Region:Global

Author(s):Rebecca

Product Code:KRAA1470

Pages:95

Published On:August 2025

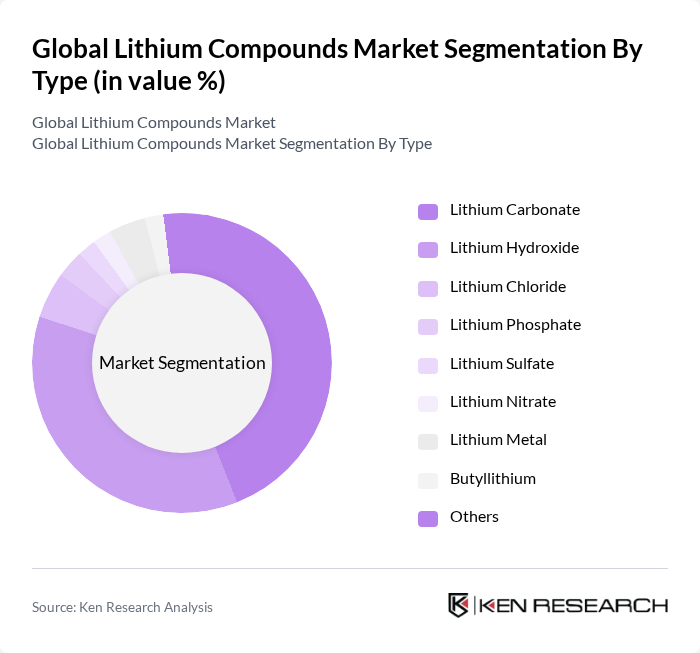

By Type:The lithium compounds market is segmented into various types, including Lithium Carbonate, Lithium Hydroxide, Lithium Chloride, Lithium Phosphate, Lithium Sulfate, Lithium Nitrate, Lithium Metal, Butyllithium, and Others. Among these, Lithium Carbonate and Lithium Hydroxide are the most prominent due to their extensive use in lithium-ion batteries, which are critical for electric vehicles and portable electronics. The increasing demand for high-performance batteries has led to a significant rise in the consumption of these two subsegments, making them the leaders in the market .

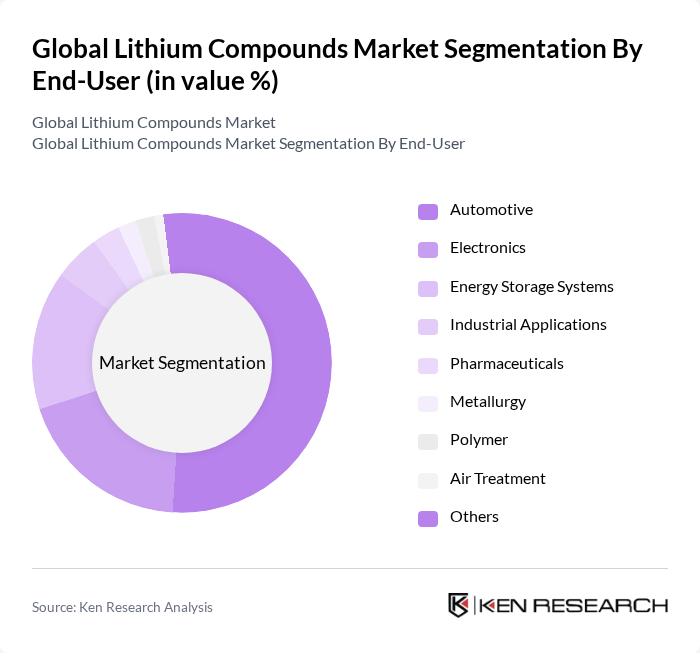

By End-User:The end-user segmentation includes Automotive, Electronics, Energy Storage Systems, Industrial Applications, Pharmaceuticals, Metallurgy, Polymer, Air Treatment, and Others. The automotive sector is the largest consumer of lithium compounds, driven by the rapid growth of electric vehicles. The increasing focus on sustainable transportation solutions and the expansion of battery manufacturing capacity have led to a surge in demand for lithium-ion batteries, which are essential for EVs, thereby propelling the lithium compounds market .

The Global Lithium Compounds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, Sociedad Química y Minera de Chile S.A. (SQM), Livent Corporation, Ganfeng Lithium Co., Ltd., Tianqi Lithium Industries, Inc., Orocobre Limited (now Allkem Limited), Galaxy Resources Limited (now part of Allkem Limited), Nemaska Lithium Inc., Piedmont Lithium Inc., Mineral Resources Limited, American Battery Technology Company, Neometals Ltd, Lithium Americas Corp., Sayona Mining Limited, Millennial Lithium Corp. (now part of Lithium Americas Corp.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lithium compounds market appears promising, driven by the accelerating transition to electric vehicles and renewable energy solutions. As governments worldwide implement stricter emissions regulations and promote sustainable practices, the demand for lithium is expected to rise significantly. Innovations in battery technology, particularly solid-state batteries, are anticipated to enhance energy density and safety, further propelling market growth. Additionally, the focus on sustainable mining practices will likely shape industry standards and consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium Carbonate Lithium Hydroxide Lithium Chloride Lithium Phosphate Lithium Sulfate Lithium Nitrate Lithium Metal Butyllithium Others |

| By End-User | Automotive Electronics Energy Storage Systems Industrial Applications Pharmaceuticals Metallurgy Polymer Air Treatment Others |

| By Application | Batteries (Li-ion, Primary, Others) Ceramics Glass Lubricants & Greases Pharmaceuticals Polymers Metallurgy Air Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Lithium Mining Operations | 100 | Mining Engineers, Operations Managers |

| Battery Manufacturing Sector | 80 | Product Development Engineers, Supply Chain Managers |

| Ceramics and Glass Industry | 60 | Production Supervisors, Quality Control Managers |

| Pharmaceutical Applications | 50 | Research Scientists, Regulatory Affairs Specialists |

| Electric Vehicle Manufacturers | 70 | Battery Technology Experts, Procurement Directors |

The Global Lithium Compounds Market is valued at approximately USD 10 billion, driven by the increasing demand for electric vehicles (EVs) and energy storage systems that utilize lithium compounds extensively in their batteries.