Region:Global

Author(s):Dev

Product Code:KRAC0414

Pages:97

Published On:August 2025

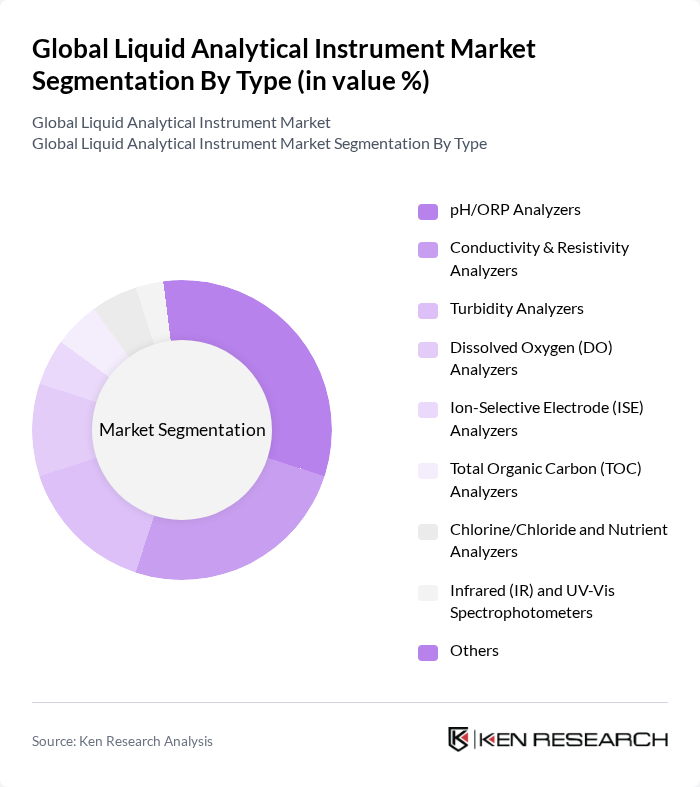

By Type:The market is segmented into various types of liquid analytical instruments, including pH/ORP analyzers, conductivity & resistivity analyzers, turbidity analyzers, dissolved oxygen (DO) analyzers, ion-selective electrode (ISE) analyzers, total organic carbon (TOC) analyzers, chlorine/chloride and nutrient analyzers, infrared (IR) and UV-Vis spectrophotometers, and others. Among these,pH/ORP analyzersandconductivity & resistivity analyzersare leading the market due to their widespread application in water quality testing and industrial processes, and their central role in regulatory compliance and process optimization across water, pharma, food, and chemicals.

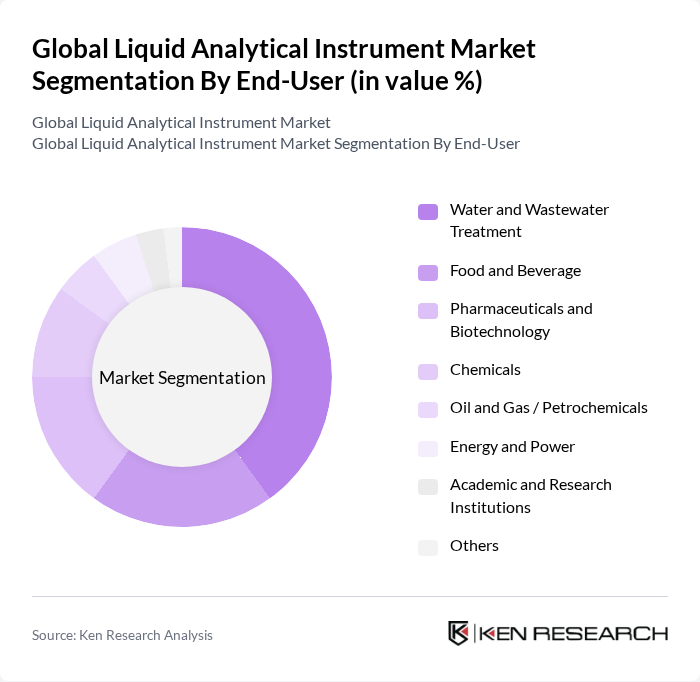

By End-User:The end-user segmentation includes water and wastewater treatment, food and beverage, pharmaceuticals and biotechnology, chemicals, oil and gas/petrochemicals, energy and power, academic and research institutions, and others. Thewater and wastewater treatmentsector is the largest end-user, driven by regulatory requirements and the need for effective water management solutions, with rising adoption of online analyzers for continuous monitoring aligned to quality standards.

The Global Liquid Analytical Instrument Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co. (Rosemount Analytical), Siemens AG (Process Instrumentation), Endress+Hauser Group Services AG, ABB Ltd., Yokogawa Electric Corporation, Honeywell International Inc., Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Hach (a Danaher company), Mettler-Toledo International Inc., PerkinElmer, Inc. (Revvity, Inc.), HORIBA, Ltd., KROHNE Messtechnik GmbH, AMETEK, Inc. (Analytical Instruments), Parker Hannifin Corporation (Parker Autoclave/Instrumentation), Xylem Inc. (including YSI), Swan Analytical Instruments AG, Analytical Technology, Inc. (ATI), Myron L Company, Hamilton Company (Process Analytics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquid analytical instrument market appears promising, driven by technological advancements and increasing regulatory demands. The integration of artificial intelligence and machine learning into analytical processes is expected to enhance data accuracy and operational efficiency. Additionally, the growing emphasis on sustainability will likely propel the development of eco-friendly analytical solutions, aligning with global environmental goals. As industries adapt to these trends, the market is poised for significant transformation and growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | pH/ORP Analyzers Conductivity & Resistivity Analyzers Turbidity Analyzers Dissolved Oxygen (DO) Analyzers Ion-Selective Electrode (ISE) Analyzers Total Organic Carbon (TOC) Analyzers Chlorine/Chloride and Nutrient Analyzers Infrared (IR) and UV-Vis Spectrophotometers Others |

| By End-User | Water and Wastewater Treatment Food and Beverage Pharmaceuticals and Biotechnology Chemicals Oil and Gas / Petrochemicals Energy and Power Academic and Research Institutions Others |

| By Application | Wastewater Management Water Purification and Drinking Water Liquid Chemistry Monitoring and Process Control Drug Discovery and QC/QA Environmental Monitoring and Compliance Others |

| By Distribution Channel | Direct Sales Distributors/Systems Integrators Online Sales Retail/Lab Supply Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Component | Hardware (Sensors, Transmitters, Probes) Software/Analytics Services (Calibration, Maintenance, Validation) |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Quality Control | 100 | Quality Assurance Managers, Lab Technicians |

| Environmental Testing Laboratories | 80 | Environmental Scientists, Lab Directors |

| Food & Beverage Safety Testing | 90 | Food Safety Managers, Compliance Officers |

| Academic Research Institutions | 70 | Research Scientists, Lab Managers |

| Industrial Manufacturing Applications | 85 | Process Engineers, Production Managers |

The Global Liquid Analytical Instrument Market is valued at approximately USD 500 million, with estimates ranging from USD 495 to USD 520 million based on recent industry studies, reflecting strong demand across various sectors such as process industries and environmental monitoring.