Region:Global

Author(s):Shubham

Product Code:KRAA1888

Pages:82

Published On:August 2025

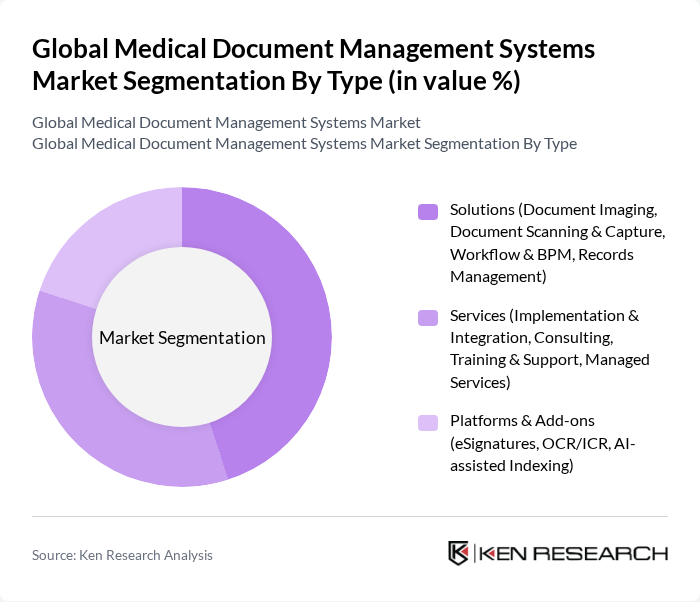

By Type:The market is segmented into Solutions, Services, and Platforms & Add-ons. The Solutions segment includes Document Imaging, Document Scanning & Capture, Workflow & BPM, and Records Management. The Services segment encompasses Implementation & Integration, Consulting, Training & Support, and Managed Services. The Platforms & Add-ons segment features eSignatures, OCR/ICR, and AI-assisted Indexing.

The Solutions segment is currently dominating the market, driven by the increasing need for efficient document management and workflow automation in healthcare settings. Document Imaging and Workflow & BPM are particularly popular as they enhance operational efficiency and reduce manual errors. The growing trend towards digitization in healthcare is pushing organizations to invest in comprehensive solutions that streamline document handling and improve patient care outcomes.

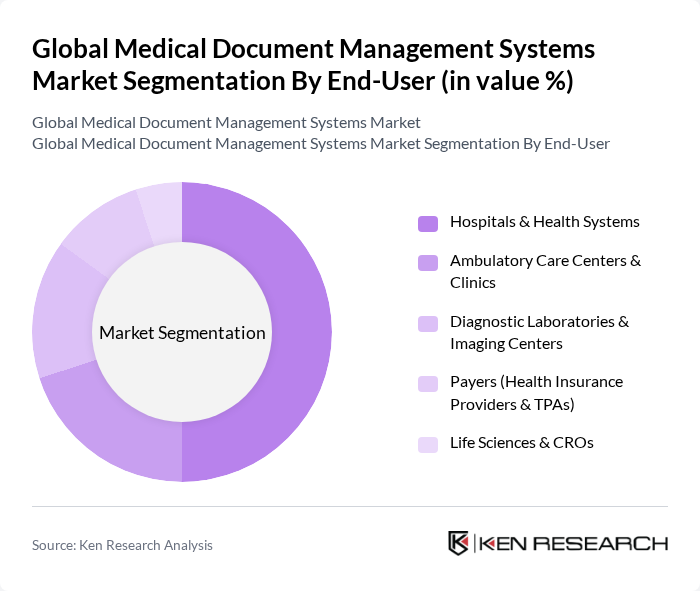

By End-User:The market is segmented into Hospitals & Health Systems, Ambulatory Care Centers & Clinics, Diagnostic Laboratories & Imaging Centers, Payers (Health Insurance Providers & TPAs), and Life Sciences & CROs. Each segment has unique requirements and drives demand for document management solutions.

The Hospitals & Health Systems segment leads the market, primarily due to the high volume of patient data generated and the need for efficient management of medical records. The increasing focus on patient care and regulatory compliance in hospitals drives the adoption of advanced document management systems. Additionally, the integration of EHRs in hospitals necessitates robust document management solutions to ensure seamless data flow and accessibility. Cloud and web-based delivery models have also gained share in provider settings due to scalability and remote access benefits.

The Global Medical Document Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyland Software (OnBase, Acuo VNA), OpenText Corporation (OpenText Extended ECM for Healthcare), Kofax Inc. (Kofax Capture, TotalAgility), 3M Health Information Systems (3M 360 Encompass, M*Modal), Nuance Communications, Inc. (a Microsoft company), Epic Systems Corporation (Chart indexing & document imaging), Oracle Health (Cerner) Document Management, ScanSTAT Technologies, M-Files, Iron Mountain (Healthcare Content Services), Infor (Infor Clinical Bridge, Document Management), eClinicalWorks (eCW eBO & document management), NextGen Healthcare, athenahealth, DocuWare contribute to innovation, geographic expansion, and service delivery in this space.

The future of medical document management systems is poised for transformative growth, driven by technological advancements and evolving healthcare needs. As organizations increasingly prioritize patient-centric care, the integration of mobile solutions and interoperability standards will become essential. Furthermore, the rise of data analytics will enhance decision-making processes, enabling healthcare providers to leverage insights from document management systems. This evolution will likely lead to more streamlined operations and improved patient outcomes across the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Solutions (Document Imaging, Document Scanning & Capture, Workflow & BPM, Records Management) Services (Implementation & Integration, Consulting, Training & Support, Managed Services) Platforms & Add-ons (eSignatures, OCR/ICR, AI-assisted Indexing) |

| By End-User | Hospitals & Health Systems Ambulatory Care Centers & Clinics Diagnostic Laboratories & Imaging Centers Payers (Health Insurance Providers & TPAs) Life Sciences & CROs |

| By Document/Application | Patient Medical Records Management (EHR/EMR attachments, Consent, Referrals) Admission & Registration Documents Patient Billing & Claims Documents Coding & Audit Documents (CDI, RAC audit support) Research & Clinical Trial Documents (eTMF, SOPs) |

| By Deployment Mode | Web-Based & Cloud On-Premises Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Compliance Standards | HIPAA, HITECH GDPR ISO 27001/27701, SOC 2 CFR Part 11 |

| By Pricing Model | Subscription (Per User/Per Facility) Perpetual License + Maintenance Usage-Based (Storage/Pages/Transactions) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Document Management | 120 | IT Managers, Health Information Officers |

| Clinical Practice Management | 100 | Practice Administrators, Compliance Officers |

| Laboratory Information Systems | 80 | Lab Managers, IT Specialists |

| Healthcare Compliance Solutions | 70 | Regulatory Affairs Managers, Quality Assurance Leads |

| Telehealth Document Management | 90 | Telehealth Coordinators, IT Support Staff |

The Global Medical Document Management Systems Market is valued at approximately USD 680 million, reflecting a significant growth driven by the increasing need for efficient data management and regulatory compliance in healthcare facilities.