Region:Global

Author(s):Rebecca

Product Code:KRAC0295

Pages:100

Published On:August 2025

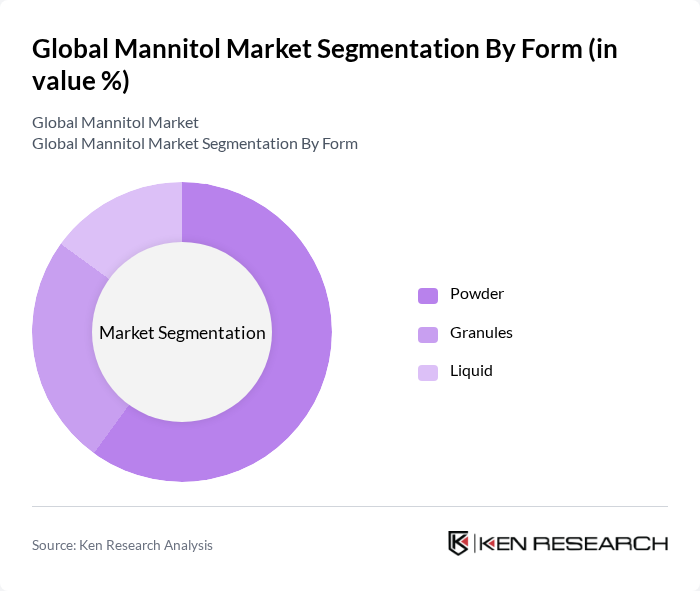

By Form:The market is segmented into three forms: Powder, Granules, and Liquid. The powder form is the most widely used due to its versatility and ease of use in a range of applications, including pharmaceuticals and food products. Granules are preferred in specific food applications for their texture and controlled dissolution, while liquid forms are utilized in pharmaceutical formulations, particularly for intravenous therapies. The powder segment dominates the market due to its broad applicability and consumer preference for powdered sweeteners.

By Application:The market is segmented into Pharmaceuticals, Food and Beverage, Industrial, Surfactants, and Others. The pharmaceutical application is the largest segment, driven by the increasing use of mannitol as an excipient in drug formulations and intravenous therapies. The food and beverage sector follows closely, as mannitol is widely used as a non-cariogenic, low-calorie sweetener in confectionery, chewing gum, and baked goods. The industrial segment is expanding due to rising demand for mannitol in chemical synthesis and specialty applications, while surfactants and other uses are growing in niche markets.

The Global Mannitol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Roquette Frères, SPI Pharma, Inc., Mingtai Chemical Co., Ltd., Merck KGaA, Tereos S.A., DFE Pharma, Hubei Yihua Chemical Industry Co., Ltd., Shijiazhuang Huabang Pharmaceutical Co., Ltd., Hunan Er-Kang Pharmaceutical Co., Ltd., Hubei Huitian Pharmaceutical Co., Ltd., Jiangsu Shunfeng Pharmaceutical Co., Ltd., Qingdao Bright Moon Seaweed Group Co., Ltd., Hebei Huaxu Pharmaceutical Co., Ltd., Zhucheng Dongxiao Biotechnology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mannitol market appears promising, driven by increasing demand across various sectors, particularly pharmaceuticals and food. As consumers become more health-conscious, the shift towards natural and low-calorie sweeteners is expected to accelerate. Additionally, advancements in production techniques and strategic partnerships among industry players will likely enhance market dynamics. Emerging markets present significant growth potential, as rising disposable incomes and changing dietary preferences create new opportunities for mannitol applications in diverse products.

| Segment | Sub-Segments |

|---|---|

| By Form | Powder Granules Liquid |

| By Application | Pharmaceuticals Food and Beverage Industrial Surfactants Others |

| By End-User | Pharmaceutical Companies Food Manufacturers Industrial Users |

| By Distribution Channel | Direct Sales Online Retail Distributors |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Others) Asia-Pacific (China, Japan, India, South Korea, Australia, Others) Latin America (Brazil, Argentina, Others) Middle East & Africa (Saudi Arabia, South Africa, Others) |

| By Price Range | Economy Mid-Range Premium |

| By Others | Specialty Applications Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Assurance Officers |

| Food and Beverage Sector | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Cosmetic Industry Usage | 60 | Formulation Chemists, Brand Managers |

| Industrial Applications | 50 | Procurement Managers, Operations Directors |

| Research Institutions | 40 | Academic Researchers, Laboratory Managers |

The Global Mannitol Market is valued at approximately USD 530 million, driven by increasing demand in the pharmaceutical and food industries, particularly for its use as a sweetener and excipient in various applications.