Region:Global

Author(s):Geetanshi

Product Code:KRAD0083

Pages:82

Published On:August 2025

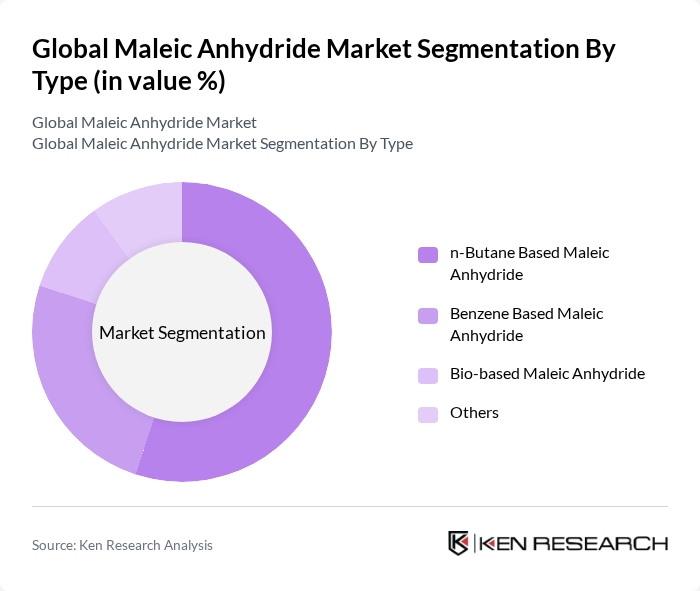

By Type:The market is segmented into n-Butane Based Maleic Anhydride, Benzene Based Maleic Anhydride, Bio-based Maleic Anhydride, and Others. Among these, n-Butane Based Maleic Anhydride is the leading subsegment due to its widespread use in the production of unsaturated polyester resins and its cost-effectiveness. The growing demand for lightweight, high-performance materials in automotive and construction applications further drives the growth of this subsegment.

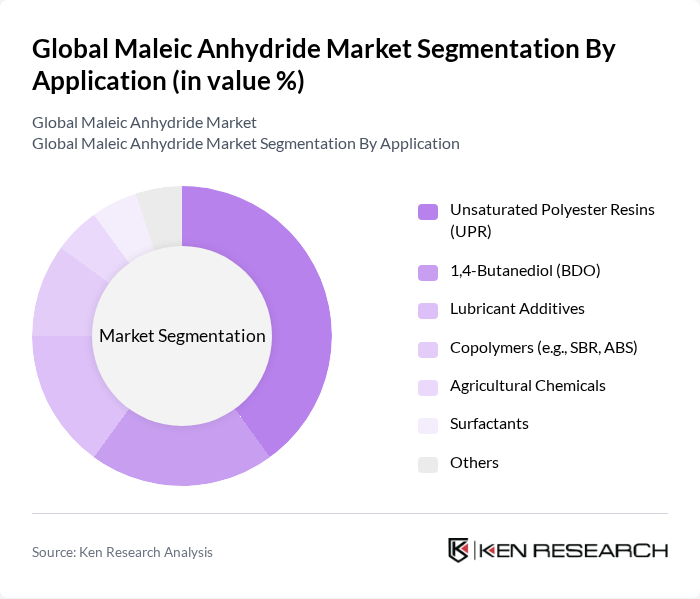

By Application:The applications of maleic anhydride include Unsaturated Polyester Resins (UPR), 1,4-Butanediol (BDO), Lubricant Additives, Copolymers (e.g., SBR, ABS), Agricultural Chemicals, Surfactants, and Others. The Unsaturated Polyester Resins (UPR) segment dominates the market due to its extensive use in automotive, construction, and marine industries, where it is valued for its durability, lightweight properties, and versatility in composite materials.

The Global Maleic Anhydride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huntsman Corporation, Ashland Global Holdings Inc., Lanxess AG, Mitsubishi Chemical Corporation, BASF SE, DIC Corporation, Polynt S.p.A., SABIC, Eastman Chemical Company, Nippon Shokubai Co., Ltd., Thirumalai Chemicals Ltd., Changzhou Yabang Chemical Co., Ltd., Bartek Ingredients Inc., Aekyung Petrochemical Co., Ltd., TPC Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the maleic anhydride market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production processes are expected to enhance efficiency and reduce environmental impact. Additionally, the increasing focus on bio-based chemicals presents opportunities for market expansion. As industries adapt to changing consumer preferences and regulatory landscapes, the maleic anhydride market is likely to witness significant growth, particularly in emerging economies where demand for high-performance materials is rising.

| Segment | Sub-Segments |

|---|---|

| By Type | n-Butane Based Maleic Anhydride Benzene Based Maleic Anhydride Bio-based Maleic Anhydride Others |

| By Application | Unsaturated Polyester Resins (UPR) ,4-Butanediol (BDO) Lubricant Additives Copolymers (e.g., SBR, ABS) Agricultural Chemicals Surfactants Others |

| By End-User | Automotive Construction Agriculture Electrical & Electronics Marine Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Product Form | Solid Maleic Anhydride (Pellets, Flakes, Lumps) Molten Maleic Anhydride (Liquid) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Development Engineers, Procurement Managers |

| Construction Materials | 60 | Construction Project Managers, Material Suppliers |

| Coatings and Adhesives | 75 | Formulation Chemists, Quality Control Managers |

| Pharmaceuticals and Agrochemicals | 50 | Regulatory Affairs Specialists, R&D Managers |

| Resins and Plastics | 65 | Manufacturing Engineers, Supply Chain Analysts |

The Global Maleic Anhydride Market is valued at approximately USD 3.7 billion, driven by the increasing demand for unsaturated polyester resins in various applications, including automotive, construction, and coatings.