Region:Global

Author(s):Dev

Product Code:KRAD0528

Pages:86

Published On:August 2025

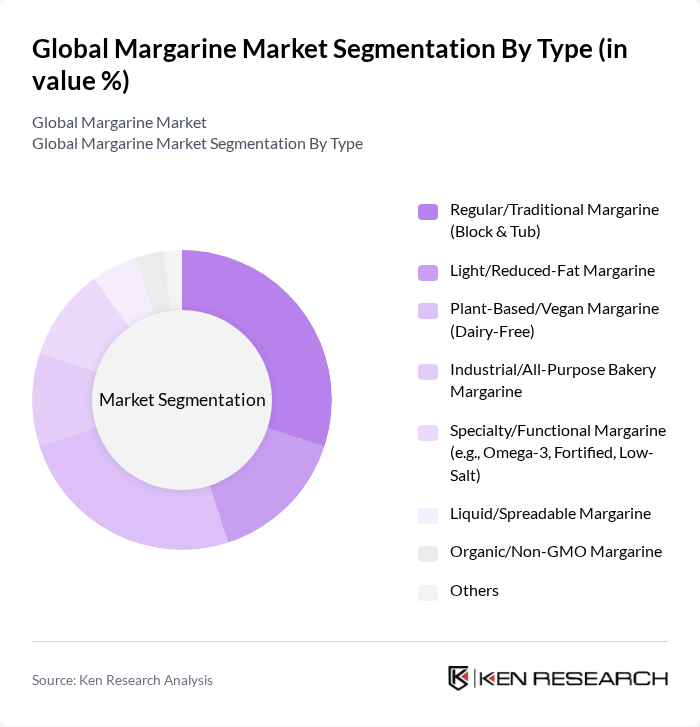

By Type:The margarine market can be segmented into various types, including Regular/Traditional Margarine, Light/Reduced-Fat Margarine, Plant-Based/Vegan Margarine, Industrial/All-Purpose Bakery Margarine, Specialty/Functional Margarine, Liquid/Spreadable Margarine, Organic/Non-GMO Margarine, and Others. Each type caters to different consumer preferences and dietary needs, influencing market dynamics. Growth is supported by rising bakery consumption, cost-effectiveness versus butter, and the shift to plant-based and low-trans-fat formulations in both retail and industrial applications .

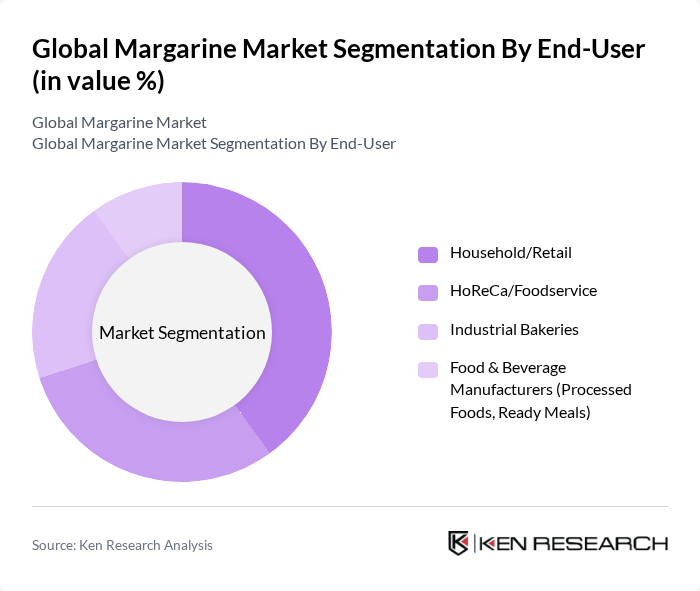

By End-User:The end-user segmentation includes Household/Retail, HoReCa/Foodservice, Industrial Bakeries, and Food & Beverage Manufacturers. Each segment reflects different consumption patterns and demand drivers, with households and foodservice sectors being the largest consumers of margarine products. Foodservice and industrial bakery usage is supported by margarine’s cost advantage, functionality, and stable performance in baking and cooking .

The Global Margarine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Upfield Holdings B.V. (Flora, Blue Band, Country Crock, Becel), Unilever PLC (Rama, Planta Fin, Bona in select markets), Bunge Global SA, Cargill, Incorporated, Wilmar International Limited, AAK AB, Conagra Brands, Inc. (Blue Bonnet, Parkay), Grupo Bimbo, S.A.B. de C.V. (industrial bakery margarines through acquisitions), Vandemoortele NV, NMGK Group (NMZhK) (Russia), Fuji Oil Holdings Inc., The J.M. Smucker Co. (Crisco brand spreads/shortening), BRF S.A. (Qualy brand, Brazil), Puratos Group, Savola Group (Afia, Middle East) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the margarine market appears promising, driven by evolving consumer preferences towards healthier and plant-based options. Innovations in product formulations, such as the introduction of functional margarines enriched with omega-3 fatty acids, are expected to capture consumer interest. Additionally, the rise of e-commerce platforms is facilitating easier access to margarine products, allowing brands to reach a broader audience and adapt to changing shopping behaviors, particularly among younger consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular/Traditional Margarine (Block & Tub) Light/Reduced-Fat Margarine Plant-Based/Vegan Margarine (Dairy-Free) Industrial/All-Purpose Bakery Margarine Specialty/Functional Margarine (e.g., Omega-3, Fortified, Low-Salt) Liquid/Spreadable Margarine Organic/Non-GMO Margarine Others |

| By End-User | Household/Retail HoReCa/Foodservice Industrial Bakeries Food & Beverage Manufacturers (Processed Foods, Ready Meals) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialty & Health Food Stores Foodservice/Wholesale Distributors |

| By Packaging Type | Tubs/Cups Sticks/Blocks Pouches/Sachets Bottles (Liquid Formats) Bulk/Industrial Packs (Cartons, Tins) Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Cooking/Frying Baking/Laminating Spreading Sauces & Dressings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Margarine | 150 | Health-conscious Consumers, Families |

| Retail Insights on Margarine Sales | 100 | Store Managers, Category Buyers |

| Food Service Industry Usage | 90 | Chefs, Restaurant Owners |

| Nutritionist Perspectives on Margarine | 60 | Registered Dietitians, Nutrition Experts |

| Market Trends in Plant-based Alternatives | 70 | Product Developers, Food Scientists |

The Global Margarine Market is valued at approximately USD 23.5 billion, reflecting a significant growth trend driven by the demand for healthier, plant-based alternatives to butter and the increasing use of margarine in various culinary applications.