Region:Global

Author(s):Geetanshi

Product Code:KRAC0099

Pages:90

Published On:August 2025

By Type:The market is segmented into various types of medical gases, including Oxygen, Nitrous Oxide, Medical Air, Carbon Dioxide, Helium, Argon, Medical Gas Mixtures, and Others. Among these, Oxygen is the most widely used medical gas, primarily due to its critical role in respiratory therapy, intensive care, and emergency medicine. Nitrous Oxide is widely used in anesthesia and pain management. The increasing number of surgical procedures, the growing prevalence of respiratory and chronic diseases, and the expansion of home healthcare are driving the demand for these gases .

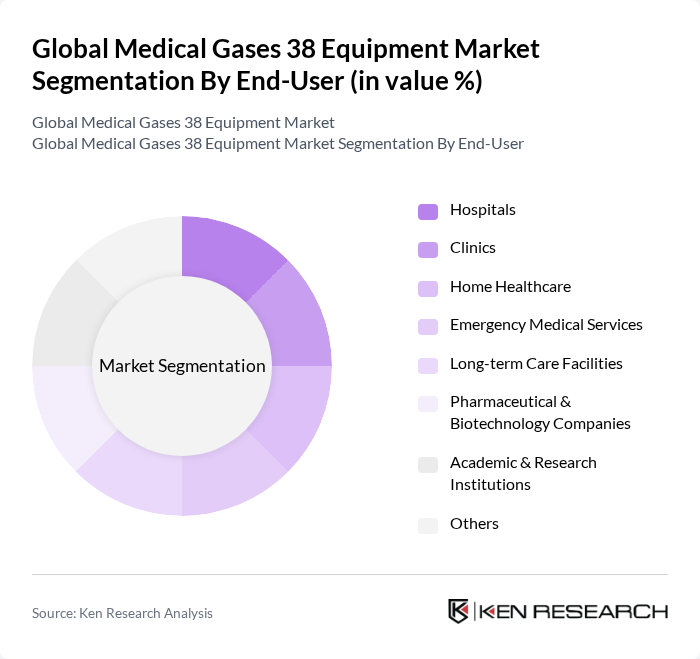

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Emergency Medical Services, Long-term Care Facilities, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, and Others. Hospitals remain the largest end-users of medical gases, driven by the high volume of patients requiring oxygen therapy, anesthesia, and critical care. The growing trend of home healthcare and portable oxygen therapy is also contributing significantly to the demand for medical gases, as more patients receive treatment at home for chronic respiratory conditions .

The Global Medical Gases & Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Liquide S.A., Linde plc, Messer Group GmbH, Air Products and Chemicals, Inc., Matheson Tri-Gas, Inc., Taiyo Nippon Sanso Corporation, GCE Group, BeaconMedaes (Atlas Copco Group), Drägerwerk AG & Co. KGaA, Allied Healthcare Products, Inc., Amico Corporation, Gentec Corporation, Rotarex S.A., Precision Medical, Inc., and Ohio Medical LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical gases market in None appears promising, driven by technological advancements and an increasing focus on patient-centric care. The integration of IoT in medical equipment is expected to enhance operational efficiency and patient monitoring. Additionally, sustainability initiatives are gaining traction, with healthcare facilities seeking eco-friendly gas solutions. These trends indicate a shift towards more innovative and responsible practices, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Oxygen Nitrous Oxide Medical Air Carbon Dioxide Helium Argon Medical Gas Mixtures Others |

| By End-User | Hospitals Clinics Home Healthcare Emergency Medical Services Long-term Care Facilities Pharmaceutical & Biotechnology Companies Academic & Research Institutions Others |

| By Application | Anesthesia Respiratory Therapy Surgical Procedures Diagnostic Imaging Pharmaceutical Manufacturing & Research Others |

| By Product | Manifolds Outlets Hose Assemblies & Valves Alarm Systems Cylinders Flowmeters Regulators Medical Air Compressors Vacuum Systems Masks Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Regulatory Compliance | ISO Compliance FDA Approval CE Marking Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Medical Gas Suppliers | 60 | Sales Managers, Product Managers |

| Healthcare Facilities | 50 | Facility Managers, Biomedical Engineers |

| Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

| Medical Professionals | 80 | Doctors, Nurses, Anesthesiologists |

The Global Medical Gases & Equipment Market is valued at approximately USD 18 billion, driven by increasing demand for medical gases in healthcare facilities, particularly due to the rise in chronic diseases and surgical procedures.