Region:Global

Author(s):Geetanshi

Product Code:KRAC0021

Pages:82

Published On:August 2025

By Type:The manganese market is segmented into High Carbon Ferromanganese, Medium Carbon Ferromanganese, Low Carbon Ferromanganese, Silico-Manganese, Electrolytic Manganese Metal, Electrolytic Manganese Dioxide, Manganese Ore, Manganese Sulfate, and Others. High Carbon Ferromanganese remains the leading subsegment, primarily due to its extensive use in steel manufacturing, which constitutes the largest share of global manganese consumption. The demand for High Carbon Ferromanganese is driven by its critical role in enhancing steel strength and durability, making it indispensable in construction and automotive industries.

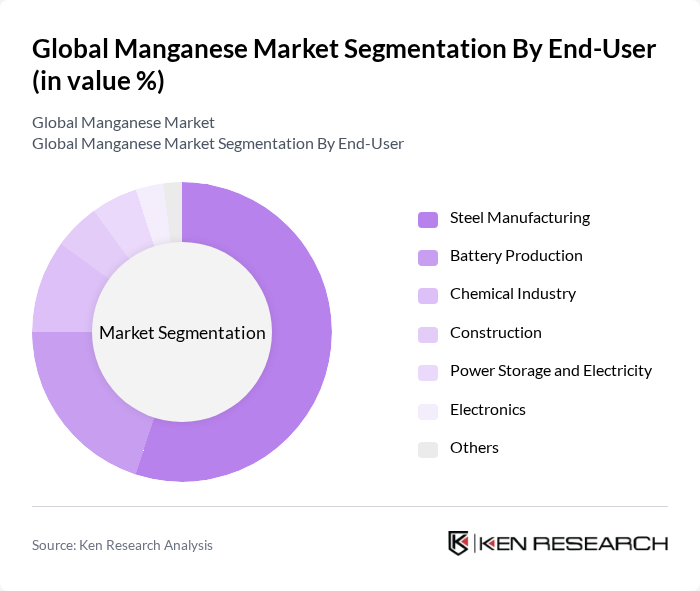

By End-User:The end-user segmentation includes Steel Manufacturing, Battery Production, Chemical Industry, Construction, Power Storage and Electricity, Electronics, and Others. Steel Manufacturing is the dominant end-user segment, accounting for the majority of manganese consumption. This is driven by the ongoing demand for high-strength steel in infrastructure and automotive applications. Battery Production is the second largest segment, supported by the rapid growth in electric vehicle and energy storage markets, which require significant quantities of manganese for cathode materials.

The Global Manganese Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vale S.A., South32 Limited, Eramet S.A., Assmang Proprietary Limited, MOIL Limited, Compagnie Minière de l'Ogooué (COMILOG), Anglo American plc, China Minmetals Corporation, Ningxia Tianyuan Manganese Industry Group Co., Ltd., OM Holdings Limited, Gulf Manganese Corporation Limited, Mesa Minerals Limited, Manganese Metal Company (MMC), Eurasian Resources Group (ERG), Tshipi é Ntle Manganese Mining (Pty) Ltd, Sibelco contribute to innovation, geographic expansion, and service delivery in this space.

The future of the manganese market appears promising, driven by increasing demand from the steel and electric vehicle sectors. As technological advancements continue to enhance extraction and processing efficiencies, the industry is likely to see a shift towards more sustainable practices. Additionally, the growing focus on recycling manganese will contribute to a more circular economy, reducing reliance on primary mining and fostering innovation in alloy development, which will further support market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | High Carbon Ferromanganese Medium Carbon Ferromanganese Low Carbon Ferromanganese Silico-Manganese Electrolytic Manganese Metal Electrolytic Manganese Dioxide Manganese Ore Manganese Sulfate Others |

| By End-User | Steel Manufacturing Battery Production Chemical Industry Construction Power Storage and Electricity Electronics Others |

| By Application | Alloy Production Electrolytic Manganese Dioxide Production Electrolytic Manganese Metal Production Battery Manufacturing Water Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Asia-Pacific North America Europe South America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price Others |

| By Quality Grade | High Grade Medium Grade Low Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Manufacturing Sector | 120 | Procurement Managers, Production Supervisors |

| Battery Production Industry | 80 | Product Development Engineers, Supply Chain Analysts |

| Manganese Mining Operations | 60 | Operations Managers, Environmental Compliance Officers |

| Alloy Manufacturing Companies | 50 | Quality Control Managers, R&D Specialists |

| Market Research Firms | 40 | Industry Analysts, Market Strategists |

The global manganese market is valued at approximately USD 28.9 billion, driven by increasing demand in steel production, battery manufacturing, and various chemical applications. This growth is supported by infrastructure development and the expansion of the automotive sector.