Region:Global

Author(s):Rebecca

Product Code:KRAC0203

Pages:93

Published On:August 2025

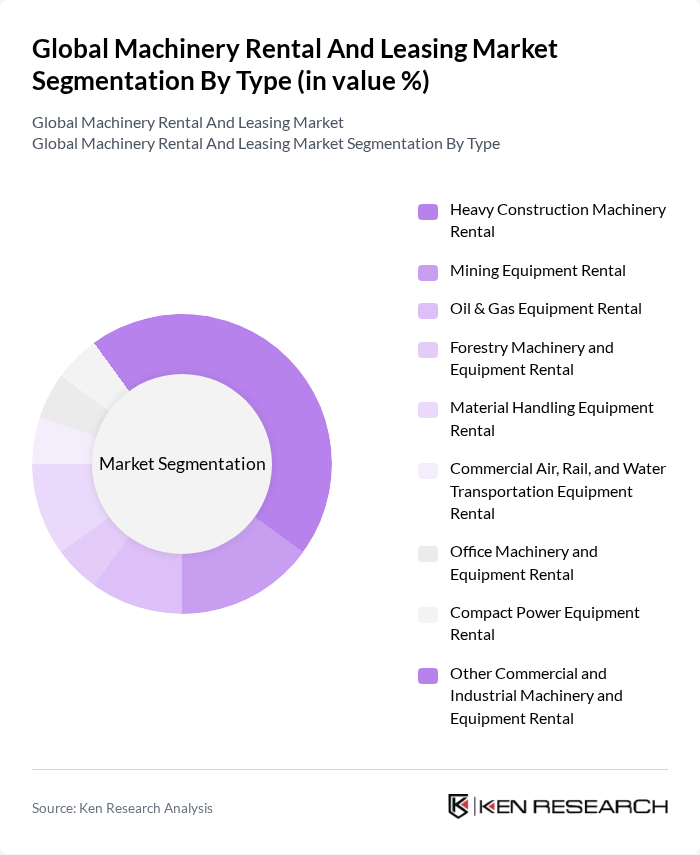

By Type:The machinery rental and leasing market is segmented into Heavy Construction Machinery Rental, Mining Equipment Rental, Oil & Gas Equipment Rental, Forestry Machinery and Equipment Rental, Material Handling Equipment Rental, Commercial Air, Rail, and Water Transportation Equipment Rental, Office Machinery and Equipment Rental, Compact Power Equipment Rental, and Other Commercial and Industrial Machinery and Equipment Rental. Among these, Heavy Construction Machinery Rental is the leading segment, driven by continuous growth in global construction activities, urbanization, infrastructure development, and increased preference for flexible equipment access through rental models .

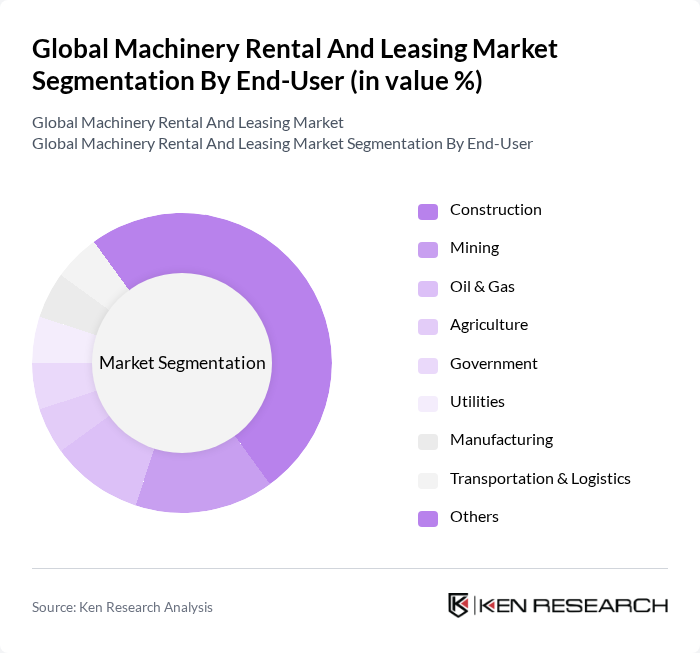

By End-User:The end-user segmentation of the machinery rental and leasing market includes Construction, Mining, Oil & Gas, Agriculture, Government, Utilities, Manufacturing, Transportation & Logistics, and Others. The Construction sector is the dominant end-user, driven by the increasing number of construction projects, urban expansion, and the need for specialized equipment, which makes renting a more viable and cost-efficient option for many companies .

The Global Machinery Rental And Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Rentals, Inc., Ashtead Group plc (Sunbelt Rentals), Herc Rentals Inc., Loxam S.A., Ahern Rentals, Inc., Cramo Plc, Riwal Holding Group, Kanamoto Co., Ltd., Nishio Rent All Co., Ltd., Ramirent Plc, Boels Rental, H&E Equipment Services, Inc., Speedy Hire Plc, Aktio Corporation, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the machinery rental market in Viet Nam appears promising, driven by ongoing infrastructure investments and technological innovations. As companies increasingly adopt digital platforms for rentals, the market is expected to see enhanced customer engagement and streamlined operations. Furthermore, the shift towards sustainable practices will likely encourage the adoption of eco-friendly machinery, aligning with global environmental goals and attracting a broader client base seeking sustainable solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Construction Machinery Rental Mining Equipment Rental Oil & Gas Equipment Rental Forestry Machinery and Equipment Rental Material Handling Equipment Rental Commercial Air, Rail, and Water Transportation Equipment Rental Office Machinery and Equipment Rental Compact Power Equipment Rental Other Commercial and Industrial Machinery and Equipment Rental |

| By End-User | Construction Mining Oil & Gas Agriculture Government Utilities Manufacturing Transportation & Logistics Others |

| By Application | Rental for Short-Term Projects Rental for Long-Term Projects Emergency Rentals Seasonal Rentals Specialized Project Rentals Others |

| By Distribution Channel | Direct Sales Online Platforms Rental Stores Third-Party Distributors Others |

| By Pricing Model | Hourly Rental Daily Rental Weekly Rental Monthly Rental Lease-to-Own Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Customer Type | Individual Contractors Small Enterprises Large Corporations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 100 | Project Managers, Equipment Rental Coordinators |

| Industrial Machinery Leasing | 60 | Operations Managers, Procurement Specialists |

| Agricultural Equipment Rental | 40 | Agronomists, Farm Managers |

| Heavy Machinery Rental for Infrastructure | 70 | Site Supervisors, Civil Engineers |

| Specialized Equipment Leasing | 50 | Technical Directors, Equipment Specialists |

The Global Machinery Rental and Leasing Market is valued at approximately USD 304 billion, driven by increasing demand for construction and infrastructure projects, as well as a growing preference for renting machinery over purchasing to reduce capital expenditure.