Region:Global

Author(s):Dev

Product Code:KRAD0450

Pages:80

Published On:August 2025

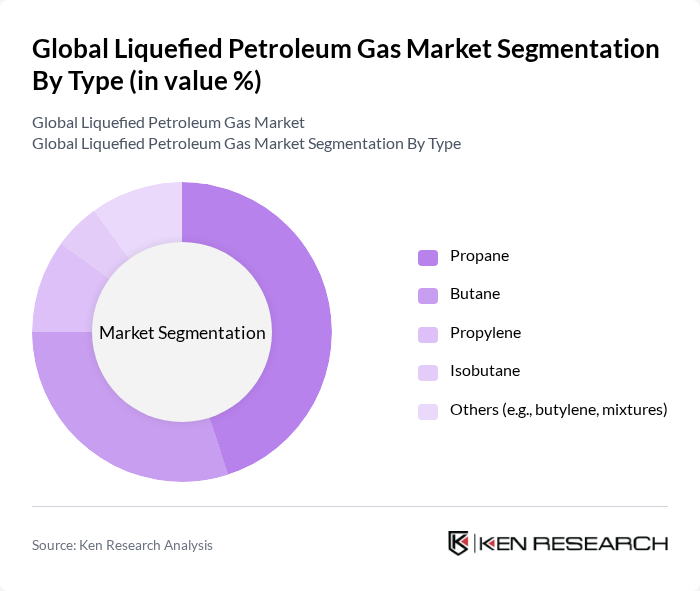

By Type:The LPG market is segmented into various types, including propane, butane, propylene, isobutane, and others. Propane is widely used in residential heating and cooking and forms the largest traded component in many markets, while butane is prevalent in cylinders, portable stoves, and blending. Propylene and isobutane are important petrochemical feedstocks, with demand linked to polypropylene and alkylation/iso-paraffin applications; the ‘Others’ category includes butylenes and various mixtures serving niche or regional specs.

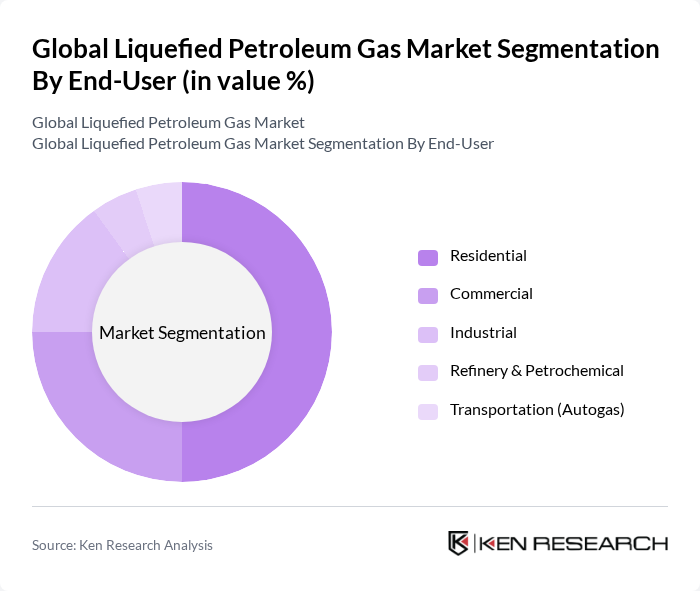

By End-User:The LPG market is segmented by end-users, including residential, commercial, industrial, refinery & petrochemical, and transportation (autogas). The residential segment dominates the market, driven by the increasing adoption of LPG for cooking and heating in households. The commercial sector follows, utilizing LPG for various applications such as restaurants and hotels. The industrial segment is also significant, with LPG being used as a fuel and feedstock in manufacturing processes.

The Global Liquefied Petroleum Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, ExxonMobil, Shell plc, BP p.l.c., TotalEnergies SE, Chevron Corporation, Phillips 66 Company, Valero Energy Corporation, Repsol S.A., PetroChina Company Limited, China Gas Holdings Ltd., Bharat Petroleum Corporation Limited, Indian Oil Corporation Limited, PETRONAS (Petroliam Nasional Berhad), Origin Energy Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquefied petroleum gas market appears promising, driven by technological advancements and a growing emphasis on sustainability. As countries strive to meet their energy needs while reducing carbon footprints, LPG is likely to play a pivotal role. Innovations in production and distribution technologies will enhance efficiency, while increasing consumer awareness of LPG's benefits will further stimulate demand. The integration of renewable energy sources alongside LPG could also create a more resilient energy landscape, fostering growth in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Propane Butane Propylene Isobutane Others (e.g., butylene, mixtures) |

| By End-User | Residential Commercial Industrial Refinery & Petrochemical Transportation (Autogas) |

| By Application | Cooking Space & Water Heating Petrochemical Feedstock (e.g., PDH/steam cracking) Power Generation Forklift & Automotive Fuel Aerosols, Refrigerants & Other Uses |

| By Distribution Channel | Bottled/Cylinder Distribution Bulk/Bowser Delivery Autogas Stations Wholesale/Direct Sales to Industrials |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Source | Refineries Associated Gas Non-Associated Gas |

| By Packaging Type | Cylinders (?14.2 kg, 15–33 kg, >33 kg) Bulk Tanks Canisters/Cartridges ISO Tanks & Railcars |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LPG Usage | 120 | Homeowners, Property Managers |

| Commercial LPG Applications | 90 | Restaurant Owners, Facility Managers |

| Industrial LPG Consumption | 80 | Manufacturing Managers, Operations Directors |

| LPG Distribution Networks | 70 | Logistics Coordinators, Supply Chain Managers |

| Regulatory Compliance in LPG | 60 | Compliance Officers, Environmental Regulators |

The Global Liquefied Petroleum Gas Market is valued at approximately USD 160 billion, driven by the increasing demand for cleaner energy sources, urbanization, and the growth of the petrochemical industry.