Region:Global

Author(s):Dev

Product Code:KRAA1594

Pages:90

Published On:August 2025

By Type:The lithotripsy devices market is segmented into various types, including Extracorporeal Shock Wave Lithotripsy (ESWL) Devices, Intracorporeal Lithotripsy Systems (Laser, Pneumatic, Ultrasonic), Fluoroscopy and Ultrasound Imaging-Guided Lithotripters, Combined/Hybrid Lithotripsy Platforms, and Accessories & Consumables (Stone Baskets, Fibers, Probes). Among these, ESWL devices are widely used due to their non-invasive nature; however, intracorporeal laser lithotripsy via ureteroscopy has seen rising utilization with technological advancements and broader minimally invasive adoption in urology.

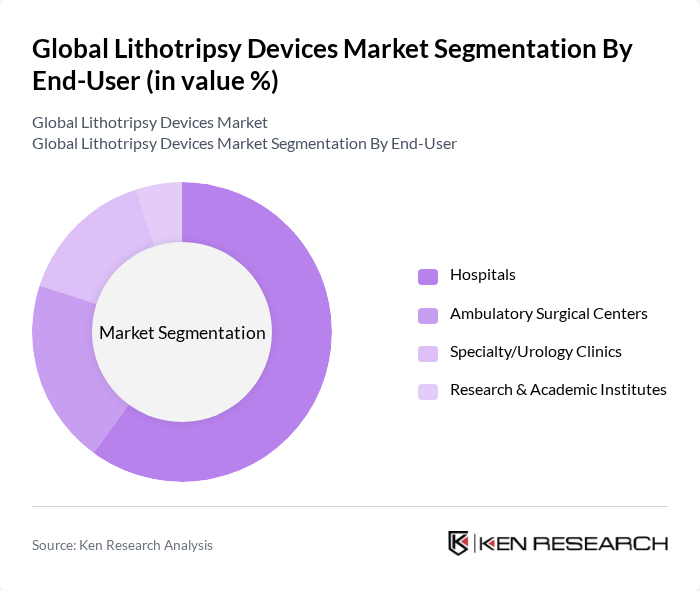

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty/Urology Clinics, and Research & Academic Institutes. Hospitals are the leading end-users of lithotripsy devices owing to comprehensive surgical and imaging capabilities and higher procedure volumes. Ambulatory surgical centers continue to gain share with the shift toward outpatient minimally invasive urology (e.g., ureteroscopy with laser lithotripsy).

The Global Lithotripsy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, Boston Scientific Corporation, Olympus Corporation, KARL STORZ SE & Co. KG, Richard Wolf GmbH, Dornier MedTech GmbH, EDAP TMS S.A., Lumenis Be Ltd., Cook Medical LLC, EMS Electro Medical Systems S.A., Direx Group, Storz Medical AG, Quanta System S.p.A., Boston Scientific (BSC) – LithoVue and Laser Portfolio, Coloplast A/S (urological stone management accessories) contribute to innovation, geographic expansion, and service delivery in this space.

The lithotripsy devices market is poised for significant transformation, driven by technological advancements and changing patient preferences. The integration of artificial intelligence in device functionality is expected to enhance treatment precision and patient outcomes. Additionally, the shift towards outpatient procedures will likely increase the demand for portable lithotripsy devices, making treatments more accessible. As healthcare providers focus on patient-centric care, the market will continue to evolve, adapting to the needs of diverse patient populations and improving overall healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Extracorporeal Shock Wave Lithotripsy (ESWL) Devices Intracorporeal Lithotripsy Systems (Laser, Pneumatic, Ultrasonic) Fluoroscopy and Ultrasound Imaging-Guided Lithotripters Combined/Hybrid Lithotripsy Platforms Accessories & Consumables (Stone Baskets, Fibers, Probes) |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty/Urology Clinics Research & Academic Institutes |

| By Application | Kidney Stones (Renal Calculi) Ureteral Stones Bladder Stones Bile Duct and Pancreatic Duct Stones |

| By Distribution Channel | Direct Sales Authorized Distributors/Dealers Group Purchasing Organizations (GPOs) Online/Procurement Portals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level Mid-Range Premium |

| By Technology (ESWL Shock-Source) | Electromagnetic Piezoelectric Electrohydraulic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Lithotripsy Departments | 120 | Urologists, Department Heads |

| Outpatient Clinics | 90 | Clinic Managers, Medical Directors |

| Medical Device Distributors | 60 | Sales Representatives, Product Managers |

| Healthcare Policy Makers | 50 | Health Economists, Regulatory Affairs Specialists |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

The Global Lithotripsy Devices Market is valued at approximately USD 1.5 billion, with estimates ranging between USD 1.4 to 1.6 billion based on recent analyses. This valuation reflects a historical growth trend in the market over the past five years.