Region:Global

Author(s):Geetanshi

Product Code:KRAC0041

Pages:81

Published On:August 2025

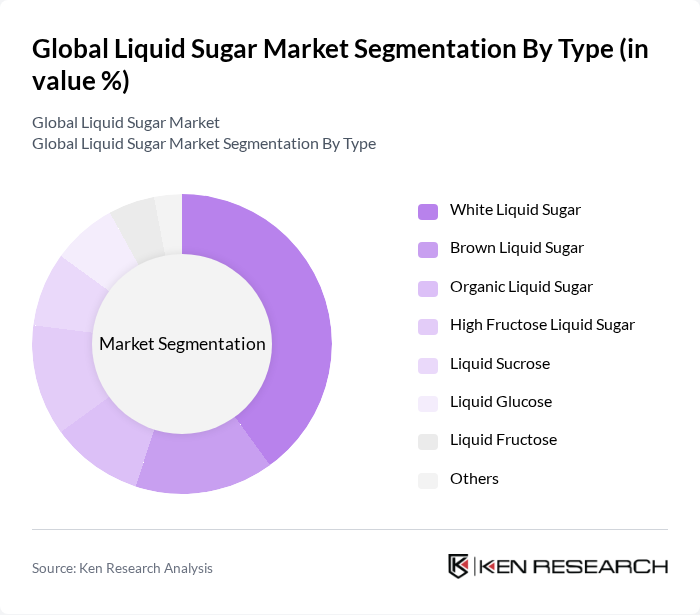

By Type:The market is segmented into White Liquid Sugar, Brown Liquid Sugar, Organic Liquid Sugar, High Fructose Liquid Sugar, Liquid Sucrose, Liquid Glucose, Liquid Fructose, and Others. White Liquid Sugar remains the most dominant segment, primarily due to its extensive use in the food and beverage industry, where it is valued for its sweetness, solubility, and versatility in large-scale processing operations. The rising demand for organic and natural sweeteners is also supporting growth in the organic liquid sugar segment .

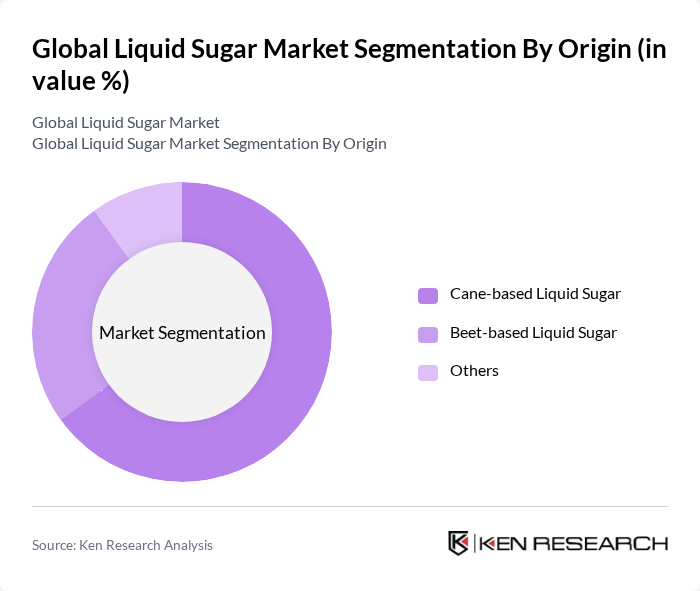

By Origin:The liquid sugar market is also categorized by origin, including Cane-based Liquid Sugar, Beet-based Liquid Sugar, and Others. Cane-based Liquid Sugar holds the largest share, reflecting the dominance of sugarcane as a raw material in global sugar production and its widespread use in food and beverage manufacturing. Beet-based Liquid Sugar is also significant, especially in regions where sugar beet cultivation is prevalent .

The Global Liquid Sugar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Südzucker AG, Ingredion Incorporated, Associated British Foods PLC, American Crystal Sugar Company, Purecane, Domino Foods, Inc., Florida Crystals Corporation, Wilmar International Limited, Tereos S.A., Cosan S.A., E.I. du Pont de Nemours and Company, and Olam International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the liquid sugar market in None appears promising, driven by evolving consumer preferences and a growing focus on health and wellness. Innovations in product development, such as organic and low-calorie liquid sugars, are expected to gain traction. Additionally, the rise of e-commerce platforms is facilitating easier access to liquid sugar products, allowing manufacturers to reach a broader audience. As sustainability becomes a priority, companies are likely to adopt eco-friendly sourcing practices, further enhancing market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | White Liquid Sugar Brown Liquid Sugar Organic Liquid Sugar High Fructose Liquid Sugar Liquid Sucrose Liquid Glucose Liquid Fructose Others |

| By Origin | Cane-based Liquid Sugar Beet-based Liquid Sugar Others |

| By Application | Bakery Confectionery Beverages Dairy Products Baby Foods Pharmaceuticals Personal Care Sauces Others |

| By End-User | Household Commercial Industrial |

| By Distribution Channel | Direct Sales Online Stores Supermarkets/Hypermarkets Specialty Stores Others |

| By Packaging Type | Bulk Packaging Retail Packaging Tetra Packs Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Procurement Managers |

| Retail Sector Distributors | 60 | Sales Managers, Distribution Coordinators |

| Health and Wellness Product Companies | 50 | Marketing Directors, Product Managers |

| Food Service Industry | 40 | Operations Managers, Menu Developers |

| Research and Development Institutions | 40 | Food Scientists, Research Analysts |

The Global Liquid Sugar Market is valued at approximately USD 4.5 billion, driven by increasing demand across various sectors such as beverages, bakery products, and pharmaceuticals. This growth reflects a significant trend towards convenient sweetening solutions in the food and beverage industry.