Region:Global

Author(s):Shubham

Product Code:KRAA1914

Pages:94

Published On:August 2025

By Type:The luxury packaging market is segmented into various types, including Rigid Boxes & Cases, Cartons & Sleeves, Rigid Tubes & Cylinders, Glass Bottles & Jars, Bags, Pouches & Dust Covers, Presentation Trays, Inserts & Fitments, Labels, Tags, and Specialty Closures, and Limited-Edition & Gift Sets. Among these, Rigid Boxes & Cases are leading due to their premium appeal, high unit margins, and ability to enhance product presentation for luxury brands, particularly in cosmetics, jewelry, and specialty confectionery .

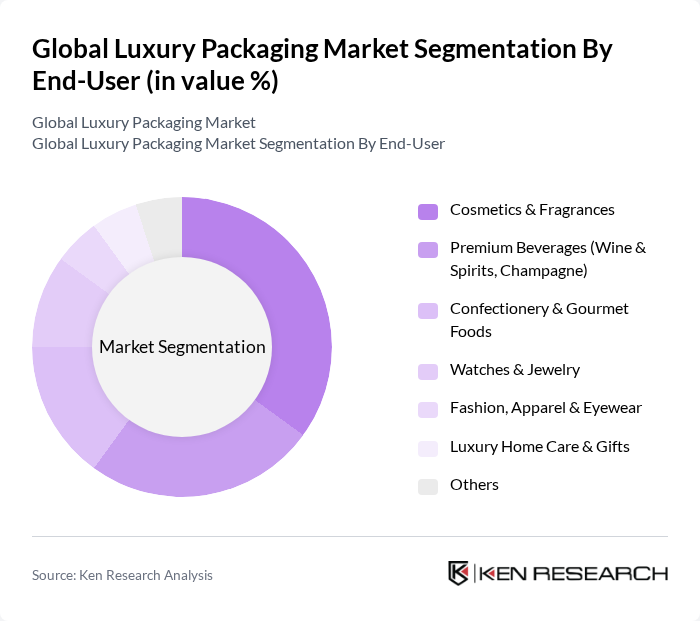

By End-User:The end-user segmentation includes Cosmetics & Fragrances, Premium Beverages (Wine & Spirits, Champagne), Confectionery & Gourmet Foods, Watches & Jewelry, Fashion, Apparel & Eyewear, Luxury Home Care & Gifts, and Others. The Cosmetics & Fragrances segment is currently dominating the market, driven by the need for visually distinctive, brand-elevating packaging and high launch frequency in beauty and fragrance lines .

The Global Luxury Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as WestRock Company, DS Smith plc, Mondi Group, Stora Enso Oyj, Smurfit Kappa Group plc, GPA Global, Amcor plc, Fedrigoni SpA (including Ritrama & Arjo Creative Papers), Valpak Limited (RPC Bramlage/Beauty Solutions), Verescence (SGD Pharma Beauty Glass), Stoelzle Glass Group, Quadpack Industries, HCP Packaging, Essel Propack (EPL Limited), Crown Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the luxury packaging market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands will increasingly adopt eco-friendly materials and innovative designs. Additionally, the integration of smart packaging technologies, such as QR codes and NFC tags, will enhance consumer engagement and provide valuable product information. These trends will shape the market landscape, fostering growth and innovation in luxury packaging solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Boxes & Cases Cartons & Sleeves Rigid Tubes & Cylinders Glass Bottles & Jars Bags, Pouches & Dust Covers Presentation Trays, Inserts & Fitments Labels, Tags, and Specialty Closures Limited-Edition & Gift Sets |

| By End-User | Cosmetics & Fragrances Premium Beverages (Wine & Spirits, Champagne) Confectionery & Gourmet Foods Watches & Jewelry Fashion, Apparel & Eyewear Luxury Home Care & Gifts Others |

| By Material | Paper & Paperboard (Coated, Foil-Laminated, Specialty) Glass (Flint, Colored, Decorated) Metal (Aluminum, Tinplate) Plastics & Bio-based Polymers Wood & Leather Textiles & Fabrics (Velvet, Satin, Felt) Others |

| By Design | Custom & Bespoke Designs Standardized Premium Lines Thematic & Limited Editions Seasonal & Gifting Collections Smart & Connected Packaging Refillable & Reusable Formats Others |

| By Distribution Channel | Direct-to-Brand (Contract/Custom Packaging) Luxury Brand Boutiques & Flagships Duty-Free & Travel Retail E-commerce & Subscription Gifting Distributors & Value-Added Resellers Others |

| By Price Range | Ultra-Premium Premium Mid-Range Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Cosmetics Packaging | 120 | Brand Managers, Product Development Leads |

| High-End Fashion Packaging | 90 | Creative Directors, Packaging Engineers |

| Premium Spirits Packaging | 80 | Marketing Managers, Supply Chain Coordinators |

| Luxury Food Packaging | 70 | Product Managers, Quality Assurance Specialists |

| Jewelry Packaging Solutions | 60 | Retail Managers, Packaging Designers |

The Global Luxury Packaging Market is valued at approximately USD 22 billion, driven by the increasing demand for premium packaging solutions in sectors such as cosmetics, premium beverages, and gourmet foods.