Region:Global

Author(s):Dev

Product Code:KRAB0462

Pages:100

Published On:August 2025

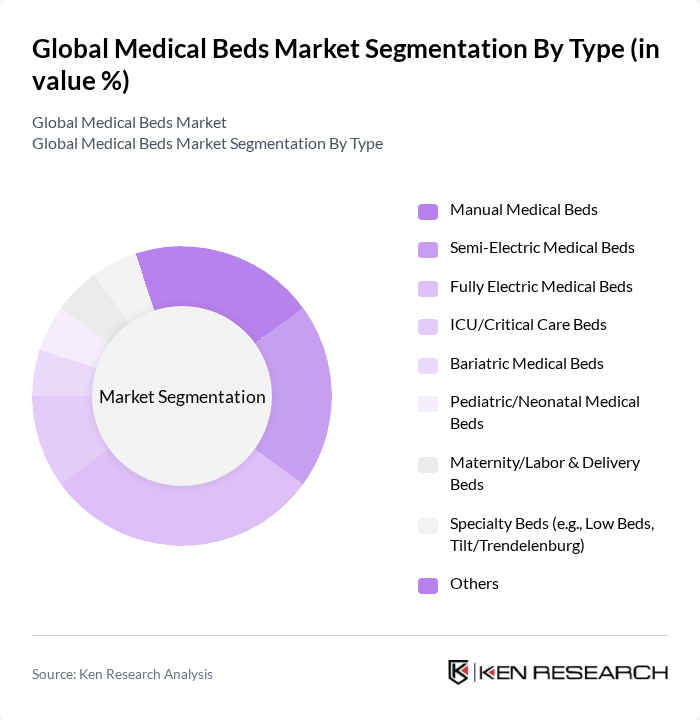

By Type:The market is segmented into Manual Medical Beds, Semi-Electric Medical Beds, Fully Electric Medical Beds, ICU/Critical Care Beds, Bariatric Medical Beds, Pediatric/Neonatal Medical Beds, Maternity/Labor & Delivery Beds, Specialty Beds (e.g., Low Beds, Tilt/Trendelenburg), and Others. Fully Electric Medical Beds are gaining traction due to ease of use, powered positioning, and integration of patient safety features, making them a preferred choice in hospitals and long-term care facilities .

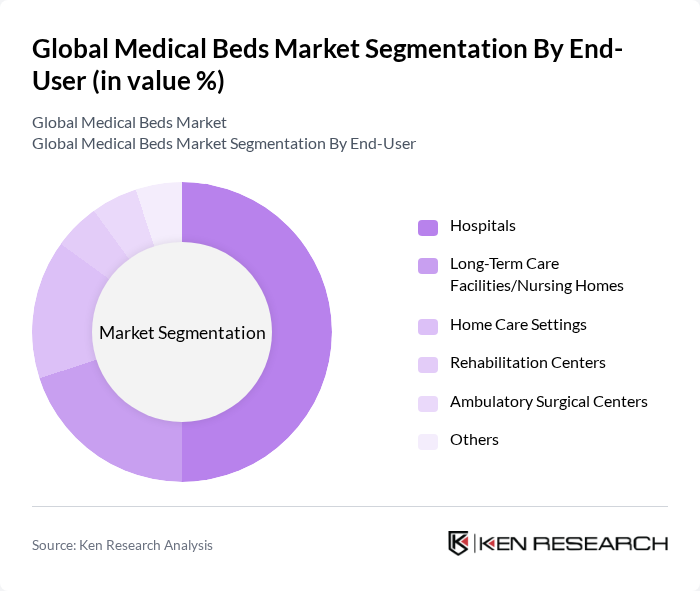

By End-User:The market is segmented by end-users into Hospitals, Long-Term Care Facilities/Nursing Homes, Home Care Settings, Rehabilitation Centers, Ambulatory Surgical Centers, and Others. Hospitals lead due to higher admission volumes, surgical caseloads, and ongoing replacement cycles for acute and non-intensive care beds, supported by capital spending on patient safety and workflow efficiency .

The Global Medical Beds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hillrom (Baxter International Inc.), Stryker Corporation, Invacare Corporation, Arjo AB, Getinge AB, Medline Industries, LP, LINET Group SE, Paramount Bed Holdings Co., Ltd., Gendron, Inc., Drive DeVilbiss Healthcare, Joerns Healthcare LLC, Savaria Corporation (Span-America/Savaria Pressure Care), Merivaara Corp., Malvestio S.p.A., Stiegelmeyer GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical beds market in the None region appears promising, driven by technological innovations and demographic shifts. As healthcare systems increasingly adopt smart technologies, the integration of IoT in medical beds will enhance patient monitoring and comfort. Additionally, the growing focus on home healthcare solutions will create new avenues for market expansion, allowing manufacturers to cater to diverse patient needs while improving overall healthcare delivery in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Medical Beds Semi-Electric Medical Beds Fully Electric Medical Beds ICU/Critical Care Beds Bariatric Medical Beds Pediatric/Neonatal Medical Beds Maternity/Labor & Delivery Beds Specialty Beds (e.g., Low Beds, Tilt/Trendelenburg) Others |

| By End-User | Hospitals Long-Term Care Facilities/Nursing Homes Home Care Settings Rehabilitation Centers Ambulatory Surgical Centers Others |

| By Application | Acute Care Intensive/Critical Care Post-operative/Recovery Care Long-Term/Palliative Care Maternity Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Group Purchasing Organizations (GPOs) Online/Manufacturer E-commerce Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Material | Steel Aluminum High-Performance Polymers/Plastics Composite Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Hospital Bed Market | 120 | Hospital Administrators, Procurement Managers |

| ICU Bed Segment | 90 | Critical Care Physicians, ICU Managers |

| Long-term Care Facilities | 70 | Facility Managers, Nursing Home Administrators |

| Home Healthcare Beds | 60 | Home Care Providers, Patient Care Coordinators |

| Specialized Medical Beds (e.g., Pediatric, Bariatric) | 50 | Specialist Physicians, Equipment Buyers |

The Global Medical Beds Market is valued at approximately USD 3.8 billion, driven by increasing demand for advanced healthcare facilities, an aging population, and the prevalence of chronic diseases requiring long-term care.