Region:Global

Author(s):Shubham

Product Code:KRAA1928

Pages:98

Published On:August 2025

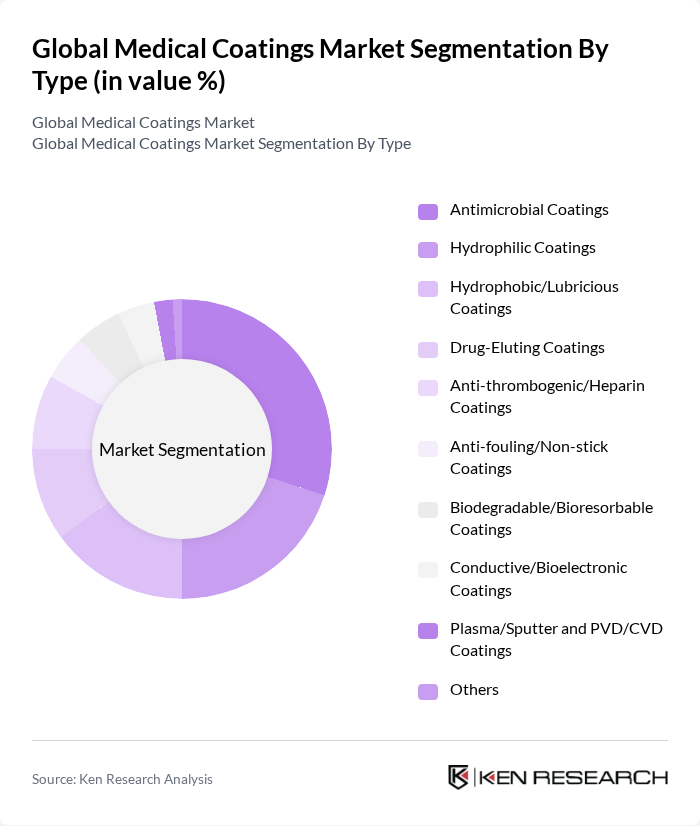

By Type:The market is segmented into various types of coatings, including Antimicrobial Coatings, Hydrophilic Coatings, Hydrophobic/Lubricious Coatings, Drug-Eluting Coatings, Anti-thrombogenic/Heparin Coatings, Anti-fouling/Non-stick Coatings, Biodegradable/Bioresorbable Coatings, Conductive/Bioelectronic Coatings, Plasma/Sputter and PVD/CVD Coatings, and Others. Among these, Antimicrobial Coatings and Hydrophilic Coatings hold prominent shares due to their critical role in infection prevention and improved device maneuverability, respectively. The increasing incidence of hospital-acquired infections (HAIs) and the rise in minimally invasive procedures have driven demand for these coatings, as they reduce bacterial adhesion and provide lubricity for catheter-based interventions.

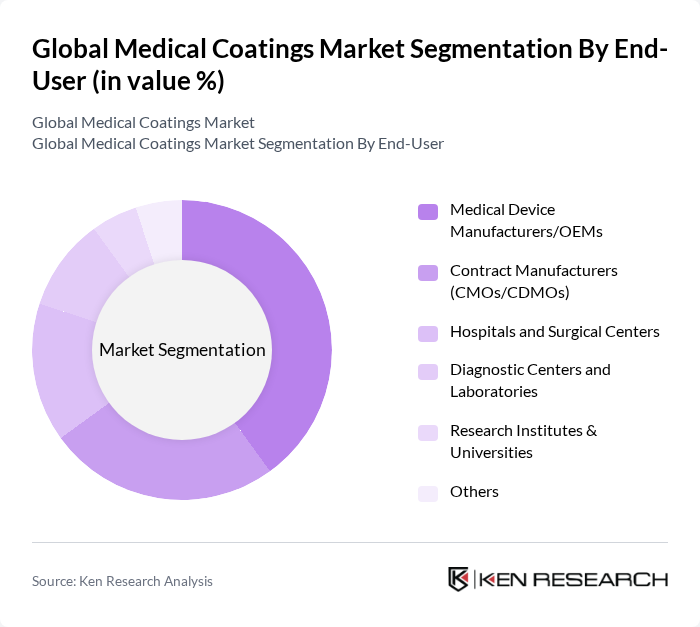

By End-User:The market is segmented by end-users, including Medical Device Manufacturers/OEMs, Contract Manufacturers (CMOs/CDMOs), Hospitals and Surgical Centers, Diagnostic Centers and Laboratories, Research Institutes & Universities, and Others. Medical Device Manufacturers/OEMs dominate this segment given their investment in integrating coatings to enhance performance (lubricity, antimicrobial protection, hemocompatibility) and compliance with biocompatibility standards across high-volume products such as catheters, guidewires, implants, and tubing.

The Global Medical Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Surmodics, Inc., Biocoat, Inc., Hydromer, Inc., DSM Biomedical (dsm-firmenich), Covalon Technologies Ltd., AST Products, Inc., Harland Medical Systems, Inc., Freudenberg Medical (Freudenberg Group), Merit Medical Systems, Inc. (Applied Medical Coatings), PPG Industries, Inc. (Medical Coatings), The Sherwin-Williams Company (Valspar Medical Coatings), Materion Corporation (Advanced Coatings), Biotronik SE & Co. KG, Abbott (Drug-Eluting Stents Coatings), Boston Scientific Corporation (DES and implant coatings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical coatings market is poised for significant growth, driven by ongoing advancements in technology and increasing healthcare demands. The integration of smart technologies into coatings, such as sensors for real-time monitoring, is expected to enhance patient outcomes. Additionally, the shift towards eco-friendly and sustainable coatings will likely gain momentum, aligning with global sustainability goals. As healthcare systems evolve, the focus on patient safety and infection control will further propel innovations in medical coatings, ensuring their critical role in future medical applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimicrobial Coatings Hydrophilic Coatings Hydrophobic/Lubricious Coatings Drug-Eluting Coatings Anti-thrombogenic/Heparin Coatings Anti-fouling/Non-stick Coatings Biodegradable/Bioresorbable Coatings Conductive/Bioelectronic Coatings Plasma/Sputter and PVD/CVD Coatings Others |

| By End-User | Medical Device Manufacturers/OEMs Contract Manufacturers (CMOs/CDMOs) Hospitals and Surgical Centers Diagnostic Centers and Laboratories Research Institutes & Universities Others |

| By Application | Catheters and Guidewires Stents and Vascular Implants Orthopedic Implants and Instruments Surgical Instruments and Needles Diagnostic Imaging Devices and Sensors Wound Care and Dressings Dental Devices and Implants Wearables and Bioelectronic Devices Others |

| By Material | Polymer Coatings (e.g., PTFE, Polyurethane, Parylene, Hydrogels) Metal Coatings (e.g., Silver, Titanium, Nitinol) Ceramic and Oxide Coatings (e.g., Hydroxyapatite, TiO2) Composite and Hybrid Coatings Others |

| By Distribution Channel | Direct to OEMs Specialty Distributors/Coating Service Providers Online/Inside Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 150 | R&D Managers, Product Development Leads |

| Healthcare Providers | 120 | Clinical Directors, Procurement Officers |

| Coating Material Suppliers | 80 | Sales Managers, Technical Support Engineers |

| Regulatory Bodies | 50 | Compliance Officers, Policy Makers |

| Research Institutions | 70 | Research Scientists, Academic Professors |

The Global Medical Coatings Market is valued at approximately USD 15 billion, driven by the increasing demand for advanced medical devices, rising healthcare expenditures, and the growing prevalence of chronic diseases.