Region:Global

Author(s):Dev

Product Code:KRAD0559

Pages:100

Published On:August 2025

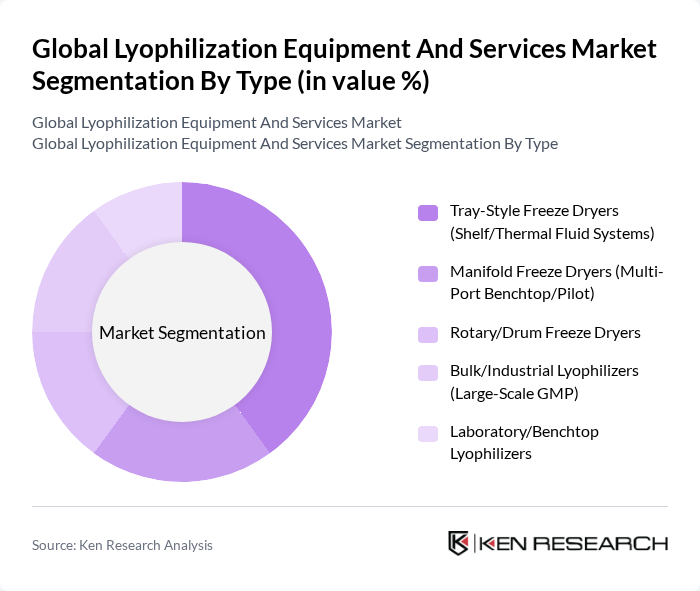

By Type:The lyophilization equipment market is segmented into various types, including tray-style freeze dryers, manifold freeze dryers, rotary/drum freeze dryers, bulk/industrial lyophilizers, and laboratory/benchtop lyophilizers. Among these, tray-style freeze dryers are the most widely used due to their efficiency in large-scale production and ability to handle various product types. The demand for these systems is driven by their versatility and effectiveness in preserving the quality of sensitive materials.

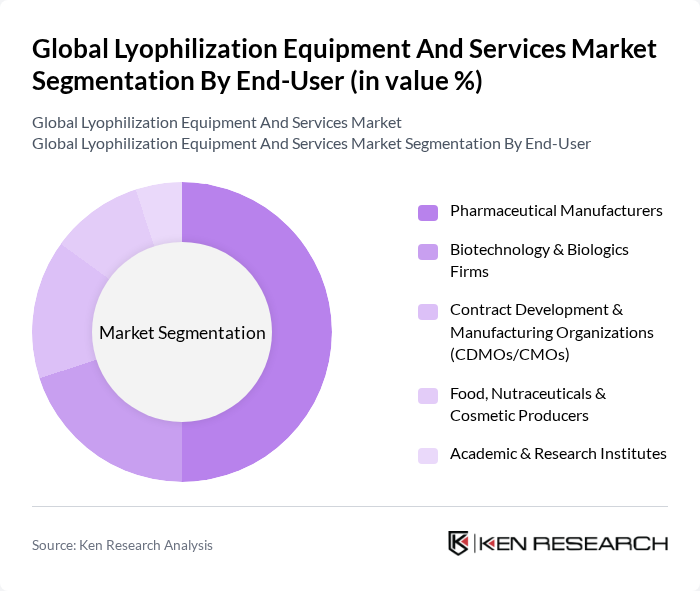

By End-User:The end-user segmentation includes pharmaceutical manufacturers, biotechnology and biologics firms, contract development and manufacturing organizations (CDMOs/CMOs), food, nutraceuticals and cosmetic producers, and academic and research institutes. Pharmaceutical manufacturers dominate this segment due to the increasing need for lyophilized injectables and vaccines, which require precise and controlled drying processes to maintain product integrity and efficacy. Ongoing biologics and sterile injectables growth and outsourcing to CDMOs reinforce demand for cGMP lyophilization capacity.

The Global Lyophilization Equipment And Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SP Industries (SP Scientific), GEA Group Aktiengesellschaft, Thermo Fisher Scientific Inc., Millrock Technology, Inc., OPTIMA packaging group GmbH, Shanghai Tofflon Science and Technology Co., Ltd., Cuddon Freeze Dry (Cuddon Engineering Ltd.), ZIRBUS Technology GmbH, Labconco Corporation, HOF Sonderanlagenbau GmbH, BÜCHI Labortechnik AG, Ningbo XIANFENG Machinery Co., Ltd., Aseptic Technologies S.A., IMA Group (IMA Life), Azbil Telstar, S.L.U. (Telstar Life-Sciences) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lyophilization equipment and services market appears promising, driven by technological advancements and increasing demand across various sectors. As companies prioritize efficiency and sustainability, the integration of automation and IoT technologies is expected to enhance operational capabilities. Furthermore, the growing focus on eco-friendly solutions will likely lead to innovations that reduce energy consumption and waste, positioning the market for significant growth in the coming years, particularly in emerging economies.

| Segment | Sub-Segments |

|---|---|

| By Type | Tray-Style Freeze Dryers (Shelf/Thermal Fluid Systems) Manifold Freeze Dryers (Multi-Port Benchtop/Pilot) Rotary/Drum Freeze Dryers Bulk/Industrial Lyophilizers (Large-Scale GMP) Laboratory/Benchtop Lyophilizers |

| By End-User | Pharmaceutical Manufacturers Biotechnology & Biologics Firms Contract Development & Manufacturing Organizations (CDMOs/CMOs) Food, Nutraceuticals & Cosmetic Producers Academic & Research Institutes |

| By Application | Pharmaceutical & Biotech Manufacturing (Injectables, Vaccines, mAbs) Diagnostics & Reagents (IVD kits, Enzymes) Food Processing & Packaging (Fruits, Coffee, Ready Meals) Cosmetics & Personal Care Others (Tissue Engineering, Preservation) |

| By Component | Dryers (Tray, Manifold, Rotary) Accessories & Subsystems (Vacuum Pumps, Condensers, CIP/SIP, Vials/Stoppering, Monitoring/SCADA) Services (Process Development, Cycle Optimization, Validation, Maintenance, Contract Lyophilization) |

| By Sales Channel | Direct (OEM Sales) Authorized Distributors/Integrators Online/Inside Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Entry/Benchtop Pilot/Medium Scale Industrial/GMP Scale |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 140 | Production Managers, Quality Control Specialists |

| Biotechnology Firms | 100 | R&D Directors, Process Engineers |

| Contract Manufacturing Organizations (CMOs) | 80 | Operations Managers, Business Development Executives |

| Research Institutions | 70 | Lab Managers, Principal Investigators |

| Regulatory Bodies | 50 | Compliance Officers, Regulatory Affairs Managers |

The Global Lyophilization Equipment and Services Market is valued at approximately USD 6.6 billion, driven by the rising demand for freeze-dried products in the pharmaceutical and food industries, along with advancements in lyophilization technology that enhance product stability and shelf life.