Region:Global

Author(s):Shubham

Product Code:KRAD0812

Pages:96

Published On:August 2025

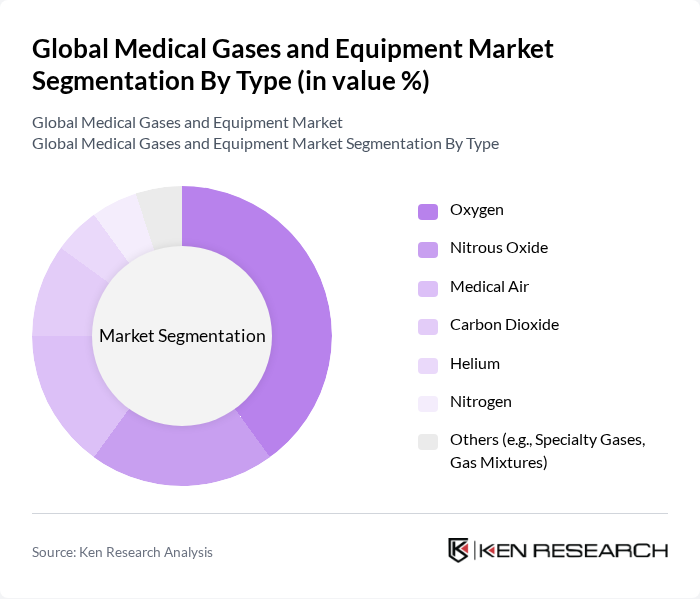

By Type:The market is segmented into various types of medical gases, including Oxygen, Nitrous Oxide, Medical Air, Carbon Dioxide, Helium, Nitrogen, and Others (e.g., Specialty Gases, Gas Mixtures). Among these,Oxygenis the most widely used gas, primarily due to its critical role in respiratory therapy, emergency medical services, and the management of chronic pulmonary conditions. The increasing incidence of respiratory diseases and the growing elderly population are key factors driving the demand for oxygen.Nitrous Oxideis also significant, particularly in anesthesia, due to its analgesic and sedative properties. The adoption of portable and home-based oxygen delivery systems has further accelerated demand, especially in home healthcare and long-term care settings .

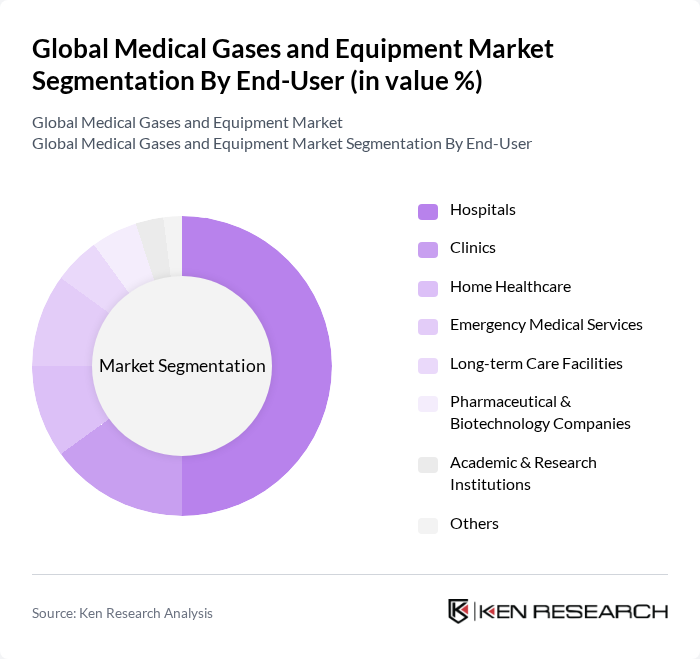

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Home Healthcare, Emergency Medical Services, Long-term Care Facilities, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, and Others.Hospitalsare the leading end-user segment, driven by the high demand for medical gases in surgical procedures, intensive care, and emergency response. The increasing number of hospital admissions, expansion of healthcare infrastructure, and integration of advanced gas delivery systems contribute significantly to this segment's growth.Home Healthcareis the fastest-growing segment, supported by the shift towards outpatient care and the availability of portable medical gas equipment .

The Global Medical Gases and Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Liquide, Linde plc, Messer Group GmbH, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Matheson Tri-Gas, Inc., GCE Group, BeaconMedaes (Atlas Copco Group), Rotarex S.A., Allied Healthcare Products, Inc., Amico Group of Companies, Gentec Corporation, Precision Medical, Inc., Westfalen AG, SOL Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical gases and equipment market in None is poised for significant transformation, driven by technological advancements and evolving healthcare needs. The integration of telemedicine and patient-centric care models is expected to reshape service delivery, enhancing accessibility and efficiency. Additionally, the focus on sustainability will likely lead to innovative practices in medical gas management, promoting environmentally friendly solutions. As healthcare systems adapt, the demand for advanced medical gases and equipment will continue to rise, creating new opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Oxygen Nitrous Oxide Medical Air Carbon Dioxide Helium Nitrogen Others (e.g., Specialty Gases, Gas Mixtures) |

| By End-User | Hospitals Clinics Home Healthcare Emergency Medical Services Long-term Care Facilities Pharmaceutical & Biotechnology Companies Academic & Research Institutions Others |

| By Application | Anesthesia Respiratory Therapy Surgical Procedures Diagnostic Imaging Pharmaceutical Manufacturing & Research Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Component | Cylinders Pipeline Systems Manifolds Outlets Hose Assemblies and Valves Alarm Systems Flow Meters Medical Air Compressors Vacuum Systems Regulators Masks Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 80 | Procurement Managers, Supply Chain Coordinators |

| Medical Equipment Distributors | 60 | Sales Managers, Distribution Executives |

| Healthcare Facilities (Clinics & Hospitals) | 70 | Facility Managers, Clinical Directors |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Regulatory Affairs Specialists |

| Medical Gas Manufacturers | 50 | Product Managers, R&D Directors |

The Global Medical Gases and Equipment Market is valued at approximately USD 18 billion, driven by factors such as the increasing prevalence of chronic respiratory diseases and advancements in medical technology.