Region:Global

Author(s):Shubham

Product Code:KRAD0710

Pages:83

Published On:August 2025

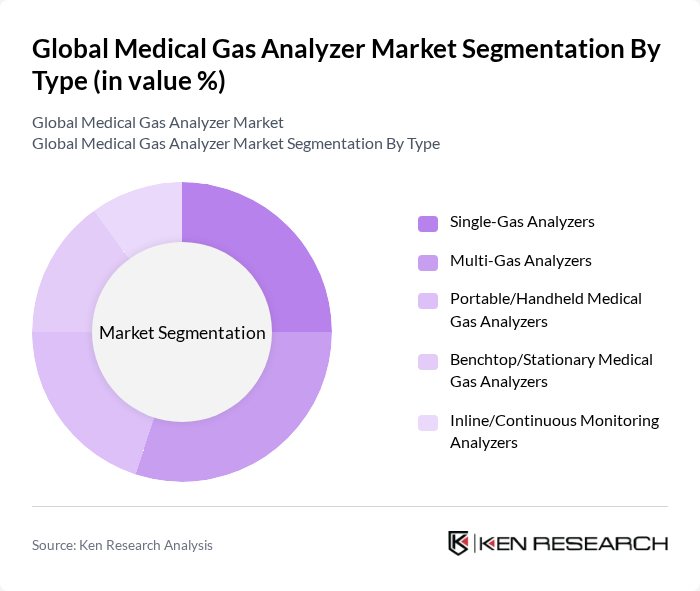

By Type:The market is segmented into various types of medical gas analyzers, including Single-Gas Analyzers, Multi-Gas Analyzers, Portable/Handheld Medical Gas Analyzers, Benchtop/Stationary Medical Gas Analyzers, and Inline/Continuous Monitoring Analyzers. Each type serves specific applications and user needs, with the demand for portable analyzers increasing due to their convenience and ease of use in various healthcare settings .

The Multi-Gas Analyzers segment is currently dominating the market due to their versatility and ability to measure multiple gases simultaneously, which is essential in critical care environments. Hospitals and healthcare facilities prefer these analyzers for their efficiency in monitoring various gases, including oxygen, carbon dioxide, and nitrous oxide, thereby enhancing patient safety. The trend towards integrated solutions that offer comprehensive monitoring capabilities is driving the growth of this segment .

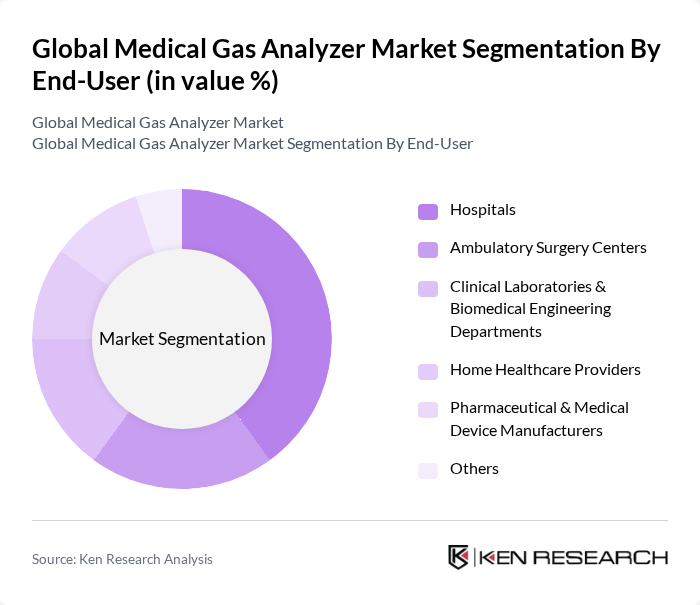

By End-User:The market is segmented by end-users, including Hospitals, Ambulatory Surgery Centers, Clinical Laboratories & Biomedical Engineering Departments, Home Healthcare Providers, Pharmaceutical & Medical Device Manufacturers, and Others. Each end-user category has distinct requirements for gas analysis, influencing the types of analyzers they utilize .

Hospitals are the leading end-user segment, accounting for a significant share of the market. This dominance is attributed to the high demand for medical gas analyzers in critical care units, operating rooms, and emergency departments. The increasing focus on patient safety and regulatory compliance in hospitals drives the need for reliable gas monitoring solutions, making them the primary consumers of medical gas analyzers .

The Global Medical Gas Analyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fluke Biomedical, Drägerwerk AG & Co. KGaA, Teledyne Technologies Incorporated, Maxtec (a Perma Pure company), IMT Analytics AG, TSI Incorporated, Bacharach, Inc. (Ametek Mocon), Servomex (Servomex Group Limited), WITT-Gasetechnik GmbH & Co KG, OxyGuard International A/S, BK Medical ApS, UVP LLC (Analytical Technologies), Cambridge Sensotec Ltd (Rapidox), Sable Systems International, GSS Ltd (Gas Sensing Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical gas analyzer market appears promising, driven by ongoing advancements in technology and a growing emphasis on patient safety. The integration of IoT and AI in gas monitoring systems is expected to enhance operational efficiency and accuracy. Additionally, the shift towards preventive healthcare will likely increase the demand for reliable gas analyzers. As healthcare infrastructure continues to expand globally, the market is poised for significant growth, with innovative solutions addressing emerging healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Gas Analyzers Multi-Gas Analyzers Portable/Handheld Medical Gas Analyzers Benchtop/Stationary Medical Gas Analyzers Inline/Continuous Monitoring Analyzers |

| By End-User | Hospitals Ambulatory Surgery Centers Clinical Laboratories & Biomedical Engineering Departments Home Healthcare Providers Pharmaceutical & Medical Device Manufacturers Others |

| By Application | Anesthesia and Respiratory Gas Monitoring Medical Gas Pipeline System (MGPS) Verification & Compliance Testing Ventilator and Respiratory Therapy Calibration Gas Purity and Contaminant Detection (O2, N2O, CO2, CO, H2O) Pharmaceutical Cleanroom and Manufacturing QA/QC Others |

| By Component | Sensors (Electrochemical, Infrared/NDIR, Paramagnetic, Thermal Conductivity) Software & Connectivity (Data Logging, IoT/Remote Monitoring) Calibration Gas & Fixtures Displays & User Interfaces Housings, Power & Accessories |

| By Sales Channel | Direct Sales to Healthcare Facilities Authorized Distributors/Value-Added Resellers OEM/Private Label Online/Tenders & e-Procurement Others |

| By Distribution Mode | Wholesale Distribution Retail/Dealer Networks Direct-to-Healthcare Provider Others |

| By Price Range | Entry (Under $2,000) Mid ($2,000–$8,000) Premium ($8,000+) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Medical Gas Management | 150 | Facility Managers, Biomedical Engineers |

| Home Healthcare Providers | 100 | Procurement Officers, Home Care Coordinators |

| Medical Gas Equipment Suppliers | 80 | Sales Managers, Product Development Leads |

| Regulatory Compliance in Medical Gas | 70 | Quality Assurance Managers, Compliance Officers |

| Research Institutions Utilizing Medical Gases | 60 | Research Scientists, Lab Managers |

The Global Medical Gas Analyzer Market is valued at approximately USD 360 million, based on a five-year historical analysis. This valuation reflects the market's position in the low-hundreds of millions, rather than the billion range.