Region:Global

Author(s):Dev

Product Code:KRAC0484

Pages:94

Published On:August 2025

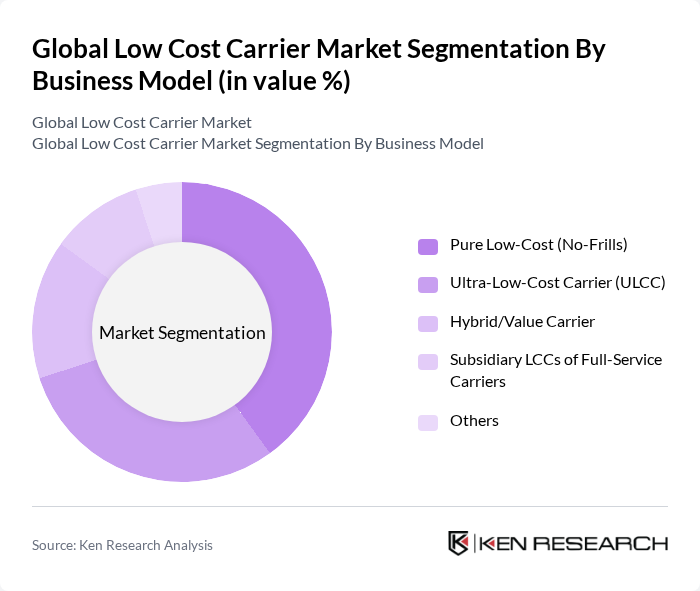

By Business Model:The business model segmentation includes various types of low-cost carriers that cater to different market needs. The primary subsegments are Pure Low-Cost (No-Frills), Ultra-Low-Cost Carrier (ULCC), Hybrid/Value Carrier, Subsidiary LCCs of Full-Service Carriers, and Others. Each model has its unique approach to pricing and service offerings, appealing to diverse traveler preferences.

The Pure Low-Cost (No-Frills) segment dominates the market due to its straightforward pricing model and ability to offer lower fares by eliminating unnecessary services. This model appeals particularly to budget-conscious travelers who prioritize cost over additional amenities. The increasing trend of spontaneous travel and the rise of digital platforms for booking flights have further fueled the growth of this segment, making it the preferred choice for many consumers.

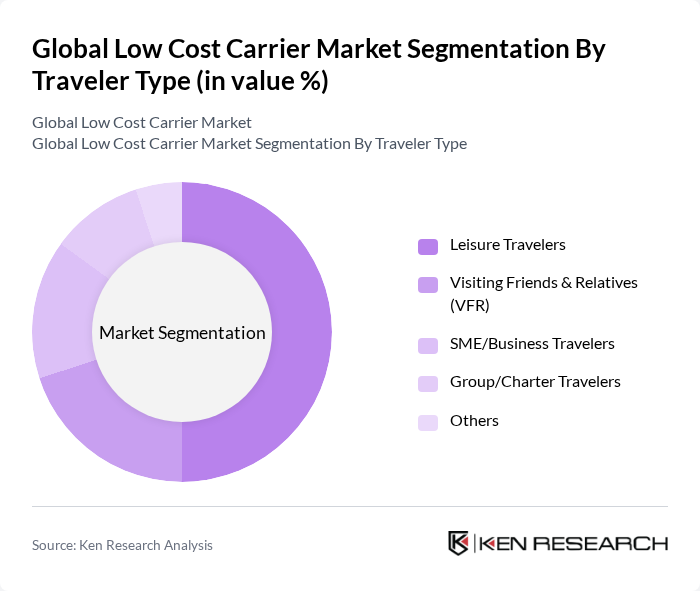

By Traveler Type:This segmentation focuses on the different categories of travelers utilizing low-cost carriers. The subsegments include Leisure Travelers, Visiting Friends & Relatives (VFR), SME/Business Travelers, Group/Charter Travelers, and Others. Each traveler type has distinct motivations and preferences that influence their choice of airline.

Leisure Travelers represent the largest segment in the market, driven by the increasing popularity of budget travel and the desire for affordable vacation options. This demographic is often more flexible with travel dates and destinations, allowing low-cost carriers to fill seats efficiently. The rise of social media and travel influencers has also encouraged more people to explore new destinations, further boosting this segment's growth.

The Global Low Cost Carrier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ryanair Holdings plc, easyJet plc, Southwest Airlines Co., AirAsia Group (Capital A Berhad), JetBlue Airways Corporation, Spirit Airlines, Inc., IndiGo (InterGlobe Aviation Ltd.), Wizz Air Holdings plc, Frontier Airlines, Inc., Volaris (Controladora Vuela Compañía de Aviación, S.A.B. de C.V.), Norwegian Air Shuttle ASA, Scoot Pte Ltd, Vueling Airlines, S.A., Pegasus Airlines, Jetstar Airways Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the low-cost carrier market appears promising, driven by ongoing trends in consumer behavior and technological advancements. As more travelers seek budget-friendly options, LCCs are likely to expand their offerings and enhance customer experiences. Additionally, the integration of sustainable practices will become increasingly important, aligning with global environmental goals. The focus on digital transformation will further streamline operations, allowing LCCs to remain competitive while meeting evolving consumer expectations in a dynamic travel landscape.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Pure Low-Cost (No-Frills) Ultra-Low-Cost Carrier (ULCC) Hybrid/Value Carrier Subsidiary LCCs of Full-Service Carriers Others |

| By Traveler Type | Leisure Travelers Visiting Friends & Relatives (VFR) SME/Business Travelers Group/Charter Travelers Others |

| By Distribution Channel | Direct (Airline Website/App) Online Travel Agencies (OTAs) Metasearch/Aggregators Travel Agents/Offline Others |

| By Fare/Service Bundle | Basic Economy (No-Frills) Standard Economy (With Add-ons) Premium/Extra Legroom Seats Ancillary Bundles (Bags, Seats, Meals) Others |

| By Haul/Route Length | Short-Haul (?3 hours) Medium-Haul (3–6 hours) Long-Haul (>6 hours) Others |

| By Aircraft Type | Narrow-Body Wide-Body Regional Jets Others |

| By Ancillary Revenue Stream | Baggage Fees Seat Selection/Extra Legroom Onboard F&B and Retail Priority/Speed Services Advertising/Co-Branding & Other Ancillaries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Low-Cost Carrier Operations | 120 | Airline Executives, Operations Managers |

| International Low-Cost Carrier Trends | 100 | Market Analysts, Travel Agency Owners |

| Consumer Preferences in Air Travel | 140 | Frequent Travelers, Travel Enthusiasts |

| Impact of Fuel Prices on Low-Cost Carriers | 80 | Financial Analysts, Airline Economists |

| Regulatory Challenges for Low-Cost Airlines | 70 | Regulatory Affairs Specialists, Legal Advisors |

The Global Low Cost Carrier Market is valued at approximately USD 270 billion, reflecting significant growth driven by increasing demand for affordable travel options, regulatory changes, and the expansion of low-cost carriers into underserved markets.