Region:Global

Author(s):Shubham

Product Code:KRAB0792

Pages:88

Published On:August 2025

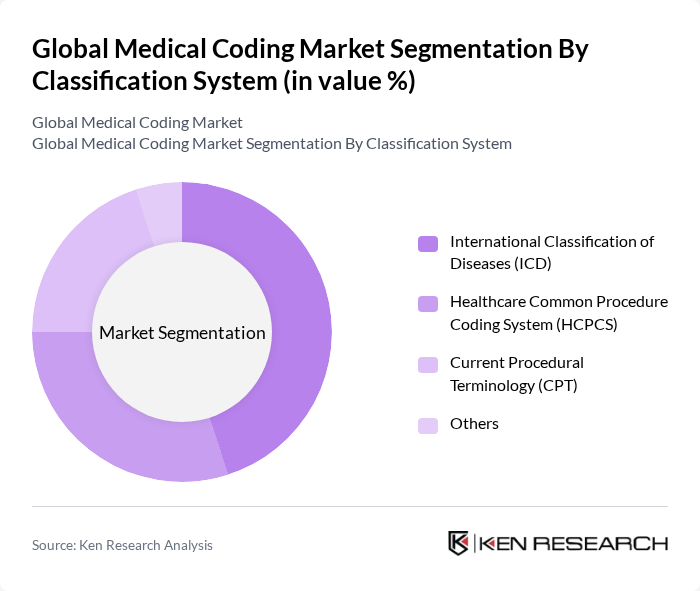

By Classification System:The classification systems used in medical coding are crucial for standardizing the coding process.The International Classification of Diseases (ICD)is widely adopted globally for diagnosing and classifying diseases.The Healthcare Common Procedure Coding System (HCPCS)is essential for billing Medicare and Medicaid services.Current Procedural Terminology (CPT)is primarily used in the United States for reporting medical, surgical, and diagnostic procedures. Other classification systems also play a role but are less prevalent.

By Component:The medical coding market is segmented intoin-houseandoutsourced medical coding. In-house medical coding is preferred by larger healthcare organizations that have the resources to maintain their coding staff. Outsourced medical coding is gaining traction due to cost-effectiveness and access to specialized coding expertise. The trend towards outsourcing is driven by the need for efficiency and accuracy in coding processes, and the outsourced segment is currently the highest contributor to market growth.

The Global Medical Coding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optum360, Cerner Corporation, 3M Health Information Systems, MRA Health Information Services, nThrive, GeBBS Healthcare Solutions, Aviacode, Omega Healthcare, Vee Technologies, eCatalyst Healthcare Solutions, Ciox Health, Dolbey Systems Inc., HCL Technologies, KODE Health, Sunknowledge Services Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the medical coding market in None is poised for transformation, driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence and machine learning into coding processes is expected to enhance accuracy and efficiency. Additionally, the expansion of telehealth services will create new coding requirements, necessitating innovative solutions. As healthcare providers adapt to these changes, the demand for skilled coders and advanced coding technologies will continue to rise, shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Classification System | International Classification of Diseases (ICD) Healthcare Common Procedure Coding System (HCPCS) Current Procedural Terminology (CPT) Others |

| By Component | In-house Medical Coding Outsourced Medical Coding |

| By End-User | Hospitals Diagnostic Centers Physician Practices Health Insurance Companies Outsourcing Companies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Coding Departments | 120 | Medical Coders, Billing Managers |

| Outpatient Clinics | 80 | Practice Managers, Coding Specialists |

| Health Insurance Providers | 50 | Claims Analysts, Compliance Officers |

| Healthcare IT Solutions | 40 | Product Managers, Software Developers |

| Telehealth Services | 40 | Telehealth Coordinators, Coding Consultants |

The Global Medical Coding Market is valued at approximately USD 24 billion, driven by the increasing demand for accurate medical billing and coding services essential for healthcare providers to ensure proper reimbursement and compliance with regulations.