Region:Global

Author(s):Shubham

Product Code:KRAA1847

Pages:91

Published On:August 2025

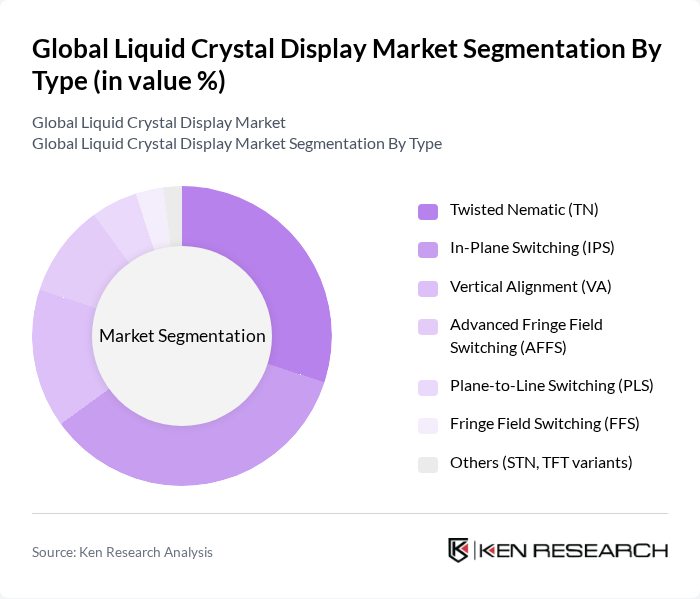

By Type:The Liquid Crystal Display market is segmented into various types, including Twisted Nematic (TN), In-Plane Switching (IPS), Vertical Alignment (VA), Advanced Fringe Field Switching (AFFS), Plane-to-Line Switching (PLS), Fringe Field Switching (FFS), and Others (STN, TFT variants). Each type has unique characteristics that cater to different consumer needs and preferences.

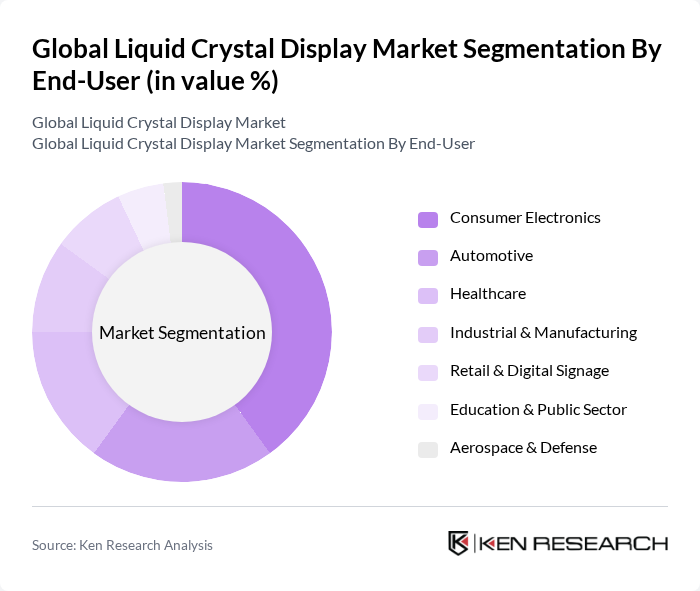

By End-User:The market is also segmented by end-user applications, which include Consumer Electronics, Automotive, Healthcare, Industrial & Manufacturing, Retail & Digital Signage, Education & Public Sector, and Aerospace & Defense. Each segment reflects the diverse applications of LCD technology across various industries.

The Global Liquid Crystal Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Display Co., Ltd., LG Display Co., Ltd., Sharp Corporation, BOE Technology Group Co., Ltd., AUO Corporation, Innolux Corporation, Japan Display Inc. (JDI), Tianma Microelectronics Co., Ltd., HKC Corporation Limited, CSOT (TCL China Star Optoelectronics Technology Co., Ltd.), HannStar Display Corporation, Truly International Holdings Limited, Visionox Technology Inc., Panda LCD Technology Co., Ltd. (Nanjing CEC Panda LCD), Sharp NEC Display Solutions, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Notes on updates and validation

The future of the liquid crystal display market in the None region appears promising, driven by ongoing technological advancements and increasing consumer demand for high-quality displays. As manufacturers invest in research and development, innovations such as flexible displays and integration with IoT devices are expected to gain traction. Additionally, the growing emphasis on energy efficiency and sustainability will likely shape product offerings, ensuring that the market remains dynamic and responsive to consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Twisted Nematic (TN) In-Plane Switching (IPS) Vertical Alignment (VA) Advanced Fringe Field Switching (AFFS) Plane-to-Line Switching (PLS) Fringe Field Switching (FFS) Others (STN, TFT variants) |

| By End-User | Consumer Electronics Automotive Healthcare Industrial & Manufacturing Retail & Digital Signage Education & Public Sector Aerospace & Defense |

| By Application | Televisions Monitors & Laptops Smartphones & Feature Phones Tablets & e-Readers Automotive Displays (Instrument Cluster, Center Stack, HUD) Digital Signage & Professional Displays Wearables & Smart Devices Others (Appliances, POS, Medical) |

| By Distribution Channel | OEM (Direct to Device/Set Makers) ODM/EMS Partners Distributors/Value-Added Resellers Online Retail Offline Retail |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium |

| By Technology (Backlighting/Enhancements) | CCFL-Backlit LCD LED-Backlit LCD (Edge, Direct) Mini-LED Backlit LCD Quantum Dot-Enhanced LCD (QDEF/QLED) Others (Local Dimming, HDR, Polarizer/Film) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Supply Chain Analysts |

| Automotive Display Solutions | 90 | Engineering Managers, Procurement Specialists |

| Healthcare Equipment Suppliers | 60 | Quality Assurance Managers, Regulatory Affairs Officers |

| Television Manufacturers | 100 | Marketing Directors, Technical Leads |

| Retail Electronics Outlets | 70 | Store Managers, Sales Executives |

The Global Liquid Crystal Display Market is valued at approximately USD 270 billion, reflecting strong demand from various sectors such as televisions, monitors, and consumer electronics, despite competition from OLED and other emerging technologies.