Region:Global

Author(s):Dev

Product Code:KRAB0412

Pages:93

Published On:August 2025

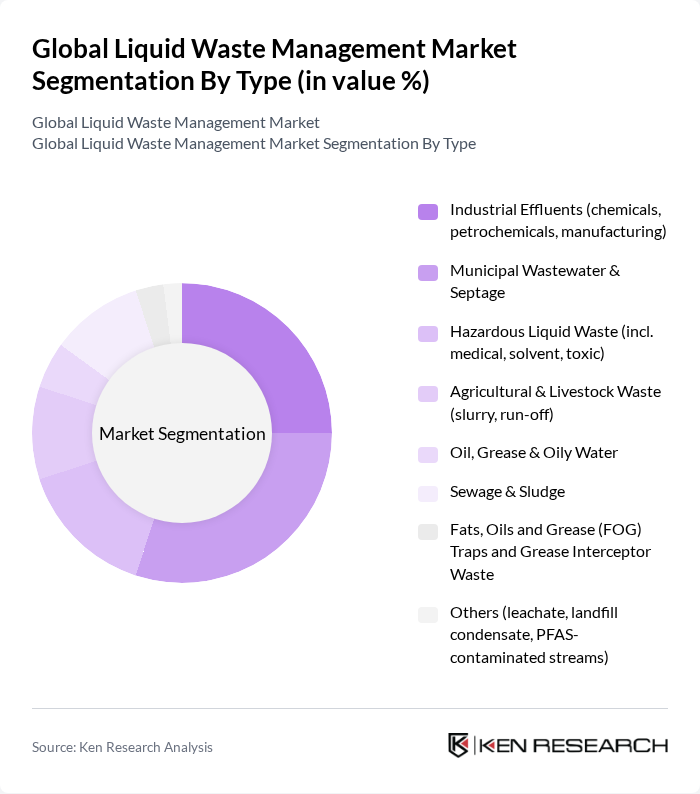

By Type:The liquid waste management market can be segmented into various types, including Industrial Effluents, Municipal Wastewater & Septage, Hazardous Liquid Waste, Agricultural & Livestock Waste, Oil, Grease & Oily Water, Sewage & Sludge, Fats, Oils and Grease (FOG) Traps and Grease Interceptor Waste, and Others. Each of these subsegments plays a crucial role in the overall market dynamics.

The Municipal Wastewater & Septage subsegment is currently dominating the market due to the increasing population and urbanization, leading to higher wastewater generation. Municipalities are investing heavily in wastewater treatment facilities to comply with stringent regulations and to ensure public health. The growing trend towards water recycling and resource recovery is also contributing to the expansion of this subsegment. As cities continue to grow, the demand for effective municipal wastewater management solutions is expected to remain strong.

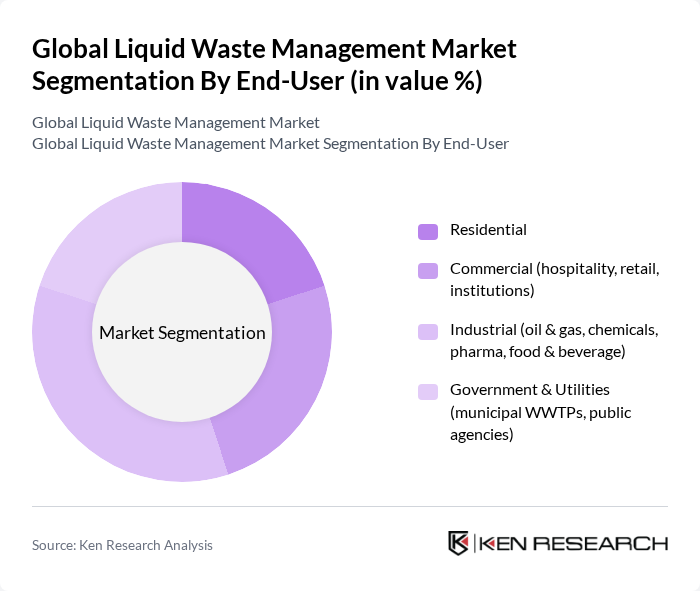

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each of these segments has unique requirements and contributes differently to the overall market.

The Industrial segment is the leading end-user in the liquid waste management market, driven by the high volume of liquid waste generated by manufacturing processes, oil and gas extraction, and chemical production. Industries are increasingly adopting advanced waste management solutions to comply with environmental regulations and to minimize their ecological footprint. The focus on sustainability and resource recovery is also pushing industrial players to invest in better waste management practices.

The Global Liquid Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environnement S.A., SUEZ, Waste Management, Inc. (WM), Republic Services, Inc., Clean Harbors, Inc., Stericycle, Inc., Covanta Holding Corporation, Biffa plc, FCC Environment (FCC Servicios Medio Ambiente), REMONDIS SE & Co. KG, GFL Environmental Inc., Recology, Waste Connections, Inc., Tervita Corporation (now part of Secure Energy Services), AECOM, Xylem Inc., Ecolab (Nalco Water), Kurita Water Industries Ltd., Beijing Enterprises Water Group Limited, Sembcorp Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of liquid waste management is poised for transformative changes driven by technological advancements and regulatory pressures. As urban populations continue to grow, the demand for efficient waste management solutions will intensify. Innovations in waste treatment technologies, such as IoT integration and AI-driven analytics, will enhance operational efficiencies. Additionally, the shift towards sustainable practices will encourage investments in recycling and waste-to-energy projects, fostering a more circular economy and reducing environmental impacts associated with liquid waste disposal.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Effluents (chemicals, petrochemicals, manufacturing) Municipal Wastewater & Septage Hazardous Liquid Waste (incl. medical, solvent, toxic) Agricultural & Livestock Waste (slurry, run-off) Oil, Grease & Oily Water Sewage & Sludge Fats, Oils and Grease (FOG) Traps and Grease Interceptor Waste Others (leachate, landfill condensate, PFAS-contaminated streams) |

| By End-User | Residential Commercial (hospitality, retail, institutions) Industrial (oil & gas, chemicals, pharma, food & beverage) Government & Utilities (municipal WWTPs, public agencies) |

| By Application | Collection & Transport Treatment (primary, secondary, tertiary, advanced/PFAS) Recycling & Resource Recovery (water reuse, sludge-to-products) Disposal (land application, deep well injection, ocean outfall where permitted) |

| By Service Type | Collection Services Treatment Services Disposal Services Recycling & Reuse Services |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Environmental Credits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Liquid Waste Management | 110 | City Waste Management Officials, Environmental Planners |

| Industrial Waste Treatment Facilities | 90 | Facility Managers, Compliance Officers |

| Healthcare Waste Management | 70 | Hospital Waste Managers, Environmental Health Officers |

| Research & Development in Waste Technologies | 60 | R&D Managers, Environmental Scientists |

| Regulatory Compliance and Policy Making | 90 | Policy Analysts, Regulatory Affairs Specialists |

The Global Liquid Waste Management Market is valued at approximately USD 97101 billion, driven by factors such as urbanization, stringent environmental regulations, and the need for sustainable waste disposal solutions.