Region:Global

Author(s):Dev

Product Code:KRAA1551

Pages:91

Published On:August 2025

By Type:The LPG tanker market is segmented into various types based on vessel size. Very Large Gas Carriers (VLGC) are the most prominent due to their ability to transport large volumes of LPG efficiently, catering to the high demand from major importing countries. Large Gas Carriers (LGC) and Medium Gas Carriers (MGC) also play significant roles, particularly in regional trade routes. Small Gas Carriers (SGC) are utilized for niche markets and smaller deliveries, but they represent a smaller share of the overall market.

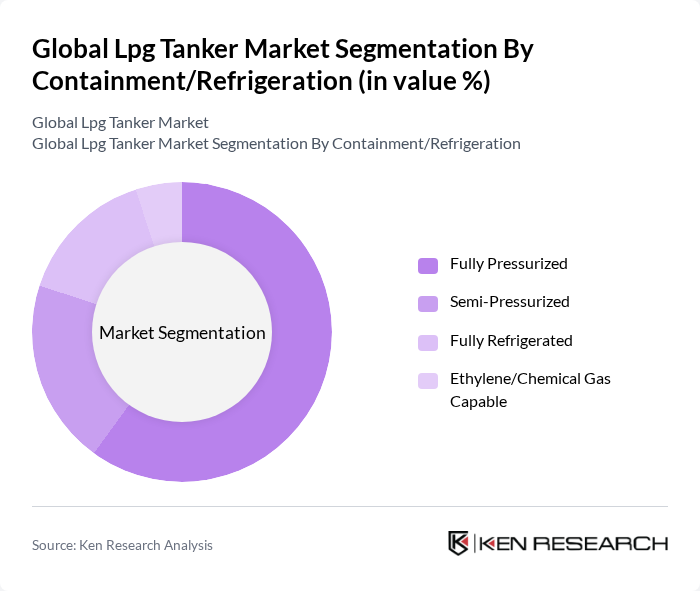

By Containment/Refrigeration:This segmentation includes various containment and refrigeration methods used in LPG tankers. Fully Pressurized vessels are widely used due to their cost-effectiveness and efficiency in transporting LPG. Semi-Pressurized vessels are also significant, offering flexibility in cargo handling. Fully Refrigerated vessels are utilized for specific cargo types requiring lower temperatures, while Ethylene/Chemical Gas Capable vessels cater to specialized markets, although they represent a smaller segment.

The Global LPG Tanker Market is characterized by a dynamic mix of regional and international players. Leading participants such as BW LPG Limited, Dorian LPG Ltd., Avance Gas Holding Ltd, StealthGas Inc., EXMAR NV, Navigator Gas, Petredec Global, Epic Gas (a Lauritzen Kosan company), Kuwait Oil Tanker Company (KOTC), The Great Eastern Shipping Co. Ltd., Hyundai Heavy Industries Co., Ltd. (shipbuilder), Kawasaki Heavy Industries, Ltd. (shipbuilder), Mitsubishi Heavy Industries, Ltd. (shipbuilder), Naftomar Shipping and Trading Co. Ltd., SHV Energy (through Primagaz/Calor, chartering) contribute to innovation, geographic expansion, and service delivery in this space.

The LPG tanker market is poised for significant transformation as digitalization and sustainability become central themes. Companies are increasingly adopting advanced technologies to optimize operations, reduce costs, and enhance safety. Furthermore, the shift towards small-scale LPG distribution is expected to create new business models, allowing for greater market penetration. As regulatory frameworks evolve, the industry will likely see increased collaboration among stakeholders to address environmental concerns while meeting growing energy demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Very Large Gas Carriers (VLGC) Large Gas Carriers (LGC) Medium Gas Carriers (MGC) Small Gas Carriers (SGC) |

| By Containment/Refrigeration | Fully Pressurized Semi-Pressurized Fully Refrigerated Ethylene/Chemical Gas Capable |

| By Trade Route | Middle East to Asia U.S. to Asia West Africa to Europe Intra-Regional/Short-Sea |

| By Charter Type | Time Charter Spot/Voyage Charter Bareboat Charter Contract of Affreightment (CoA) |

| By Cargo | Propane Butane Mixed LPG (Propane/Butane) Petrochemical Gases (e.g., Ethylene) |

| By Vessel Age | –5 Years –10 Years –20 Years + Years |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global LPG Tanker Operators | 120 | Fleet Managers, Operations Directors |

| Energy Sector Logistics Coordinators | 90 | Logistics Managers, Supply Chain Analysts |

| Port Authorities and Customs Officials | 60 | Port Managers, Regulatory Compliance Officers |

| Shipping and Freight Forwarding Companies | 75 | Business Development Managers, Sales Directors |

| Environmental and Safety Compliance Experts | 50 | Safety Officers, Environmental Managers |

The Global LPG Tanker Market is valued at approximately USD 11.8 billion, reflecting a significant growth trend driven by the increasing demand for liquefied petroleum gas (LPG) across residential, commercial, and industrial sectors.