Region:Global

Author(s):Dev

Product Code:KRAB0578

Pages:89

Published On:August 2025

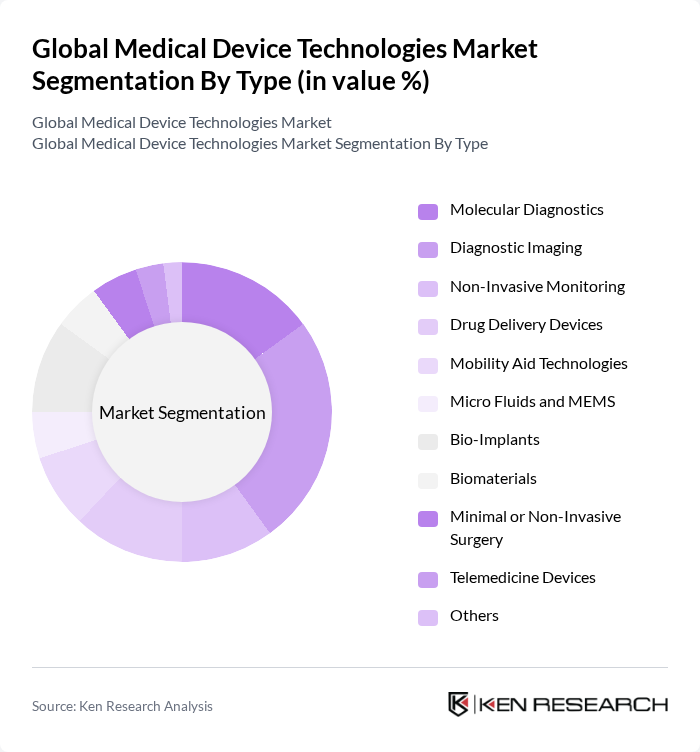

By Type:The market is segmented into various types of medical devices, each addressing specific healthcare needs. The subsegments include Molecular Diagnostics, Diagnostic Imaging, Non-Invasive Monitoring, Drug Delivery Devices, Mobility Aid Technologies, Micro Fluids and MEMS, Bio-Implants, Biomaterials, Minimal or Non-Invasive Surgery, Telemedicine Devices, and Others. Among these,Diagnostic Imagingis currently the leading subsegment due to its critical role in disease diagnosis and monitoring, driven by advancements in imaging technologies, increasing demand for early disease detection, and the integration of digital and AI-based imaging solutions .

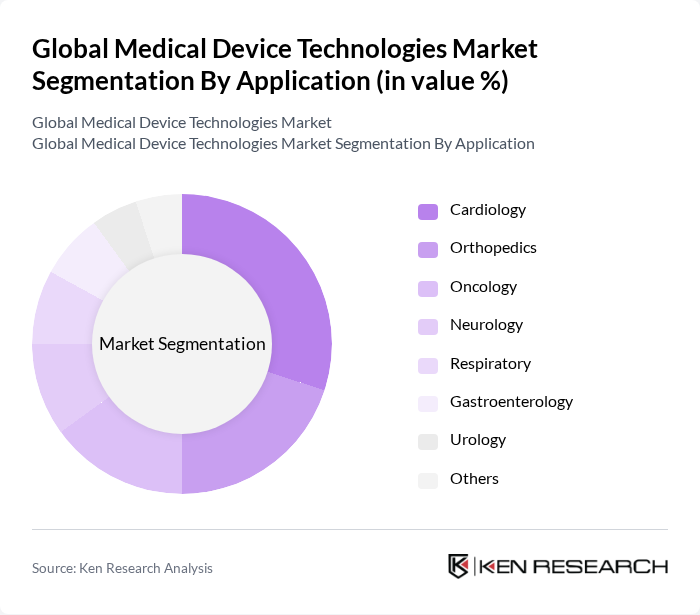

By Application:The market is also segmented by application, which includes Cardiology, Orthopedics, Oncology, Neurology, Respiratory, Gastroenterology, Urology, and Others.Cardiologyremains the leading application area, driven by the rising prevalence of cardiovascular diseases, the increasing adoption of advanced cardiac devices, and ongoing innovation in minimally invasive and remote monitoring solutions. The demand for innovative solutions in this field is further fueled by the growing awareness of heart health, preventive care, and the integration of digital health technologies .

The Global Medical Device Technologies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (including DePuy Synthes, Ethicon), Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Koninklijke Philips N.V.), Abbott Laboratories, Stryker Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Terumo Corporation, Canon Medical Systems Corporation, Olympus Corporation, Hologic, Inc., 3M Company (3M Health Care) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical device technologies market appears promising, driven by ongoing innovations and a growing focus on patient-centric solutions. As healthcare systems increasingly adopt telemedicine and remote monitoring technologies, the demand for connected devices is expected to rise. Additionally, the integration of AI and machine learning will enhance device capabilities, leading to improved patient outcomes. The market is likely to witness significant advancements in personalized medicine, further shaping the landscape of medical device technologies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Molecular Diagnostics Diagnostic Imaging Non-Invasive Monitoring Drug Delivery Devices Mobility Aid Technologies Micro Fluids and MEMS Bio-Implants Biomaterials Minimal or Non-Invasive Surgery Telemedicine Devices Others |

| By Application | Cardiology Orthopedics Oncology Neurology Respiratory Gastroenterology Urology Others |

| By End-User | Hospitals Clinics Ambulatory Surgical Centers Diagnostic Laboratories Home Healthcare Research Organizations Others |

| By Technology | Digital Health Technologies Robotics in Surgery Biometric Sensors Telehealth Technologies Wearable Health Tracking Devices Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Devices | 100 | Cardiologists, Cardiac Surgeons |

| Orthopedic Implants | 80 | Orthopedic Surgeons, Hospital Administrators |

| Diagnostic Imaging Equipment | 60 | Radiologists, Imaging Technologists |

| Diabetes Management Devices | 50 | Endocrinologists, Diabetes Educators |

| Wearable Health Technology | 40 | Health Tech Innovators, Product Managers |

The Global Medical Device Technologies Market is valued at approximately USD 580 billion, driven by technological advancements, an aging population, and increasing healthcare expenditures. This market is expected to continue growing as demand for innovative medical devices rises.