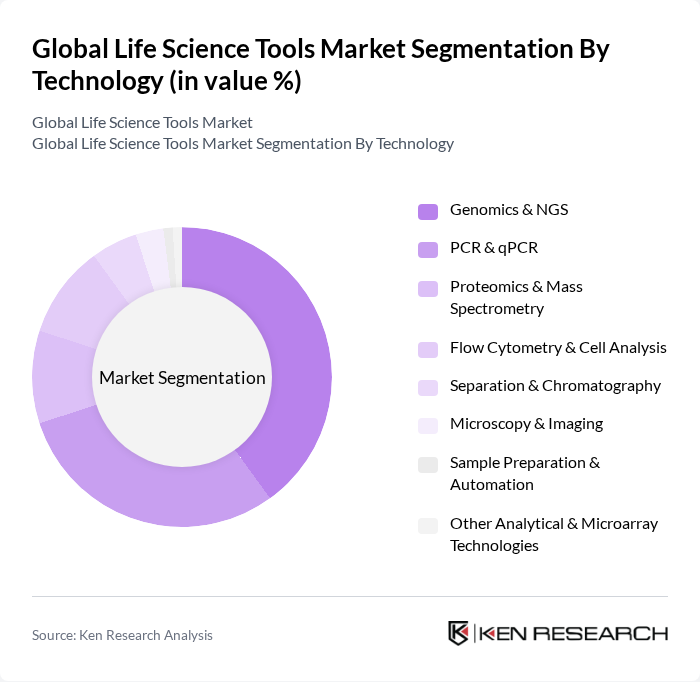

By Technology:The technology segment includes Genomics & NGS, PCR & qPCR, Proteomics & Mass Spectrometry, Flow Cytometry & Cell Analysis, Separation & Chromatography, Microscopy & Imaging, Sample Preparation & Automation, and Other Analytical & Microarray Technologies. Genomics & NGS and PCR & qPCR are leading technologies due to their critical role in genetic research and diagnostics. The increasing focus on genomics and personalized medicine is propelling the demand for these technologies.

The Global Life Science Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd (Roche Diagnostics), Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, Inc., Illumina, Inc., Revvity, Inc. (formerly PerkinElmer’s life sciences business), QIAGEN N.V., Danaher Corporation (Cytiva, Beckman Coulter Life Sciences), Waters Corporation, Bruker Corporation, Sartorius AG, Eppendorf SE, Becton, Dickinson and Company (BD), Tecan Group Ltd., Charles River Laboratories International, Inc., Shimadzu Corporation, Oxford Nanopore Technologies plc, 10x Genomics, Inc., Hamilton Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the life science tools market in future appears promising, driven by ongoing technological innovations and an increasing focus on personalized medicine. As R&D investments continue to rise, the integration of AI and machine learning will enhance data analysis capabilities, leading to more efficient research processes. Furthermore, the growing emphasis on sustainable practices will likely shape product development, encouraging companies to adopt eco-friendly technologies and materials, thereby aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Instruments (e.g., PCR/qPCR, mass spectrometers, flow cytometers, sequencers) Consumables & Reagents (e.g., assay kits, enzymes, antibodies, cartridges) Software & Informatics (data analysis, LIMS, bioinformatics) Services (installation, validation, maintenance, CRO/analytical services) Laboratory Supplies (pipettes, plasticware, filtration, benchtop equipment) |

| By Technology | Genomics & NGS PCR & qPCR Proteomics & Mass Spectrometry Flow Cytometry & Cell Analysis Separation & Chromatography Microscopy & Imaging Sample Preparation & Automation Other Analytical & Microarray Technologies |

| By Application | Drug Discovery & Development Clinical & Translational Research Genomics & Precision Medicine Proteomics & Metabolomics Cell Biology, Cell Therapy, and Bioprocessing Diagnostics & Infectious Disease Testing |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Contract Research & Contract Development/Manufacturing Organizations (CROs/CDMOs) Clinical & Diagnostic Laboratories |

| By Distribution Channel | Direct Sales Distributors/Channel Partners E-commerce/Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Lifecycle Stage | New Products Mature Products Declining Products |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotechnology Research Tools | 120 | R&D Directors, Lab Managers |

| Clinical Diagnostics Equipment | 100 | Clinical Laboratory Technologists, Quality Control Managers |

| Pharmaceutical Development Tools | 80 | Pharmaceutical Scientists, Regulatory Affairs Specialists |

| Genomics and Proteomics Tools | 110 | Genomics Researchers, Bioinformatics Analysts |

| Laboratory Automation Solutions | 90 | Automation Engineers, Lab Operations Managers |

The Global Life Science Tools Market is valued at approximately USD 170185 billion, driven by advancements in biotechnology, personalized medicine, and increasing chronic disease prevalence. This market growth is supported by significant investments in research and development by pharmaceutical and biotechnology companies.