Region:Global

Author(s):Shubham

Product Code:KRAC0838

Pages:93

Published On:August 2025

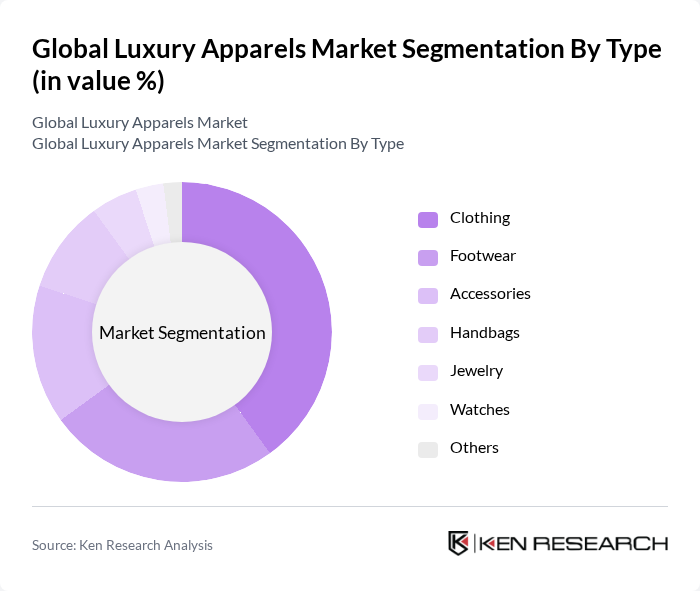

By Type:The luxury apparel market is segmented into Clothing, Footwear, Accessories, Handbags, Jewelry, Watches, and Others. Clothing remains the largest segment, reflecting consumer preferences for high-quality materials and exclusive designs. Footwear is the second largest, driven by demand for luxury sneakers and designer shoes. Accessories, including belts, scarves, and hats, are gaining traction as consumers seek to complement their outfits with distinctive luxury items.

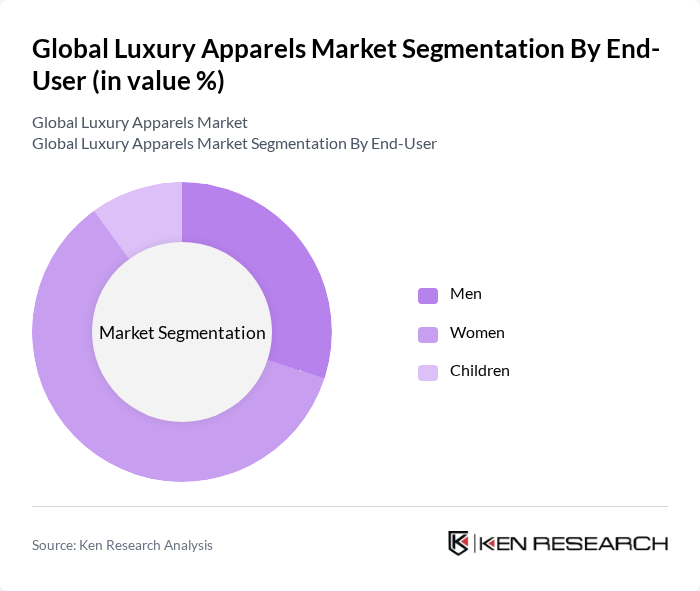

By End-User:The market is segmented by end-user into Men, Women, and Children. The Women segment dominates, reflecting a higher propensity for luxury purchases and greater engagement with fashion trends. The Men segment is expanding, supported by increasing interest in high-end fashion and luxury sportswear. The Children segment, while smaller, is growing as affluent consumers invest in luxury apparel for younger family members.

The Global Luxury Apparels Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Gucci S.p.A., Chanel S.A., Prada S.p.A., Hermès International S.A., Burberry Group plc, Ralph Lauren Corporation, Dolce & Gabbana S.r.l., Versace S.r.l., Valentino S.p.A., Salvatore Ferragamo S.p.A., Moncler S.p.A., Tory Burch LLC, Michael Kors Holdings Limited, Giorgio Armani S.p.A., Coach (Tapestry, Inc.), Hugo Boss AG, Brunello Cucinelli S.p.A., Ermenegildo Zegna N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury apparel market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to thrive. Additionally, the integration of augmented reality and artificial intelligence in retail experiences is expected to enhance customer engagement. These trends indicate a shift towards a more personalized and responsible luxury shopping experience, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Handbags Jewelry Watches Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Offline Retail Luxury Department Stores Boutiques |

| By Price Range | Premium Super Premium Ultra-Premium |

| By Material | Cotton Leather Synthetic Fabrics Wool Silk |

| By Occasion | Casual Wear Formal Wear Sportswear Evening Wear |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Retailers | 100 | Store Managers, Regional Directors |

| High-Income Consumer Insights | 120 | Affluent Shoppers, Fashion Enthusiasts |

| Online Luxury Fashion Platforms | 80 | E-commerce Managers, Digital Marketing Specialists |

| Fashion Influencers and Stylists | 60 | Social Media Influencers, Fashion Consultants |

| Luxury Brand Marketing Executives | 70 | Brand Managers, Marketing Directors |

The Global Luxury Apparels Market is valued at approximately USD 140 billion, driven by factors such as rising disposable incomes, an increase in high-net-worth individuals, and a growing demand for premium quality and exclusive designs.