Region:Global

Author(s):Geetanshi

Product Code:KRAA2092

Pages:89

Published On:August 2025

Market.png)

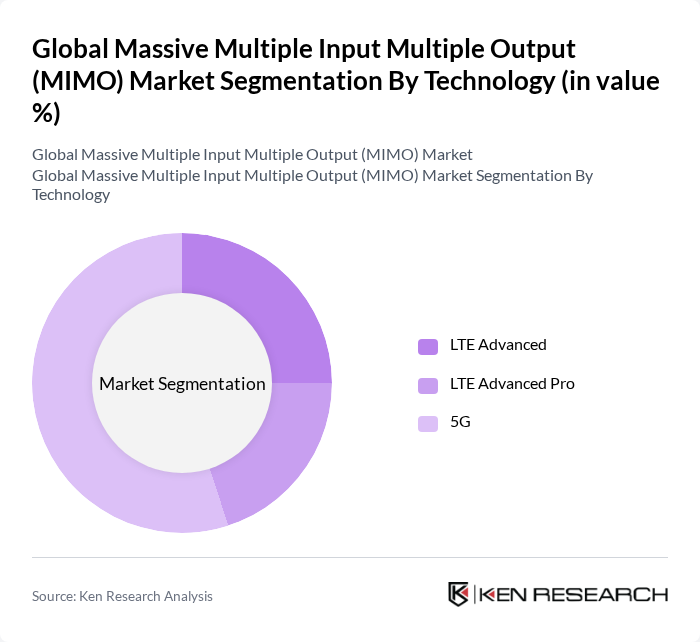

By Technology:The technology segment of the MIMO market includes LTE Advanced, LTE Advanced Pro, and 5G. Among these, 5G is the leading sub-segment due to its ability to support higher data rates, ultra-low latency, and massive device connectivity—capabilities essential for modern applications such as autonomous vehicles, smart cities, and industrial IoT. LTE Advanced and LTE Advanced Pro remain significant, particularly in regions where 5G deployment is ongoing or where legacy infrastructure continues to support critical services .

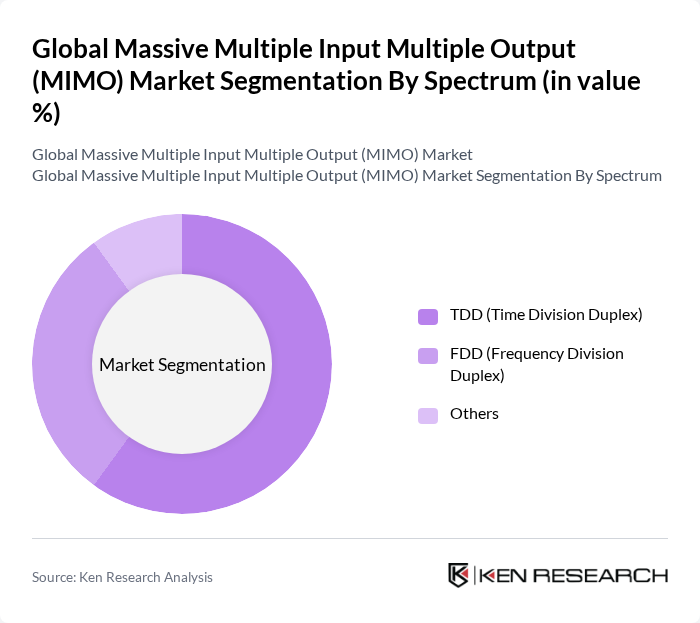

By Spectrum:The spectrum segment includes TDD (Time Division Duplex), FDD (Frequency Division Duplex), and Others. TDD is currently the dominant sub-segment, favored for its efficient use of spectrum, flexibility in uplink and downlink allocation, and suitability for dense urban deployments and 5G rollouts. FDD remains important in established networks, particularly for wide-area coverage and legacy systems, while the 'Others' category encompasses emerging spectrum technologies such as millimeter wave and dynamic spectrum sharing that are gaining traction in advanced markets .

The Global Massive Multiple Input Multiple Output (MIMO) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., ZTE Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., Intel Corporation, NEC Corporation, Fujitsu Limited, CommScope Holding Company, Inc., Keysight Technologies, Inc., Analog Devices, Inc., Spirent Communications plc, Arista Networks, Inc., Telefonaktiebolaget LM Ericsson, Xilinx, Inc., Marvell Technology, Inc., Qorvo, Inc., Broadcom Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MIMO market in None appears promising, driven by technological advancements and increasing connectivity demands. The integration of artificial intelligence and machine learning into MIMO systems is expected to enhance performance and efficiency. Additionally, the shift towards cloud-based solutions will facilitate more scalable and flexible MIMO deployments. As smart city initiatives gain momentum, the demand for MIMO technology will likely accelerate, positioning it as a cornerstone of future telecommunications infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Technology | LTE Advanced LTE Advanced Pro G |

| By Spectrum | TDD (Time Division Duplex) FDD (Frequency Division Duplex) Others |

| By Type of Antenna | Active Antenna Systems Passive Antenna Systems Hybrid Antenna Systems |

| By End-User | Telecommunications Automotive Aerospace & Defense Consumer Electronics |

| By Application | Mobile Communications Fixed Wireless Access Satellite Communications Internet of Things (IoT) |

| By Component | Transmitters Receivers Antennas Controllers |

| By Region | North America Europe Asia-Pacific Rest of the World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Network Operators | 100 | Network Engineers, CTOs |

| Satellite Communication Providers | 60 | Technical Directors, Operations Managers |

| IoT Device Manufacturers | 50 | Product Managers, R&D Engineers |

| Telecom Equipment Suppliers | 40 | Sales Directors, Product Development Managers |

| Regulatory Bodies and Standards Organizations | 40 | Policy Analysts, Compliance Officers |

The Global Massive Multiple Input Multiple Output (MIMO) Market is valued at approximately USD 12 billion, driven by the increasing demand for high-speed data transmission and the rapid expansion of 5G networks.