Region:Global

Author(s):Dev

Product Code:KRAD3411

Pages:83

Published On:November 2025

By Type:The luxury fabric market is segmented into various types, including silk, cashmere, wool, linen, cotton, velvet, leather, synthetic blends, jacquard, and others. Among these, silk and cashmere are particularly dominant due to their luxurious feel and high demand in fashion apparel. Silk is favored for its smooth texture and sheen, while cashmere is prized for its warmth and softness, making them staples in high-end clothing and accessories. Velvet and jacquard are increasingly popular in upholstery and interior applications, reflecting the market's shift toward tactile richness and intricate patterns .

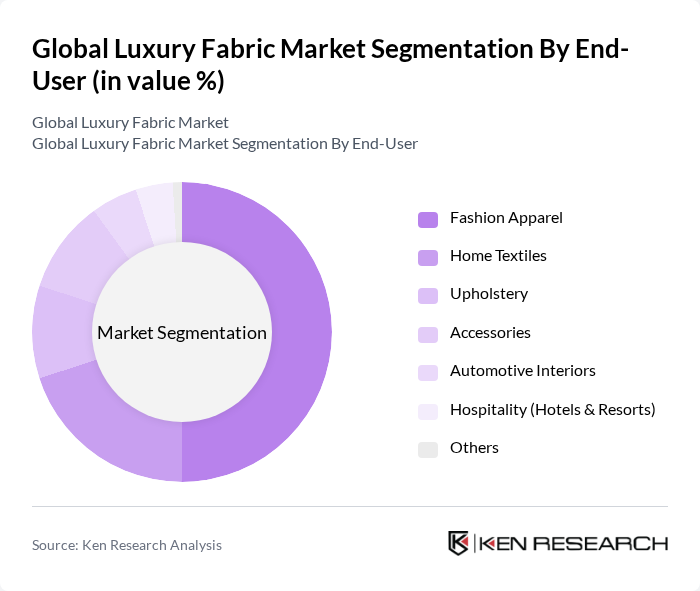

By End-User:The luxury fabric market is also segmented by end-user applications, which include fashion apparel, home textiles, upholstery, accessories, automotive interiors, hospitality (hotels & resorts), and others. Fashion apparel is the leading segment, driven by the continuous demand for high-quality fabrics in designer clothing and luxury brands. The trend towards personalization and bespoke fashion has further fueled the growth of this segment. Home textiles and upholstery are also significant, reflecting increased consumer investment in interior aesthetics and comfort .

The Global Luxury Fabric Market is characterized by a dynamic mix of regional and international players. Leading participants such as Loro Piana, Ermenegildo Zegna, Hermès, Chanel, Gucci, Prada, Burberry, Louis Vuitton, Ralph Lauren, Valentino, Dolce & Gabbana, Versace, Fendi, Giorgio Armani, Balenciaga, Rubelli Group, Pierre Frey, Designers Guild, Dedar S.p.A., E.S. Kluft & Company, Frette contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury fabric market appears promising, driven by increasing consumer awareness of sustainability and ethical sourcing. As brands adapt to these trends, innovations in eco-friendly materials are expected to gain traction. Additionally, the integration of technology in fabric production will enhance customization options, catering to the growing demand for personalized luxury experiences. These developments will likely reshape the market landscape, fostering growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Silk Cashmere Wool Linen Cotton Velvet Leather Synthetic Blends Jacquard Others |

| By End-User | Fashion Apparel Home Textiles Upholstery Accessories Automotive Interiors Hospitality (Hotels & Resorts) Others |

| By Fabric Origin | Natural Fabrics Synthetic Fabrics Blended Fabrics Others |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Direct Sales Interior Design Studios Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Geographical Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sustainability Certification | Organic Certification Fair Trade Certification Eco-Label Certification Recycled Content Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fabric Manufacturers | 100 | Production Managers, Quality Control Officers |

| Fashion Designers and Brands | 80 | Creative Directors, Product Development Managers |

| Retailers of Luxury Fabrics | 70 | Store Managers, Merchandising Directors |

| Textile Importers and Distributors | 60 | Supply Chain Managers, Sales Executives |

| Consumers of Luxury Fabrics | 90 | Fashion Enthusiasts, High-Income Households |

The Global Luxury Fabric Market is valued at approximately USD 4 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality and sustainable fabrics, as well as the rising popularity of luxury fashion brands.