Region:Global

Author(s):Shubham

Product Code:KRAA1857

Pages:99

Published On:August 2025

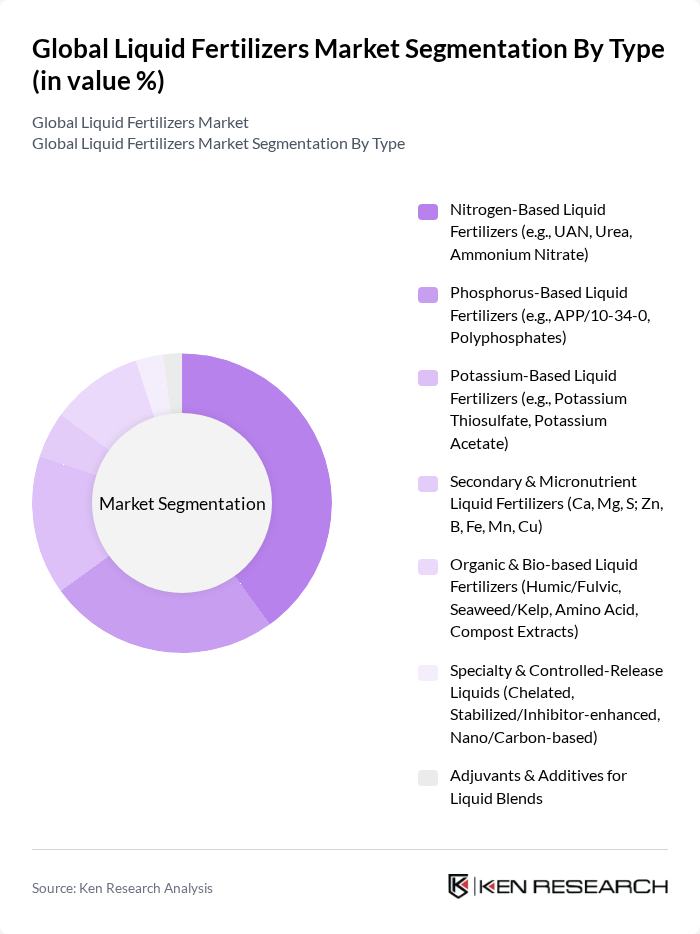

By Type:The liquid fertilizers market is segmented into various types, including nitrogen-based, phosphorus-based, potassium-based, secondary & micronutrient, organic & bio-based, specialty & controlled-release liquids, and adjuvants & additives for liquid blends. Each type serves specific agricultural needs and is tailored to enhance crop productivity.

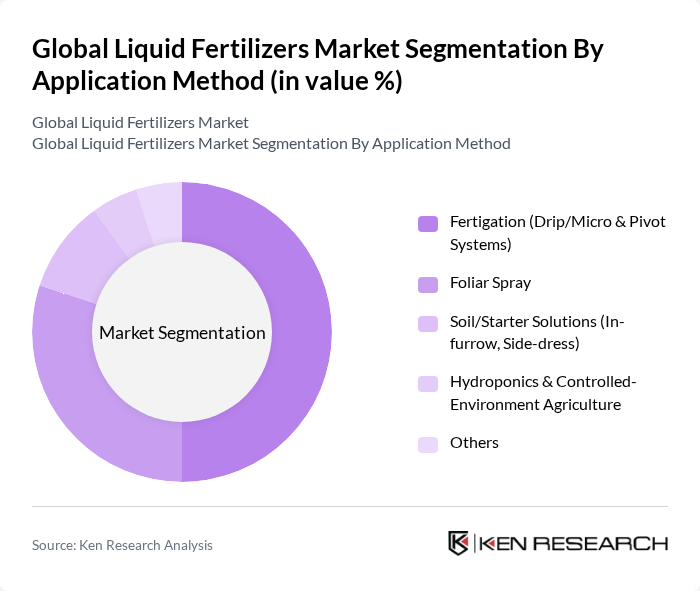

By Application Method:The application methods for liquid fertilizers include fertigation, foliar spray, soil/starter solutions, hydroponics, and others. Each method is designed to optimize nutrient uptake and enhance crop growth efficiency, with liquids favored for rapid plant availability and uniform distribution through irrigation and spray systems.

The Global Liquid Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., Yara International ASA, The Mosaic Company, CF Industries Holdings, Inc., Haifa Group, K+S AG, ICL Group Ltd., UPL Limited, Corteva, Inc., OCP Group, American Vanguard Corporation (AMVAC), Helena Agri-Enterprises, LLC, Wilbur-Ellis Company LLC, Aglukon Spezialdünger GmbH & Co. KG, Stoller Group (Corteva Biologicals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquid fertilizers market appears promising, driven by increasing agricultural productivity demands and a shift towards sustainable practices. As farmers increasingly adopt precision agriculture techniques, the need for efficient nutrient delivery systems will grow. Additionally, the rise of bio-based fertilizers will likely reshape the market landscape, aligning with global sustainability goals. Innovations in fertilizer formulations and delivery methods will further enhance the appeal of liquid fertilizers, ensuring their relevance in modern agriculture.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen-Based Liquid Fertilizers (e.g., UAN, Urea, Ammonium Nitrate) Phosphorus-Based Liquid Fertilizers (e.g., APP/10-34-0, Polyphosphates) Potassium-Based Liquid Fertilizers (e.g., Potassium Thiosulfate, Potassium Acetate) Secondary & Micronutrient Liquid Fertilizers (Ca, Mg, S; Zn, B, Fe, Mn, Cu) Organic & Bio-based Liquid Fertilizers (Humic/Fulvic, Seaweed/Kelp, Amino Acid, Compost Extracts) Specialty & Controlled-Release Liquids (Chelated, Stabilized/Inhibitor-enhanced, Nano/Carbon-based) Adjuvants & Additives for Liquid Blends |

| By Application Method | Fertigation (Drip/Micro & Pivot Systems) Foliar Spray Soil/Starter Solutions (In-furrow, Side-dress) Hydroponics & Controlled-Environment Agriculture Others |

| By Crop Type | Cereals & Grains (Corn, Wheat, Rice) Fruits & Vegetables Oilseeds & Pulses (Soybean, Canola) Turf, Ornamentals & Nurseries Plantation & Cash Crops (Sugarcane, Cotton, Coffee) Others |

| By End-User | Large-Scale Commercial Farms Commercial Greenhouses & CEA Operators Smallholders & Home Gardeners Agricultural Service Providers & Cooperatives Others |

| By Distribution Channel | Direct-to-Farm (Dealer/Ag Retailers) Company-owned Retail & Blenders Online/Marketplace Platforms Cooperatives & Buying Groups OEM/Equipment-integrated Supply (Irrigation, Pivot) Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) Others |

| By Packaging Type | Bulk & Tote/IBC Containers Drums & Jerrycans Bag-in-Box & Pouches Others |

| By Price/Grade | Commodity Grades (UAN, APP) Mid-Range Specialty (Micronutrients, Thiosulfates) Premium Specialty (Chelated, Bio-based, Inhibitor-enhanced) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Producers | 140 | Farm Owners, Agronomists |

| Fertilizer Distributors | 100 | Sales Managers, Distribution Coordinators |

| Retailers of Agricultural Inputs | 80 | Store Managers, Product Buyers |

| Research Institutions | 60 | Research Scientists, Agricultural Economists |

| Government Agricultural Agencies | 50 | Policy Makers, Program Directors |

The Global Liquid Fertilizers Market is valued at approximately USD 15 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for high-efficiency fertilizers that enhance agricultural productivity and resource-efficient nutrient delivery systems.