Region:Global

Author(s):Shubham

Product Code:KRAD0608

Pages:96

Published On:August 2025

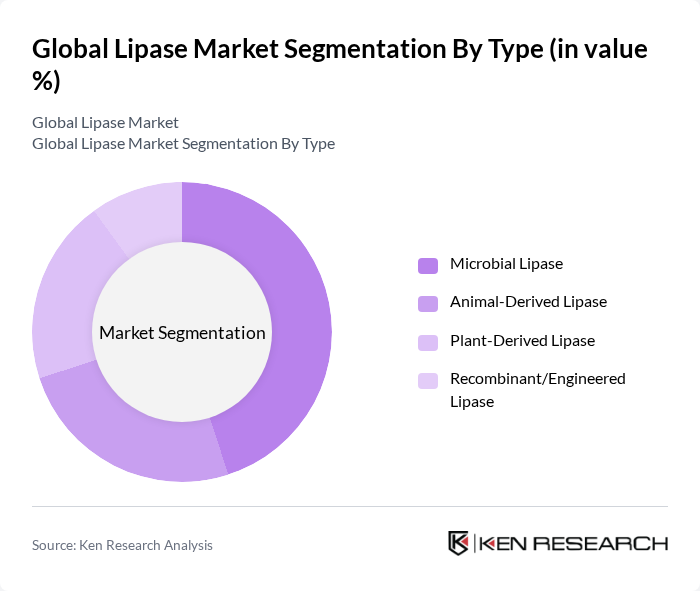

By Type:The lipase market is segmented into four main types: Microbial Lipase, Animal-Derived Lipase, Plant-Derived Lipase, and Recombinant/Engineered Lipase. Among these,Microbial Lipaseis the leading subsegment due to its broad substrate specificity, process robustness in industrial fermentation, and regulatory familiarity in food processing, baking, dairy, and detergents. The increasing preference for microbial sources over animal-derived options, driven by ethical, halal/kosher compliance, supply consistency, and sustainability considerations, further supports its dominance.

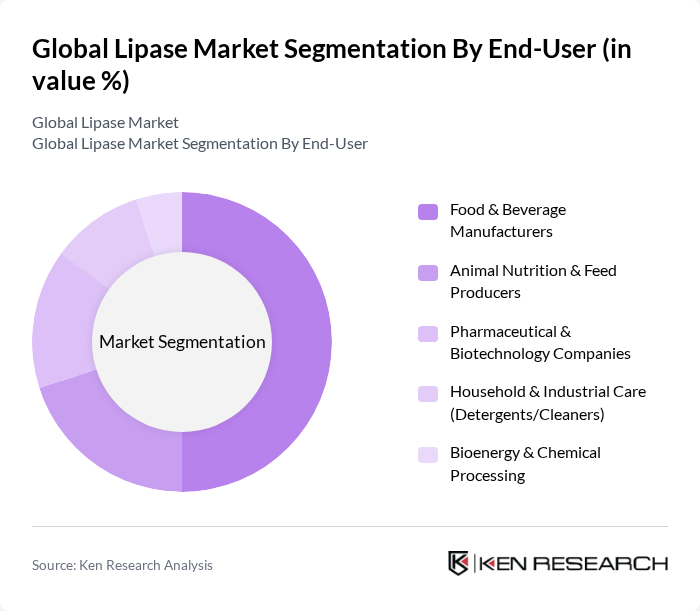

By End-User:The end-user segmentation includes Food & Beverage Manufacturers, Animal Nutrition & Feed Producers, Pharmaceutical & Biotechnology Companies, Household & Industrial Care (Detergents/Cleaners), and Bioenergy & Chemical Processing. TheFood & Beverage Manufacturerssegment is the largest, supported by enzyme-enabled improvements in flavor development, dairy fat modification, bakery texture enhancement, and process efficiency, as well as clean-label and natural processing trends.

The Global Lipase Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novozymes A/S, International Flavors & Fragrances Inc. (IFF Nutrition & Biosciences), dsm-firmenich, AB Enzymes GmbH, and BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lipase market appears promising, driven by the increasing integration of enzymes in various industries, particularly food and biofuels. As consumer preferences shift towards natural and organic products, the demand for lipases is expected to rise. Additionally, advancements in enzyme production technologies will likely enhance efficiency and reduce costs, fostering innovation. The focus on sustainability and health will further propel the market, creating a dynamic landscape for growth and development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Microbial Lipase Animal-Derived Lipase Plant-Derived Lipase Recombinant/Engineered Lipase |

| By End-User | Food & Beverage Manufacturers Animal Nutrition & Feed Producers Pharmaceutical & Biotechnology Companies Household & Industrial Care (Detergents/Cleaners) Bioenergy & Chemical Processing |

| By Application | Bakery (dough conditioning, crumb softness, shelf life) Dairy (cheese flavor development, lipolysis, UHT) Oils & Fats Modification (interesterification, transesterification) Detergents & Cleaning (degreasing, stain removal) Animal Feed (digestibility enhancement) Pharmaceuticals & Nutraceuticals (API synthesis, pancreatin) Biofuels & Biolubricants Personal Care & Cosmetics (enzymatic exfoliation) |

| By Source | Fungal (e.g., Aspergillus, Rhizopus, Candida) Bacterial (e.g., Bacillus, Pseudomonas, Burkholderia) Animal (pancreatic, gastric) Yeast and Other Microbial Sources |

| By Formulation | Liquid Powder Granular/Granulate Encapsulated/Immobilized |

| By Distribution Channel | Direct (Key Account/OEM) Distributors & System Integrators Online/Marketplace Specialty Chemical Suppliers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Production Managers, Quality Control Specialists |

| Pharmaceutical Applications | 90 | R&D Directors, Regulatory Affairs Managers |

| Animal Feed Production | 70 | Feed Formulation Experts, Nutritionists |

| Biofuel Sector | 60 | Process Engineers, Sustainability Managers |

| Cosmetic Industry | 50 | Product Development Managers, Marketing Executives |

The Global Lipase Market is valued at approximately USD 600620 million, based on a comprehensive five-year analysis. This valuation reflects the market's growth and demand across various sectors, including food, feed, and pharmaceuticals.