Region:Global

Author(s):Dev

Product Code:KRAA1609

Pages:97

Published On:August 2025

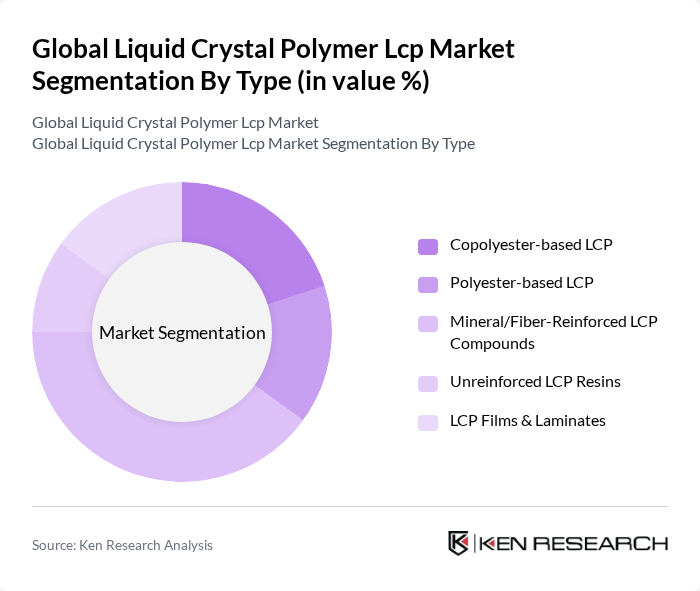

By Type:

The LCP market is segmented into five main types: Copolyester-based LCP, Polyester-based LCP, Mineral/Fiber-Reinforced LCP Compounds, Unreinforced LCP Resins, and LCP Films & Laminates. Among these, the Mineral/Fiber-Reinforced LCP Compounds segment is leading the market due to their superior mechanical properties and enhanced performance in demanding applications. These compounds are increasingly used in the automotive and electronics sectors, where durability and reliability are critical. The growing trend towards lightweight materials in automotive manufacturing further boosts the demand for reinforced LCPs.

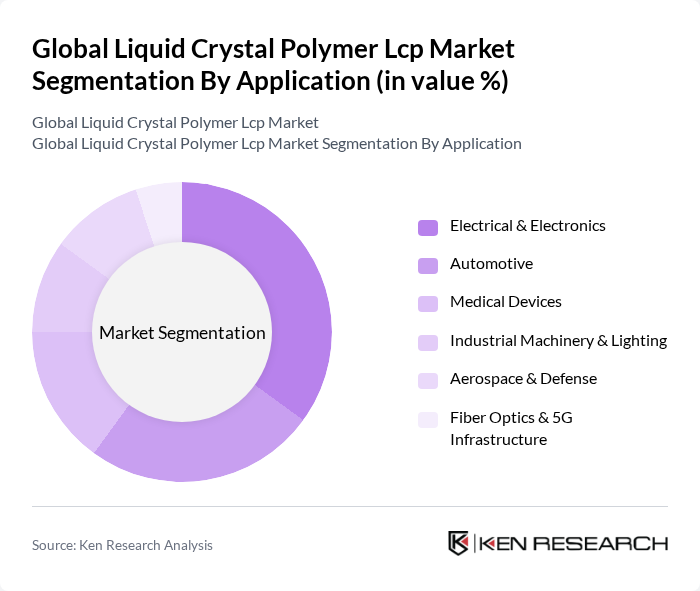

By Application:

The applications of LCPs are diverse, including Electrical & Electronics, Automotive, Medical Devices, Industrial Machinery & Lighting, Aerospace & Defense, and Fiber Optics & 5G Infrastructure. The Electrical & Electronics segment is currently the dominant application area, driven by the increasing demand for high-frequency components and connectors in consumer electronics and telecommunications. The rapid growth of 5G technology and the need for miniaturized electronic devices are propelling the demand for LCPs in this sector.

The Global Liquid Crystal Polymer Lcp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Celanese Corporation (including former DuPont LCP business), Sumitomo Chemical Co., Ltd., Polyplastics Co., Ltd. (Daicel Group), Toray Industries, Inc., Solvay S.A., KANEKA Corporation, UENO FINE CHEMICALS INDUSTRY, LTD., Ensigner Inc., RTP Company, SABIC, Sumitomo Bakelite Co., Ltd., Chang Chun Group, Shenzhen Wote Advanced Materials Co., Ltd., Kingfa Sci. & Tech. Co., Ltd., Avient Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquid crystal polymer market appears promising, driven by technological advancements and increasing demand for sustainable materials. As industries prioritize lightweight and high-performance materials, LCPs are expected to gain traction in emerging sectors such as renewable energy and smart technologies. Additionally, ongoing research and development efforts are likely to yield innovative applications, further enhancing the versatility and appeal of LCPs in various manufacturing processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Copolyester-based LCP Polyester-based LCP Mineral/Fiber-Reinforced LCP Compounds Unreinforced LCP Resins LCP Films & Laminates |

| By Application | Electrical & Electronics (connectors, FPC antennas, high-frequency components) Automotive (lighting, sensor housings, e-mobility electronics) Medical Devices (catheters, reinforcement braiding, surgical tools) Industrial Machinery & Lighting Aerospace & Defense Fiber Optics & 5G Infrastructure |

| By End-User | Consumer Electronics & Mobile Devices Electrical & Electronics OEMs Automotive OEMs & Tier-1s Healthcare & Medical OEMs Industrial & Aerospace |

| By Distribution Channel | Direct Sales (Producers to OEMs/Tier-1s) Specialized Chemical Distributors Online Technical Sales Portals Retail/Resale for Prototyping & Small Batch Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy (general-purpose grades) Mid-Range (enhanced E&E/auto grades) Premium (high-frequency/medical grades) |

| By Product Form | Pellets/Resins Compounds Films Laminates Fibers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Industry Applications | 120 | Product Managers, Design Engineers |

| Automotive Component Manufacturing | 90 | Supply Chain Managers, Quality Assurance Leads |

| Telecommunications Equipment | 70 | Technical Directors, Procurement Specialists |

| Medical Device Applications | 60 | Regulatory Affairs Managers, R&D Scientists |

| Consumer Goods Packaging | 80 | Marketing Managers, Product Development Teams |

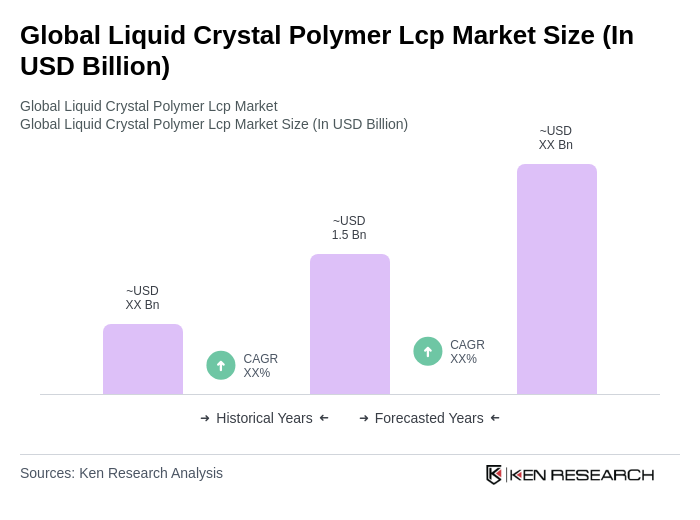

The Global Liquid Crystal Polymer market is valued at approximately USD 1.5 billion, driven by the increasing demand for high-performance materials across various industries, including electronics, automotive, and medical devices.