Region:Global

Author(s):Rebecca

Product Code:KRAD0170

Pages:81

Published On:August 2025

By Type:The liquid synthetic rubber market is segmented into various types, including Liquid Styrene-Butadiene Rubber (LSBR), Liquid Polybutadiene Rubber (LPBR), Liquid Isoprene Rubber (LIR), Liquid Nitrile Rubber (LNBR), and Others (including Liquid EPDM, Liquid Silicone Rubber). Among these, Liquid Styrene-Butadiene Rubber (LSBR) is the leading subsegment due to its widespread use in tire manufacturing and its excellent performance characteristics, such as durability, abrasion resistance, and superior processability. LSBR's versatility in adhesives, sealants, and polymer modification further solidifies its leading market position.

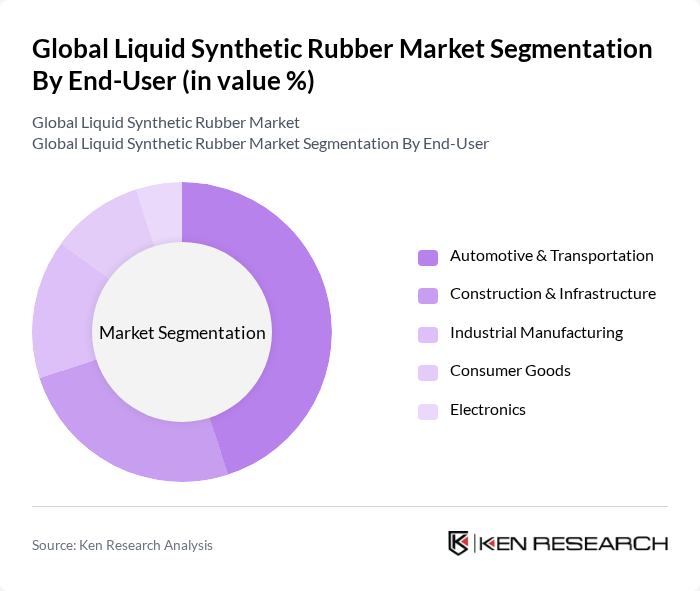

By End-User:The end-user segmentation of the liquid synthetic rubber market includes Automotive & Transportation, Construction & Infrastructure, Industrial Manufacturing, Consumer Goods, Electronics, and Others. The Automotive & Transportation sector is the dominant end-user, driven by the increasing production of vehicles and the demand for high-performance tires, which require advanced synthetic rubber materials for enhanced safety, durability, and fuel efficiency. The construction and industrial manufacturing sectors also represent significant demand, leveraging liquid synthetic rubber for adhesives, sealants, and coatings that offer superior flexibility and resilience.

The Global Liquid Synthetic Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Lanxess AG, Kraton Corporation, TSRC Corporation, LG Chem Ltd., Sinopec Limited, Asahi Kasei Corporation, Kuraray Co., Ltd., Versalis S.p.A., Dow Chemical Company, Chevron Phillips Chemical Company LLC, Bridgestone Corporation, JSR Corporation, H.B. Fuller Company, and Cray Valley (TotalEnergies) contribute to innovation, geographic expansion, and service delivery in this space. These companies are focusing on product development, capacity expansion, and sustainability initiatives to strengthen their market presence.

The future of the liquid synthetic rubber market appears promising, driven by increasing demand for sustainable products and innovations in recycling technologies. As environmental regulations tighten, manufacturers are likely to invest in bio-based synthetic rubber, which could capture a significant market share. Additionally, the digital transformation in supply chain management will enhance operational efficiency, allowing companies to respond swiftly to market changes and consumer preferences, thereby fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Styrene-Butadiene Rubber (LSBR) Liquid Polybutadiene Rubber (LPBR) Liquid Isoprene Rubber (LIR) Liquid Nitrile Rubber (LNBR) Others (including Liquid EPDM, Liquid Silicone Rubber) |

| By End-User | Automotive & Transportation Construction & Infrastructure Industrial Manufacturing Consumer Goods Electronics Others |

| By Application | Tire Manufacturing Adhesives & Sealants Polymer Modification Coatings Industrial Rubber Goods Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Synthetic Rubber Usage | 100 | Product Managers, R&D Engineers |

| Construction Industry Applications | 80 | Procurement Managers, Project Engineers |

| Consumer Goods Manufacturing | 60 | Operations Managers, Quality Control Specialists |

| Footwear Industry Insights | 50 | Design Managers, Supply Chain Coordinators |

| Adhesives and Sealants Market | 40 | Product Development Managers, Technical Sales Representatives |

The Global Liquid Synthetic Rubber Market is valued at approximately USD 15.9 billion, reflecting a significant growth driven by demand in automotive, construction, and consumer goods industries, as well as applications in adhesives and sealants.