Region:Global

Author(s):Shubham

Product Code:KRAD0727

Pages:99

Published On:August 2025

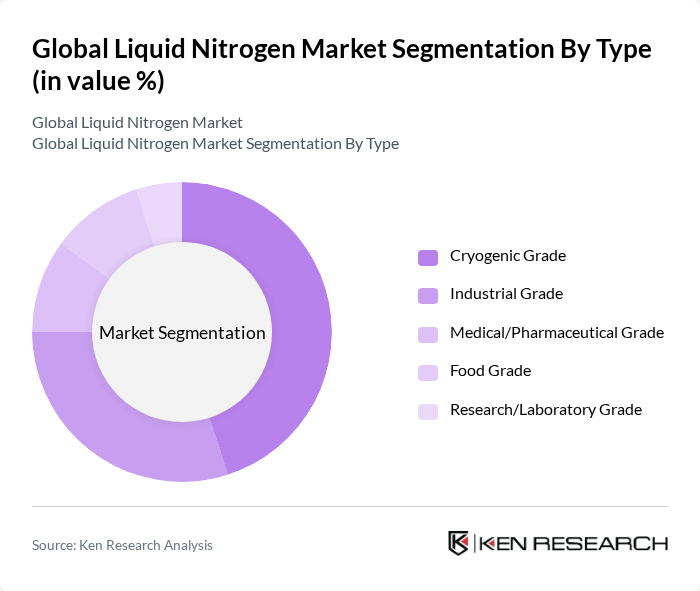

By Type:The liquid nitrogen market is segmented into Cryogenic Grade, Industrial Grade, Medical/Pharmaceutical Grade, Food Grade, and Research/Laboratory Grade. Cryogenic Grade is widely used across industrial applications and thermal processing where ultra?low temperatures are required, including tunnel and spiral freezing in food, cryogenic grinding, and shrink?fitting. Food Grade is essential for direct food contact and rapid freezing, while Medical/Pharmaceutical Grade supports cryopreservation, biobanking, and cryosurgery. Industrial Grade serves welding, metal treatment, and general manufacturing, and Research/Laboratory Grade supports scientific experiments and instrument cooling.

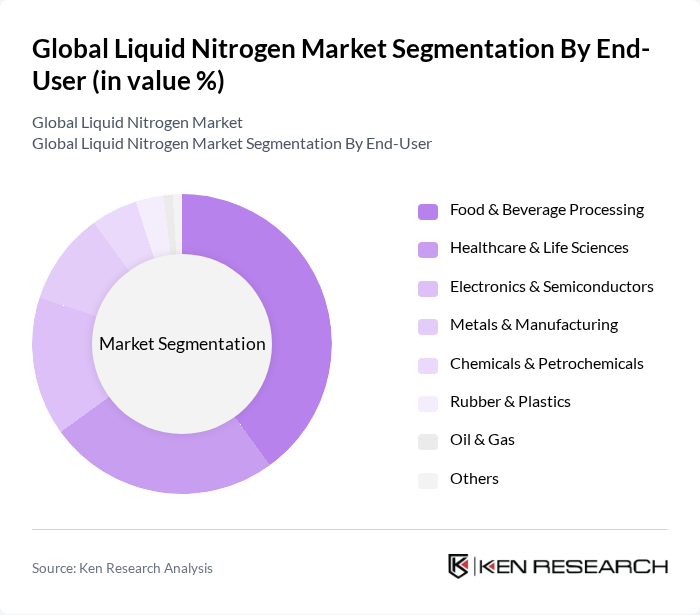

By End-User:The end-user segmentation of the liquid nitrogen market includes Food & Beverage Processing, Healthcare & Life Sciences, Electronics & Semiconductors, Metals & Manufacturing, Chemicals & Petrochemicals, Rubber & Plastics, Oil & Gas, and Others. Food & Beverage Processing is a major consumer due to demand for rapid freezing, cold chain integrity, and product quality retention. Healthcare & Life Sciences uses liquid nitrogen for cryopreservation, dermatology, and vaccine/biologic storage. Electronics & Semiconductors apply it for inerting and temperature control during manufacturing and testing. Metals & Manufacturing utilize it for shrink?fitting, heat?treat support, and cryogenic processing; Chemicals & Petrochemicals use it for inerting, purging, and temperature control.

The Global Liquid Nitrogen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Linde plc, Air Liquide S.A., Air Products and Chemicals, Inc., Messer SE & Co. KGaA, Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso), Matheson Tri-Gas, Inc. (MATHESON), Airgas, an Air Liquide company, Gulf Cryo, INOX Air Products, INOXCVA (Cryogenic Vessel Manufacturing), Universal Industrial Gases, Inc., Southern Industrial Gas Sdn. Bhd., PT Samator Indo Gas Tbk, Nippon Gases (Europe), SOL S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquid nitrogen market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of sustainable practices is expected to reshape production methods, enhancing efficiency and reducing environmental impact. Additionally, the expansion into emerging markets presents significant growth potential, as industries in these regions adopt liquid nitrogen for diverse applications, including food preservation and healthcare, thereby driving demand and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cryogenic Grade Industrial Grade Medical/Pharmaceutical Grade Food Grade Research/Laboratory Grade |

| By End-User | Food & Beverage Processing Healthcare & Life Sciences Electronics & Semiconductors Metals & Manufacturing Chemicals & Petrochemicals Rubber & Plastics Oil & Gas Others |

| By Application | Cryopreservation & Biobanking Food Freezing & Chilling (IQF/Immersion) Inerting, Purging & Blanketing Cooling in Industrial Processes & Metal Treating Electronics Cooling & Testing Others |

| By Distribution Channel | On-site Generation (ASUs) Merchant/Bulk Deliveries Packaged Gases (Cylinders/Dewars) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Tanks Cylinders Dewar Flasks Microbulk Others |

| By Pricing Strategy | Contract Pricing (Merchant/On-site) Spot Pricing Value-Added Service Pricing (Rental, Logistics) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Production Managers, Quality Assurance Managers |

| Healthcare Sector Applications | 100 | Biomedical Engineers, Hospital Procurement Managers |

| Electronics Manufacturing | 80 | Manufacturing Engineers, Supply Chain Analysts |

| Aerospace and Defense | 70 | Project Managers, R&D Directors |

| Research and Development Facilities | 90 | Lab Managers, Research Scientists |

The Global Liquid Nitrogen Market is valued at approximately USD 18.5 billion, based on a five-year historical analysis. This valuation reflects the extensive use of liquid nitrogen across various industries, including food processing, healthcare, and manufacturing.