Region:Global

Author(s):Shubham

Product Code:KRAA1723

Pages:89

Published On:August 2025

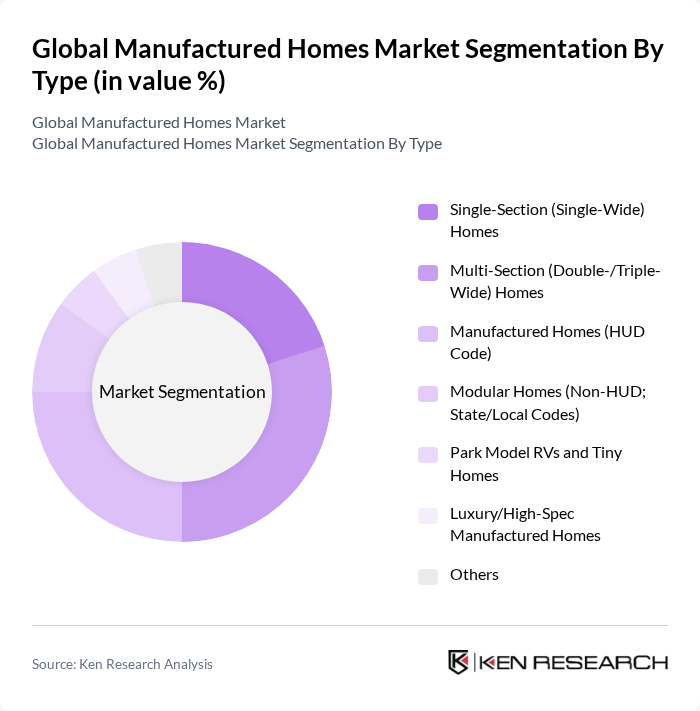

By Type:The manufactured homes market can be segmented into various types, including Single-Section (Single-Wide) Homes, Multi-Section (Double-/Triple-Wide) Homes, Manufactured Homes (HUD Code), Modular Homes (Non-HUD; State/Local Codes), Park Model RVs and Tiny Homes, Luxury/High-Spec Manufactured Homes, and Others. Each of these subsegments caters to different consumer preferences and needs, influencing their market dynamics.

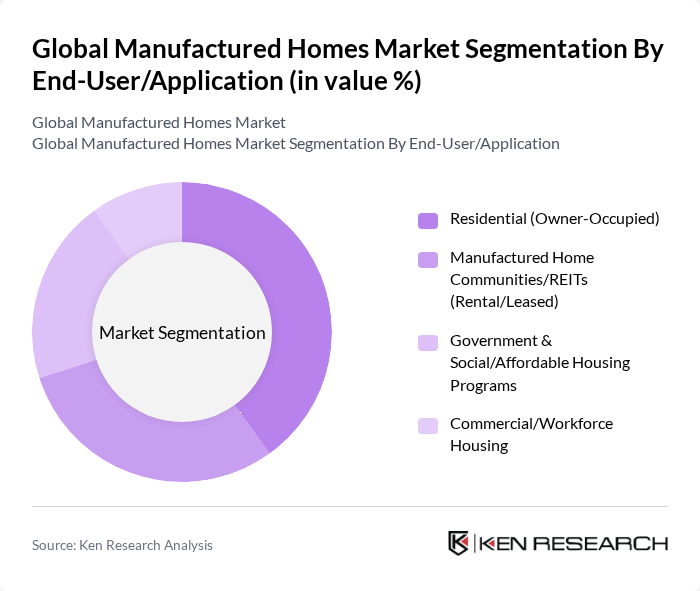

By End-User/Application:The market can also be segmented based on end-users, which include Residential (Owner-Occupied), Manufactured Home Communities/REITs (Rental/Leased), Government & Social/Affordable Housing Programs, and Commercial/Workforce Housing. Each application serves distinct market needs, with varying levels of demand and growth potential.

The Global Manufactured Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Clayton Homes, Inc. (Berkshire Hathaway), Skyline Champion Corporation, Cavco Industries, Inc., Champion Home Builders (a Skyline Champion brand), Fleetwood Homes (a Cavco brand), Palm Harbor Homes (a Cavco brand), Fairmont Homes (a Cavco brand), Commodore Homes (Commodore Homes of Pennsylvania/Indiana), Redman Homes (a Skyline Champion brand), TruMH (a Clayton Homes brand), Marlette Homes (a Clayton Homes brand), Karsten Homes (Karsten Manufacturing; legacy brand in NM/TX), Giles Industries, Inc., Deer Valley Homebuilders, Inc., Adventure Homes, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the manufactured homes market appears promising, driven by increasing consumer demand for affordable and sustainable housing solutions. As technological advancements continue to reshape manufacturing processes, the industry is likely to see enhanced customization options and improved quality. Additionally, the growing trend of eco-friendly living will further propel the market, encouraging manufacturers to innovate and adapt to changing consumer preferences. Overall, the landscape is set for significant transformation, with opportunities for growth in various segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Section (Single-Wide) Homes Multi-Section (Double-/Triple-Wide) Homes Manufactured Homes (HUD Code) Modular Homes (Non-HUD; State/Local Codes) Park Model RVs and Tiny Homes Luxury/High-Spec Manufactured Homes Others |

| By End-User/Application | Residential (Owner-Occupied) Manufactured Home Communities/REITs (Rental/Leased) Government & Social/Affordable Housing Programs Commercial/Workforce Housing |

| By Sales Channel | Manufacturer-Direct Sales Independent Retailers/Dealers Online/Digital Sales Distributors/Channel Partners |

| By Price Range | Entry-Level (Value) Homes Mid-Range Homes Premium Homes |

| By Financing Type | Cash Purchases Chattel (Home-Only) Loans Mortgage/Real Property Loans Lease-to-Own/Installment |

| By Installation/Land Tenure | Private Land (Fee Simple) Land-Lease Communities Temporary/Relocatable Sites |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufactured Home Buyers | 140 | First-time Homebuyers, Retirees |

| Manufactured Home Manufacturers | 90 | Production Managers, Sales Directors |

| Real Estate Agents Specializing in Manufactured Homes | 80 | Real Estate Brokers, Market Analysts |

| Financial Institutions Offering Loans for Manufactured Homes | 70 | Loan Officers, Mortgage Brokers |

| Regulatory Bodies and Housing Authorities | 50 | Policy Makers, Housing Inspectors |

The Global Manufactured Homes Market is valued at approximately USD 24 billion, reflecting a sustained demand for affordable, factory-built housing solutions. This growth is driven by urbanization and the need for quick construction methods, appealing to both consumers and institutional investors.