Region:Global

Author(s):Dev

Product Code:KRAC0496

Pages:82

Published On:August 2025

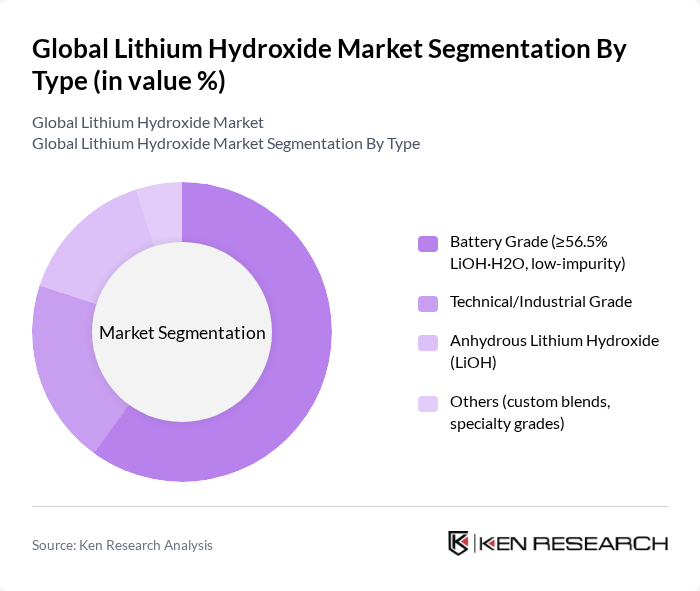

By Type:The lithium hydroxide market can be segmented into four main types: Battery Grade (?56.5% LiOH·H2O, low-impurity), Technical/Industrial Grade, Anhydrous Lithium Hydroxide (LiOH), and Others (custom blends, specialty grades). Among these, Battery Grade lithium hydroxide is the most dominant segment due to its critical role in the production of high-performance lithium-ion batteries used in electric vehicles and consumer electronics.

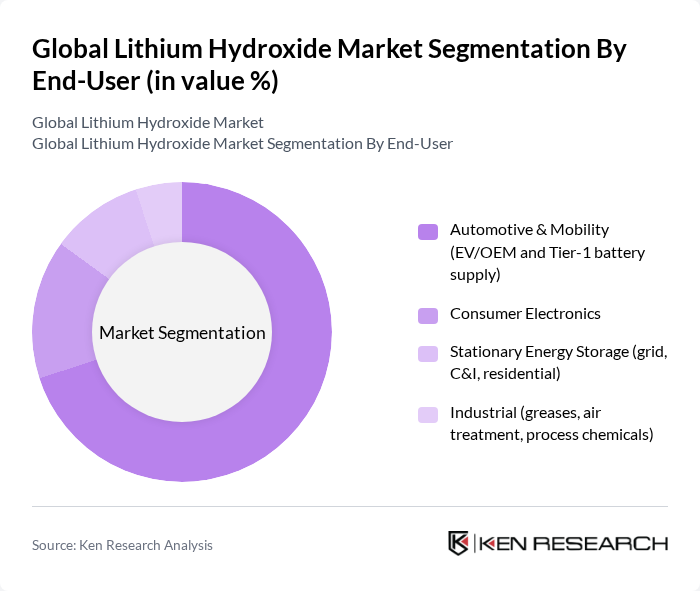

By End-User:The end-user segmentation includes Automotive & Mobility (EV/OEM and Tier-1 battery supply), Consumer Electronics, Stationary Energy Storage (grid, C&I, residential), and Industrial (greases, air treatment, process chemicals). The Automotive & Mobility segment is the leading end-user, driven by the rapid adoption of electric vehicles and the increasing demand for high-capacity batteries.

The Global Lithium Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, SQM (Sociedad Química y Minera de Chile S.A.), Livent Corporation (now part of Arcadium Lithium plc), Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, Allkem Limited (now part of Arcadium Lithium plc), Mineral Resources Limited, Nemaska Lithium Inc., Piedmont Lithium Inc., AMG Critical Materials N.V. (AMG Lithium), IGO Limited, Pilbara Minerals Limited, Lithium Americas Corp., Sayona Mining Limited, POSCO Future M Co., Ltd. (lithium conversion JV stakes) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lithium hydroxide market appears promising, driven by the increasing adoption of electric vehicles and renewable energy solutions. As governments worldwide implement stricter emissions regulations, the demand for lithium hydroxide is expected to rise significantly. Additionally, advancements in battery technology will likely enhance the performance of lithium-ion batteries, further solidifying their position in the energy storage market. Companies that adapt to these trends will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Grade (?56.5% LiOH·H2O, low-impurity) Technical/Industrial Grade Anhydrous Lithium Hydroxide (LiOH) Others (custom blends, specialty grades) |

| By End-User | Automotive & Mobility (EV/OEM and Tier-1 battery supply) Consumer Electronics Stationary Energy Storage (grid, C&I, residential) Industrial (greases, air treatment, process chemicals) |

| By Application | Lithium-Ion Battery Cathodes (NCM/NCA, high-nickel) Lubricating Greases Ceramics and Glass Absorbents and Air Purification (CO2 scrubbing) |

| By Distribution Channel | Direct Offtake/Contracts with OEMs & Cell Makers Distributors & Chemical Traders Spot/Exchange and Online Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America |

| By Price/Contract Structure | Long-term Indexed Contracts Spot Market Sales Tolling/Conversion Agreements |

| By Policy & Sustainability | Subsidies & Incentives (IRA, EU IPCEI, etc.) Local Content & Trade Measures ESG & Certification Compliance (IRMA, Responsible Sourcing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 120 | Production Managers, Supply Chain Analysts |

| Automotive Industry | 100 | Procurement Managers, R&D Engineers |

| Mining and Extraction Companies | 80 | Operations Directors, Environmental Compliance Officers |

| Renewable Energy Storage Solutions | 70 | Product Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

The Global Lithium Hydroxide Market is valued at approximately USD 16 billion, driven by the increasing demand for electric vehicles and energy storage systems, which require high-purity lithium hydroxide for battery production.